- Dell Technologies' strategic partnership with Nvidia focuses on AI innovation.

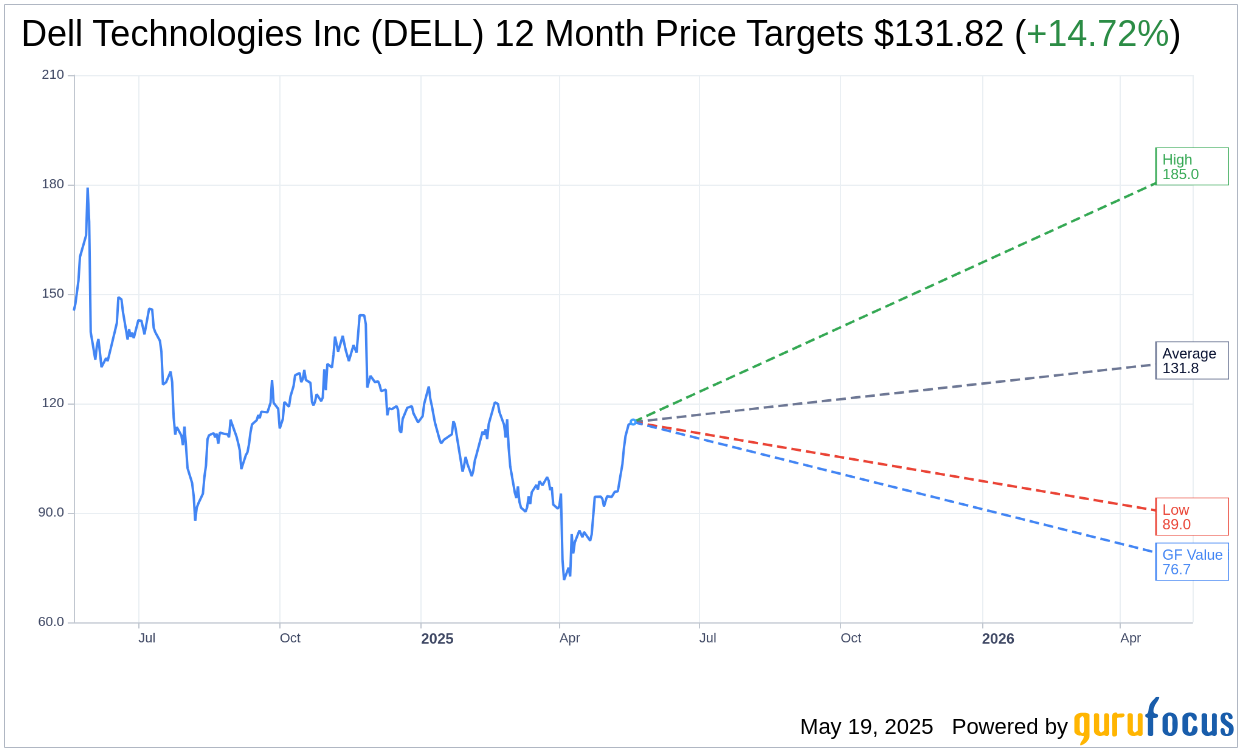

- Analysts predict an average price increase of 14.72% for Dell's stock.

- Despite a current "Outperform" recommendation, GF Value indicates a potential downside.

Dell Technologies (NYSE: DELL) shares surged recently as the company announced an enhanced alliance with Nvidia. This collaboration is poised to revolutionize artificial intelligence (AI) through the introduction of cutting-edge solutions at Dell's annual conference. Key highlights include the launch of the Dell AI Factory alongside advanced server options, designed to optimize AI functionalities across numerous sectors.

Analyst Projections and Price Targets

Wall Street analysts have chimed in with one-year price targets for Dell Technologies (DELL, Financial), with insights from 20 experts leading to an average target price of $131.82. These projections range from a high of $185.00 to a low of $89.00, insinuating a potential upside of 14.72% from its current trading price of $114.91. Investors can explore more comprehensive data on the Dell Technologies Inc (DELL) Forecast page.

Reflecting a robust outlook, 24 brokerage firms have collectively positioned Dell Technologies (DELL, Financial) with an average recommendation of 2.0, equating to an "Outperform" rating. This scoring is based on a scale where 1 signifies a Strong Buy and 5 denotes a Sell.

Evaluating GF Value Predictions

Turning to GuruFocus evaluations, the GF Value estimate for Dell Technologies (DELL, Financial) in one year is pegged at $76.65, which suggests a potential decline of 33.3% from its current price point of $114.9099. GF Value reflects an estimation of the stock's fair trading value, calculated from historical price multiples, past business growth, and future performance forecasts. Investors seeking more detailed information can visit the Dell Technologies Inc (DELL) Summary page.

While Dell Technologies embarks on transforming AI through its partnership with Nvidia, investors are encouraged to weigh the insights from both Wall Street analysts and GuruFocus metrics to make informed investment decisions in the rapidly evolving tech landscape.