Summary:

- Shift4 Payments partners with UATP to enhance payment solutions for the travel industry.

- Analysts project an average price target of $113.35, suggesting potential stock growth.

- Current consensus aligns Shift4 Payments with an "Outperform" rating.

Shift4 Payments (NYSE: FOUR) has embarked on a promising strategic collaboration with UATP, aiming to significantly enhance its payment solutions within the travel sector. This partnership will integrate UATP's unique technology into Shift4's systems, marking a pivotal step forward in their global payment capabilities.

Analyst Predictions and Price Targets

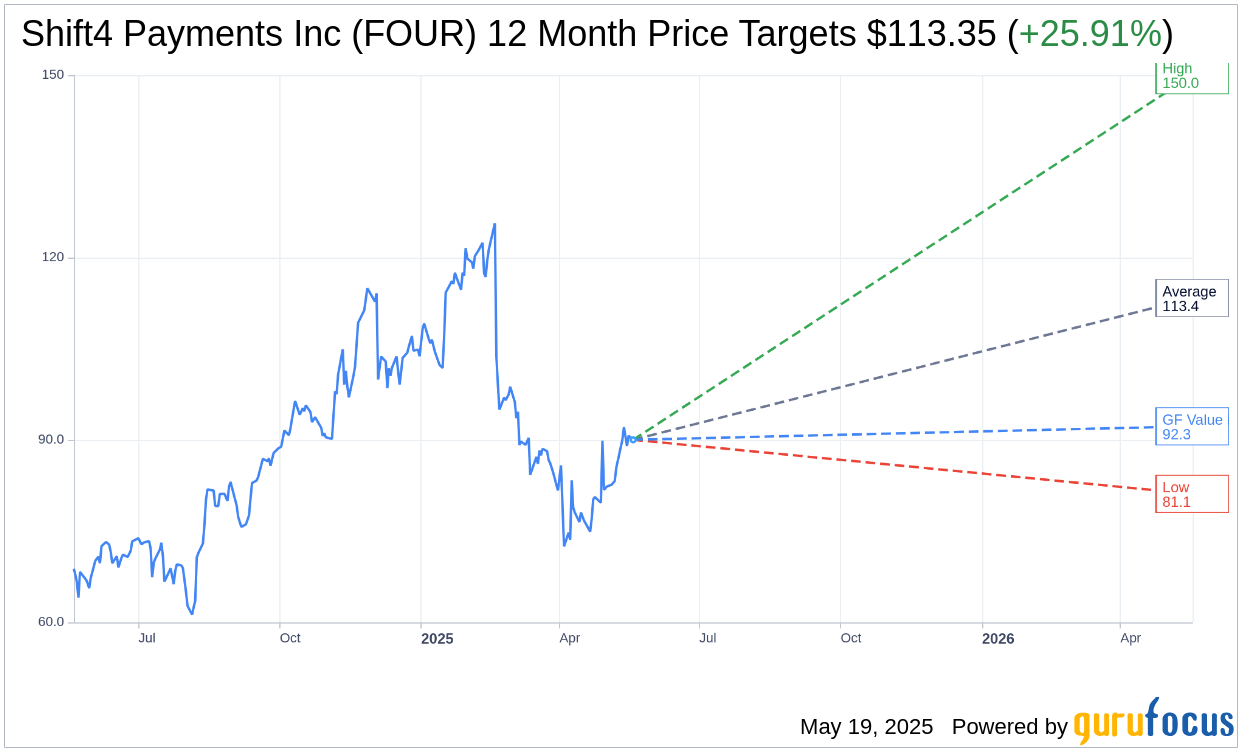

Based on evaluations from 23 analysts over the next year, Shift4 Payments Inc (FOUR, Financial) is projected to reach an average target price of $113.35. Price forecasts range from a high of $150.00 to a low of $81.14, indicating a potential upside of 25.91% from its current stock price of $90.03. For more in-depth financial metrics and forecast data, please visit the Shift4 Payments Inc (FOUR) Forecast page.

Brokerage Recommendations and GF Value

The consensus recommendation from 23 brokerage firms currently rates Shift4 Payments Inc. (FOUR, Financial) with an average score of 1.9, which corresponds to an "Outperform" status. On the rating scale, with 1 representing a Strong Buy and 5 indicating a Sell, this positions Shift4 Payments favorably within the market.

According to GuruFocus estimates, the one-year projected GF Value for Shift4 Payments Inc (FOUR, Financial) stands at $92.25. This suggests a modest upside of 2.47% from the current price levels. The GF Value represents GuruFocus's estimation of the fair market value for the stock, calculated using historical trading multiples, past growth performance, and anticipated future business developments. Detailed insights and further data are available on the Shift4 Payments Inc (FOUR) Summary page.