UBS has revised its rating for Mettler-Toledo (MTD, Financial) from Neutral to Buy, signaling increased confidence in the company's potential. The financial firm has set a new price target for Mettler-Toledo at $1,350, a reduction from the previous target of $1,530. This adjustment reflects UBS's strategic outlook on the stock's future performance.

Wall Street Analysts Forecast

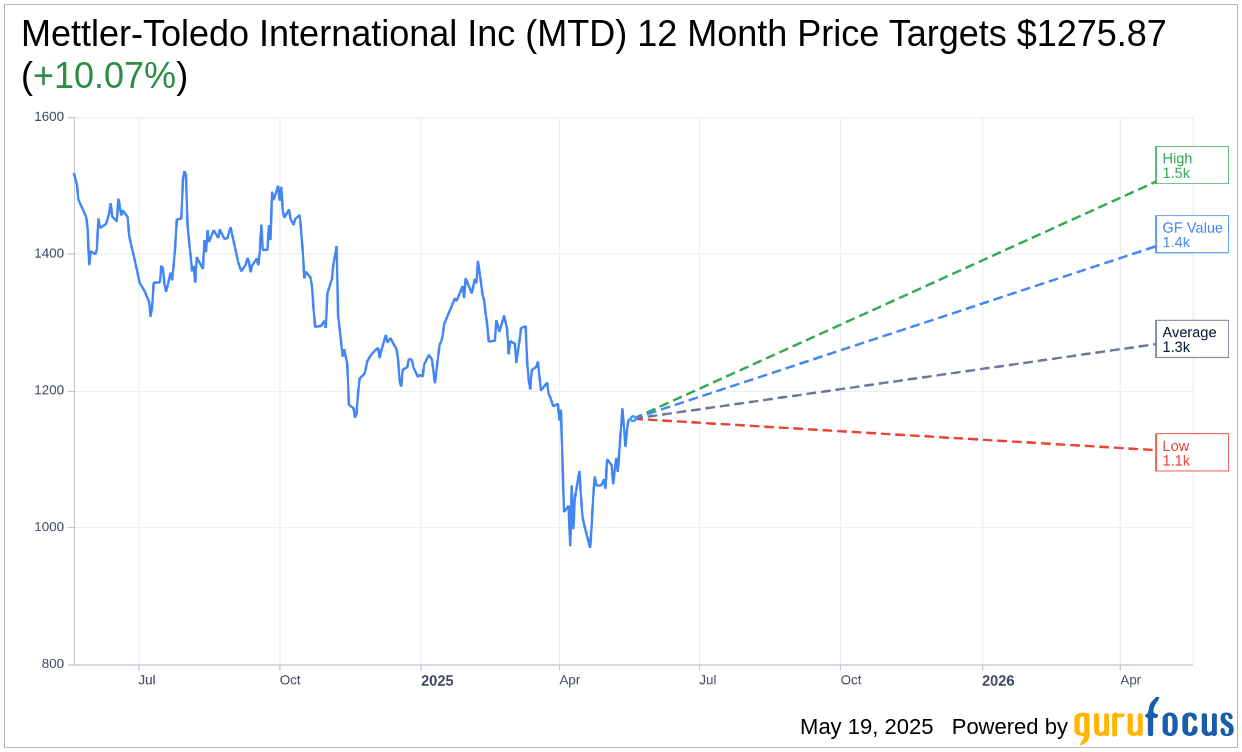

Based on the one-year price targets offered by 11 analysts, the average target price for Mettler-Toledo International Inc (MTD, Financial) is $1,275.87 with a high estimate of $1,530.00 and a low estimate of $1,110.00. The average target implies an upside of 10.07% from the current price of $1,159.10. More detailed estimate data can be found on the Mettler-Toledo International Inc (MTD) Forecast page.

Based on the consensus recommendation from 15 brokerage firms, Mettler-Toledo International Inc's (MTD, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Mettler-Toledo International Inc (MTD, Financial) in one year is $1428.94, suggesting a upside of 23.28% from the current price of $1159.1. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Mettler-Toledo International Inc (MTD) Summary page.

MTD Key Business Developments

Release Date: May 02, 2025

- Sales: $884 million, a 3% decrease in local currency; 5% decline on a US dollar reported basis.

- Gross Margin: 59.5%, an increase of 30 basis points; expanded 90 basis points excluding shipping delays.

- Adjusted Operating Profit: $237 million, down 11% from the prior year.

- Adjusted Operating Margin: 26.8%, a decrease of 210 basis points; expanded 50 basis points excluding shipping delays.

- Adjusted EPS: $8.19, an 8% decrease over the prior year; 11% growth excluding shipping delay recovery and foreign exchange headwinds.

- Free Cash Flow: $180 million, a 1% increase on a per share basis.

- R&D Expenses: $46 million, a 2% increase in local currency.

- SG&A Expenses: $243 million, a 5% increase in local currency.

- Effective Tax Rate: 19% for the quarter.

- Fully Diluted Shares: 20.9 million, approximately a 3% decline from the prior year.

- Local Currency Sales Growth by Region: Declined 1% in the Americas, 7% in Europe, 2% in Asia, Rest of the World; flat in China.

- Local Currency Sales Growth by Product Area: Laboratory sales decreased 3%, industrial declined 1%, product inspection up 8%, food retail declined 12%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Mettler-Toledo International Inc (MTD, Financial) reported solid growth in its laboratory business, driven by recent innovations and strategic market penetration.

- The company achieved better-than-expected earnings for the quarter due to strong execution of margin expansion strategies.

- Service sales increased by 6% in local currency, indicating a robust demand for MTD's service offerings.

- The process analytics business experienced strong growth, benefiting from favorable biopharma market trends and recent innovations.

- MTD's product inspection business showed resilience, with growth initiatives and a new portfolio offsetting challenging market conditions in the food manufacturing industry.

Negative Points

- Global trade disputes and tariffs have increased uncertainty in customer demand, with estimated incremental global tariff costs of approximately $115 million annually.

- Sales in the quarter decreased by 3% in local currency, with a 5% decline on a US dollar reported basis.

- Local currency sales declined in key regions: 1% in the Americas, 7% in Europe, and 2% in Asia, Rest of the World.

- Adjusted operating profit decreased by 11% from the prior year, with an adjusted operating margin decrease of 210 basis points.

- The company faces a headwind in gross margin due to higher tariff costs, with a net headwind to EPS growth of approximately 3% for the second quarter.