On May 19, 2025, 8x8 Inc (EGHT, Financial) released its 8-K filing detailing the financial results for the fourth quarter and fiscal year 2025. The company, known for its contact-center-as-a-service and unified-communications-as-a-service software applications, reported a total revenue of $177 million for the fourth quarter, slightly below the analyst estimate of $177.84 million. The fiscal year 2025 total revenue was $715 million, also missing the annual estimate of $715.88 million.

Company Overview

8x8 Inc provides a unified platform that enables omnichannel communication, assisting approximately 2.5 million users in communicating across voice, video, text, chat, and contact centers. The company derives a majority of its revenue from the United States, with additional revenue from hardware sales and professional services that complement its integrated technology platform.

Performance and Challenges

The company's performance in the fourth quarter reflects ongoing transitions, particularly the decline in revenue from former Fuze customers, which contributed to a 1% decrease in service revenue. Excluding these customers, service revenue growth accelerated to nearly 5% year-over-year. This performance is crucial as it highlights the company's efforts to stabilize and grow its core business amidst integration challenges.

Financial Achievements

Despite the revenue decline, 8x8 Inc achieved a GAAP operating income of $15.2 million for fiscal year 2025, a significant improvement from a GAAP operating loss of $27.6 million in fiscal 2024. This turnaround is important as it demonstrates the company's progress towards profitability, a key metric in the software industry where sustainable growth is often prioritized.

Key Financial Metrics

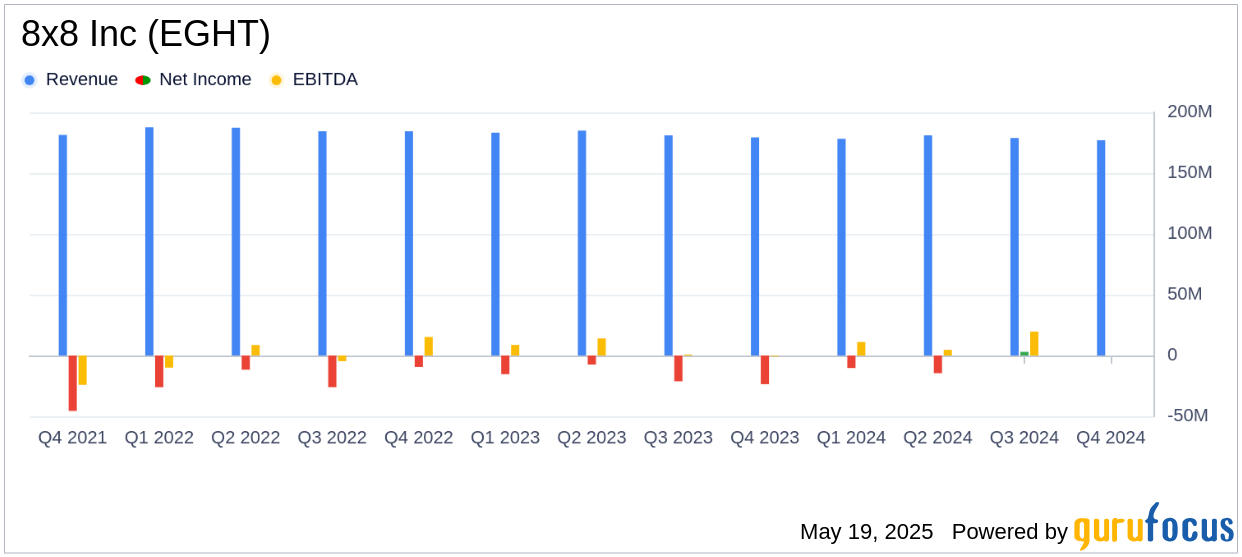

For the fourth quarter, 8x8 Inc reported a GAAP net loss of $5.4 million, an improvement from a net loss of $23.6 million in the same quarter of the previous year. The non-GAAP net income was $11.3 million, up from $10.6 million. The adjusted EBITDA for the quarter was $22.2 million, compared to $26.0 million in the prior year. These metrics are critical as they provide insights into the company's operational efficiency and profitability.

| Metric | Q4 2025 | Q4 2024 | FY 2025 | FY 2024 |

|---|---|---|---|---|

| Total Revenue | $177M | $179.4M | $715M | $728.7M |

| GAAP Net Loss | $(5.4)M | $(23.6)M | $(27.2)M | $(67.6)M |

| Non-GAAP Net Income | $11.3M | $10.6M | $48.3M | $58.0M |

| Adjusted EBITDA | $22.2M | $26.0M | $98.6M | $121.0M |

Analysis and Insights

The financial results indicate that while 8x8 Inc is making strides towards profitability, challenges remain, particularly in stabilizing revenue streams post-Fuze acquisition. The company's focus on upgrading Fuze customers and enhancing its platform with AI-driven capabilities is expected to drive future growth. The reduction in debt and improvement in operating income are positive signs, but the company must continue to address revenue declines to achieve long-term sustainable growth.

Our results in the fourth quarter and fiscal 2025 reflect multiple transitions as we build a foundation for durable growth and profitability," said Samuel Wilson, Chief Executive Officer at 8x8, Inc.

Overall, 8x8 Inc's financial performance underscores the importance of strategic execution and innovation in navigating industry challenges and achieving growth objectives.

Explore the complete 8-K earnings release (here) from 8x8 Inc for further details.