Summary:

- Gilat Satellite Networks (GILT, Financial) reports a remarkable 21% revenue growth in Q1 2025.

- Significant contracts, including $5 million from the US Department of Defense, enhance the company's Defense Division.

- Analysts forecast a potential upside of up to 78.46% based on current valuations.

Gilat Satellite Networks (GILT) has revealed its robust financial performance for the first quarter of 2025, spotlighting an impressive 21% revenue increase to $92 million year-over-year. A key highlight is the $25 million contribution from the recently acquired Stellar Blu, despite an accompanying adjusted EBITDA loss of $3.6 million. However, excluding this acquisition, the company's adjusted EBITDA saw a 20% rise, totaling $11.2 million. Adding to the positive momentum, significant new contracts, notably over $5 million from the US Department of Defense, have propelled the company's Defense Division forward.

Wall Street Analysts Forecast

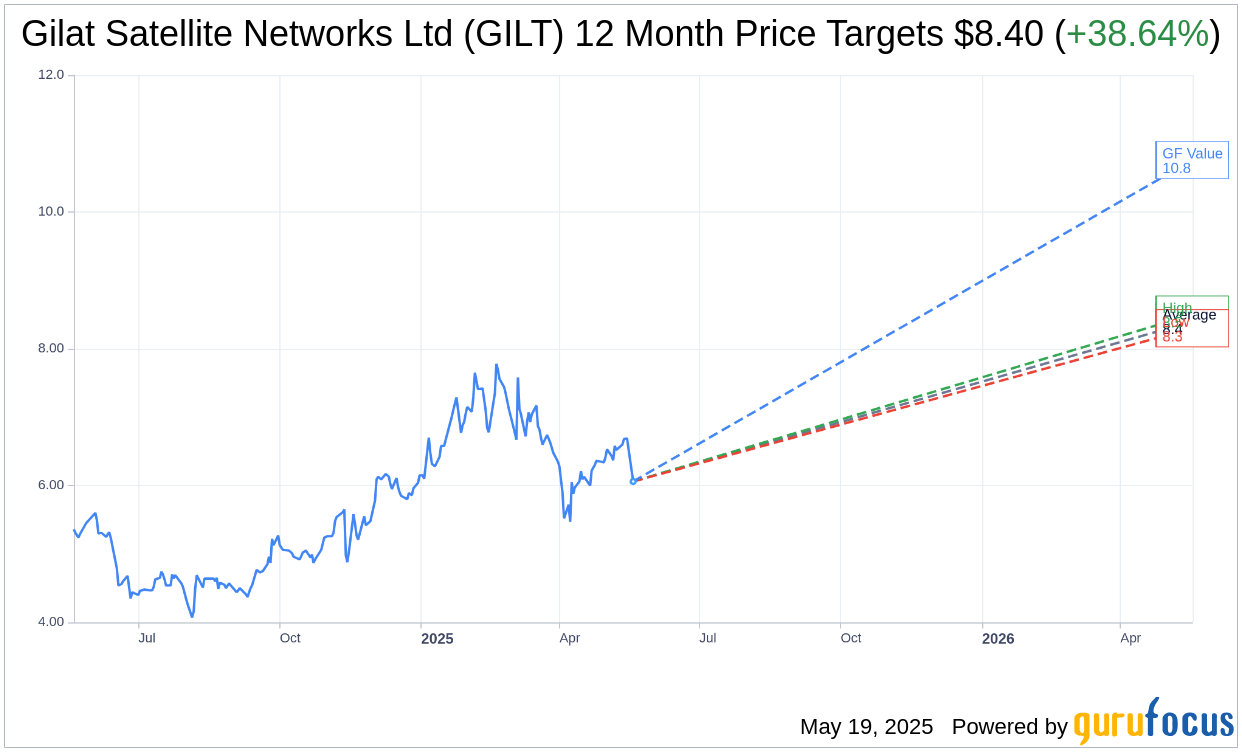

According to projections from two analysts, the average one-year price target for Gilat Satellite Networks Ltd (GILT, Financial) stands at $8.40, with estimates ranging between a high of $8.50 and a low of $8.30. This average target indicates a potential 39.32% upside from the current stock price of $6.03. For a deeper dive into these estimates, visit the Gilat Satellite Networks Ltd (GILT) Forecast page.

Market sentiment remains optimistic with a consensus "Outperform" rating from three brokerage firms, reflected by an average recommendation score of 1.7. This scale ranges from 1, representing a Strong Buy, to 5, indicating a Sell, further solidifying the positive outlook for Gilat Satellite Networks Ltd (GILT, Financial).

GuruFocus provides an estimated GF Value of $10.76 for Gilat in the coming year, suggesting a significant potential upside of 78.46% from the current price of $6.0292. The GF Value offers a calculated fair value based on historical trading multiples, past business growth, and forecasted performance metrics. For comprehensive data, investors can explore the Gilat Satellite Networks Ltd (GILT, Financial) Summary page.