In a bid to accelerate AI adoption within enterprises, Dell Technologies (DELL, Financial) has introduced a series of advancements through the DellAIFactory, in collaboration with NVIDIA. The recent updates include the air-cooled Dell PowerEdge XE9780 and XE9785 servers, which streamline integration into existing data centers, alongside liquid-cooled XE9780L and XE9785L models for enhanced rack-scale deployment.

The new PowerEdge systems can be equipped with up to 192 NVIDIA Blackwell Ultra GPUs, featuring direct-to-chip liquid cooling, and customized with up to 256 GPUs per Dell IR7000 rack. These servers succeed the fast-selling PowerEdge XE9680, offering up to four times faster large language model training capabilities using the 8-way NVIDIA HGX B300.

Moreover, the Dell PowerEdge XE9712 is equipped with the NVIDIA GB300 NVL72, designed to improve training efficiencies and AI reasoning inference output significantly. A forthcoming addition, the Dell PowerEdge XE7745, available by July 2025, will feature NVIDIA RTX Pro 6000 Blackwell Server Edition GPUs, supporting diverse AI applications with up to 8 GPUs in a 4U chassis. Dell is also planning to incorporate NVIDIA's Vera CPU and Vera Rubin platform into its new PowerEdge XE server, catering to a range of AI use cases.

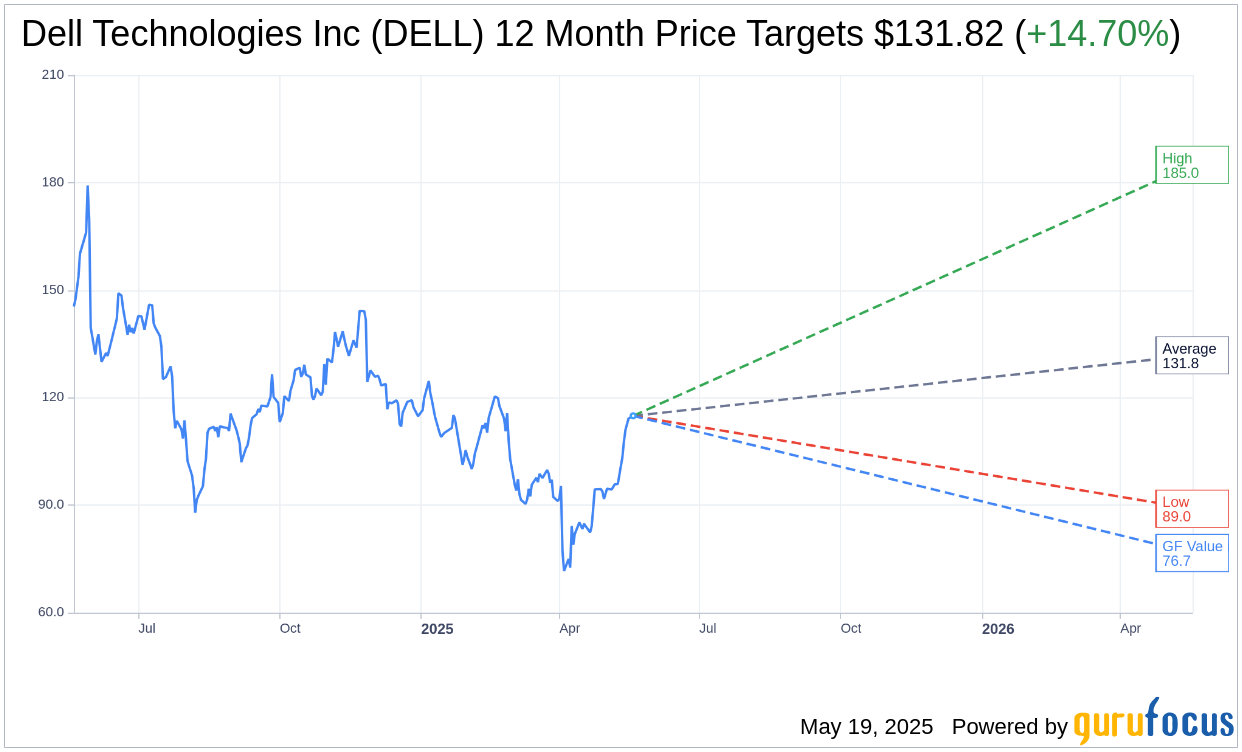

Wall Street Analysts Forecast

Based on the one-year price targets offered by 20 analysts, the average target price for Dell Technologies Inc (DELL, Financial) is $131.82 with a high estimate of $185.00 and a low estimate of $89.00. The average target implies an upside of 14.70% from the current price of $114.93. More detailed estimate data can be found on the Dell Technologies Inc (DELL) Forecast page.

Based on the consensus recommendation from 24 brokerage firms, Dell Technologies Inc's (DELL, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Dell Technologies Inc (DELL, Financial) in one year is $76.65, suggesting a downside of 33.31% from the current price of $114.93. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Dell Technologies Inc (DELL) Summary page.

DELL Key Business Developments

Release Date: February 27, 2025

- FY25 Revenue: $95.6 billion, up 8% year-over-year.

- Operating Income: $8.5 billion.

- EPS: Record $8.14, up 10% year-over-year.

- Cash Flow: $4.5 billion.

- Q4 Revenue: $23.9 billion, up 7% year-over-year.

- Q4 EPS: $2.68, up 18% year-over-year.

- ISG Revenue: $11.4 billion in Q4, up 22% year-over-year.

- Servers and Networking Revenue: $6.6 billion in Q4, up 37% year-over-year.

- Storage Revenue: $4.7 billion in Q4, up 5% year-over-year.

- CSG Revenue: $11.9 billion in Q4, up 1% year-over-year.

- Commercial Revenue: $10 billion in Q4, up 5% year-over-year.

- Consumer Revenue: $1.9 billion in Q4, down 12% year-over-year.

- Operating Expense: Down 6% to $3.1 billion in Q4.

- Gross Margin: $5.8 billion or 24.3% of revenue in Q4.

- Q4 Net Income: $1.9 billion, up 15% year-over-year.

- Dividend Increase: 18% increase to $2.10 per share annually.

- Share Repurchase Authorization: $10 billion increase approved.

- FY26 Revenue Guidance: $101 billion to $105 billion, up 8% at midpoint.

- FY26 EPS Guidance: $9.30 plus or minus $0.25, up 14% at midpoint.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Dell Technologies Inc (DELL, Financial) reported FY25 revenue of $95.6 billion, an 8% increase, with operating income of $8.5 billion.

- The company achieved record EPS of $8.14, up 10%, and generated $4.5 billion in cash flow.

- Dell Technologies Inc (DELL) introduced several innovative products, including AI-optimized platforms and advancements in storage solutions like PowerStore Prime.

- The company maintained its leadership in commercial AI PCs and PC monitors, launching new products with advanced features.

- Dell Technologies Inc (DELL) announced an 18% increase in its annual dividend to $2.10 per share and a $10 billion increase in share repurchase authorization, reflecting confidence in its business outlook.

Negative Points

- The consumer segment faced challenges with softer demand and increased discounting, impacting profitability.

- Gross margin was slightly down due to a competitive pricing environment, particularly in the CSG segment.

- The company noted a slowdown in demand in January, despite some strength in small and medium business sectors.

- Dell Technologies Inc (DELL) faces a competitive environment in the AI server market, with concerns about ODM encroachment.

- The company anticipates a decline in gross margin rate by roughly 100 basis points in FY26 due to a higher mix of AI-optimized servers and competitive pressures.