On May 19, 2025, Educational Development Corp (EDUC, Financial) released its 8-K filing detailing the financial results for the fiscal fourth quarter and fiscal year ended February 28, 2025. As a prominent publisher of educational children's books in the United States, EDUC operates through two segments: PaperPie and Publishing. The company markets its products through various channels, including retail accounts and independent brand partners.

Fiscal Year 2025 Performance Overview

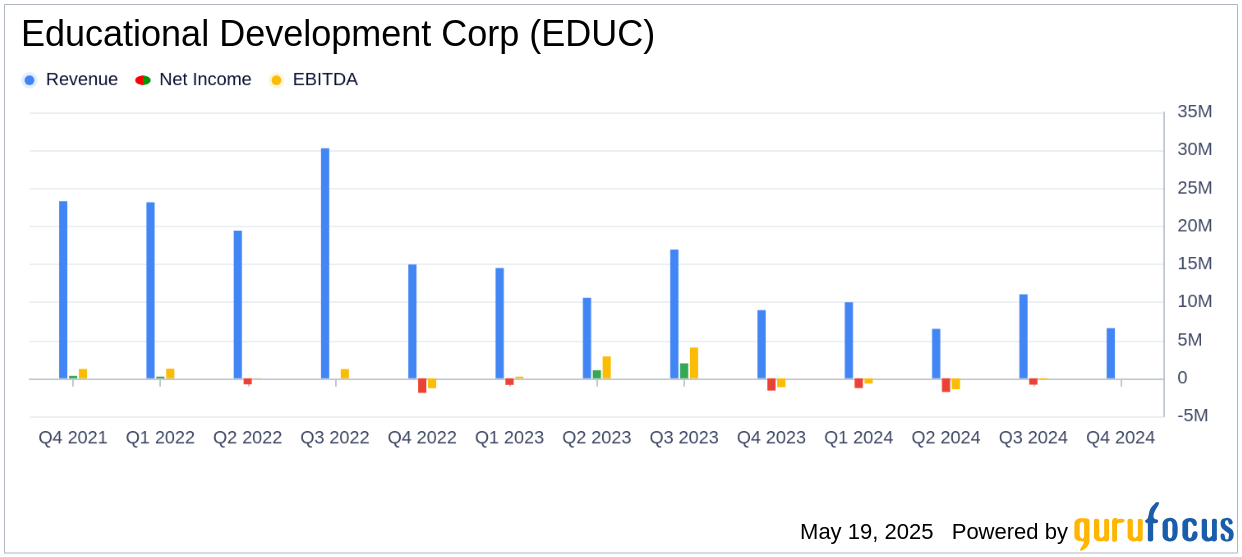

Educational Development Corp (EDUC, Financial) reported net revenues of $34.2 million for fiscal 2025, a significant decline from $51.0 million in the previous year. The company faced a net loss of $5.3 million, compared to a net gain of $0.5 million in fiscal 2024. Earnings per share (EPS) also reflected this downturn, with a loss of $(0.63) compared to a gain of $0.07 in the prior year.

Fourth Quarter Results and Strategic Adjustments

In the fourth quarter, EDUC's net revenues were $6.6 million, down from $9.0 million in the same period last year. The company reported a net loss of $1.3 million, an improvement of $0.3 million over the previous year's fourth quarter. The loss per share was $(0.16), compared to $(0.19) in the prior year.

Per Craig White, Chief Executive Officer, “Throughout fiscal 2025, we continued to run promotions with discounted pricing, prioritizing cash flow over profitability to reduce debt and lower inventory as part of our plan with the bank. These tactical decisions have generated cash which was used to pay down debt and past due invoices with our vendors.”

Financial Achievements and Strategic Initiatives

Despite the challenges, EDUC made significant strides in reducing its financial liabilities. The company reduced vendor payables by $2.0 million and bank debts by $3.1 million. Inventory levels were also decreased from $55.6 million to $44.7 million, generating $10.9 million in cash flow. These efforts are crucial for strengthening the company's financial position amidst economic uncertainties.

“Our strategic direction remains to strengthen our financial position through the sale and leaseback of our headquarters building, the ‘Hilti Complex.’ This transaction will bring financial value to our shareholders and the proceeds from the sale are expected to fully pay down all of our remaining bank debts, eliminating interest expense which has challenged our profitability,” stated Craig White.

Income Statement and Key Metrics

| Metric | 2025 | 2024 |

|---|---|---|

| Net Revenues | $34.2 million | $51.0 million |

| Net Earnings (Loss) | $(5.3) million | $0.5 million |

| Earnings (Loss) Per Share | $(0.63) | $0.07 |

Analysis and Outlook

Educational Development Corp (EDUC, Financial) has faced a challenging fiscal year with declining revenues and profitability. However, the company's strategic focus on reducing debt and inventory levels is a positive step towards financial stability. The planned sale and leaseback of the headquarters building is expected to further alleviate financial burdens by eliminating bank debts and associated interest expenses.

As the company navigates through economic challenges, its efforts to streamline operations and focus on cash flow generation are critical. The reduction in operating expenses and improved cash flow from inventory reductions are expected to support EDUC in maintaining operational liquidity and positioning itself for future growth.

Explore the complete 8-K earnings release (here) from Educational Development Corp for further details.