Market Recap and Reactions

- After Moody's downgraded the U.S. credit rating to Aa due to rising government debt and interest payment ratios, longer-dated Treasury yields initially spiked. - The 10-year note yield increased from 4.44% to 4.56%, while the 30-year bond yield went from 4.90% to 5.04% before reversing. They settled at 4.47% and 4.94%, respectively. - Equity futures experienced selling interest, accompanied by a 1.0% decline in the U.S. Dollar Index. - Despite initial declines, the stock market saw recovery and buy-the-dip interest, driven by optimism about Congressional action on the reconciliation bill.

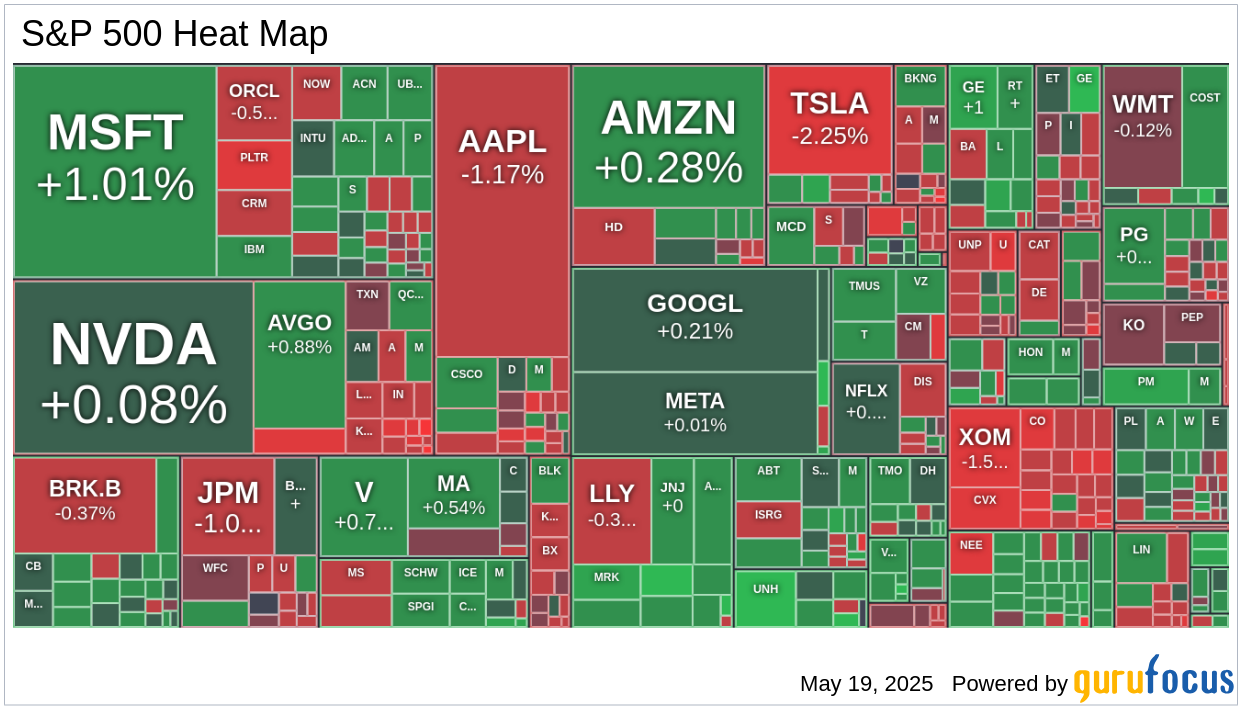

Stock Market Performance

- The S&P 500 achieved a sixth consecutive winning session even after the Moody's downgrade, as participants realized it wasn't surprising, given past downgrades by other agencies. - Seven sectors in the S&P 500 closed higher, led by the health care sector with a 1.0% gain. Consumer staples rose by 0.4%, while the energy sector fell by 1.6%. - Market breadth slightly favored decliners at both the NYSE and Nasdaq.Corporate Highlights

- JPMorgan Chase (JPM) marginally raised its FY25 net interest income outlook. - UnitedHealth Group's (UNH) CEO and CFO purchased approximately $30 million in company stock. - JPMorgan downgraded Netflix (NFLX) from Overweight to Neutral. - President Trump criticized Walmart (WMT) over tariffs.Economic Data

- The Leading Economic Index for April showed a 1.0% decline, exceeding the consensus expectation of -0.7%, and followed a downward revision in March from -0.7% to -0.8%.Global Markets and Commodities

- European markets saw mixed results with the DAX up 0.6%, the FTSE up 0.2%, and the CAC flat. - In Asia, the Nikkei declined by 0.7%, while both the Hang Seng and Shanghai Composite remained flat. - Commodity prices experienced slight changes: Crude Oil +$0.15 at $62.12, Natural Gas -$0.24 at $3.45, Gold +$48.00 at $3,234.80, Silver +$0.16 at $32.52, and Copper +$0.09 at $4.67.JPM,WMT,UNH,NFLX

Stock News

● Nvidia (NVDA, Financial) unveiled a series of cutting-edge AI technologies and strategic partnerships at the Computex 2025 conference in Taiwan. The company introduced its next-generation GB300 systems and RTX Pro Server, promising significant performance improvements. Nvidia also announced a collaboration with Foxconn and Taiwan's government to build an AI supercomputer factory, reinforcing its leadership in AI computing.

● Nvidia (NVDA, Financial) is reportedly in advanced talks to invest in PsiQuantum, a quantum computing startup. This potential investment marks Nvidia's first direct foray into quantum computing, signaling a strategic shift from its traditional AI focus. PsiQuantum is raising $750 million, valuing the company at $6 billion, with BlackRock leading the funding round.

● Qualcomm (QCOM, Financial) announced plans to develop custom CPUs for data centers that will integrate with Nvidia's AI chips. This move reintroduces Qualcomm to the data center market, leveraging Nvidia's NVLink Fusion technology to enhance CPU-GPU connectivity. The collaboration aims to advance high-performance, energy-efficient computing solutions.

● Alibaba (BABA, Financial) shares fell after reports of U.S. scrutiny over its AI partnership with Apple (AAPL, Financial). The potential deal involves integrating Alibaba's AI technology into Apple's iPhones in China, raising concerns from the Trump administration. This development adds to Alibaba's recent challenges, including disappointing quarterly revenue.

● Xiaomi (OTCPK:XIACF) plans to invest $6.9 billion in chip design over the next decade, starting in 2025. This long-term commitment aims to enhance Xiaomi's capabilities in semiconductor technology, supporting its ambitions in the smartphone and electric vehicle markets.

● Blackstone (BX, Financial) agreed to acquire TXNM Energy (TXNM, Financial) for $11.5 billion, including net debt. The deal offers a 16% premium to TXNM's last closing price and involves a $400 million investment in newly issued shares to support growth initiatives. This acquisition follows a previously abandoned deal with Iberdrola's Avangrid unit.

● AMD (AMD, Financial) announced the sale of ZT Systems' data center infrastructure manufacturing unit to Sanmina (SANM, Financial) for $3 billion. The transaction includes a contingent payment of up to $450 million and positions Sanmina as a preferred manufacturing partner for AMD's AI solutions, expected to close by the end of 2025.

● Ant Group's international division generated $3 billion in revenue ahead of its planned spinoff. The Singapore-based unit, part of Alibaba (BABA, Financial), is set to list on the Hong Kong stock exchange, focusing on AI and overseas expansion to drive growth.

● Regeneron Pharmaceuticals (REGN, Financial) will acquire 23andMe's (OTC:MEHCQ) assets for $256 million in a court-supervised sale. The acquisition includes 23andMe's Personal Genome Service and Biobank, excluding its Lemonaid Health subsidiary. The deal is expected to close in Q3 2025, pending approvals.

● Dick's Sporting Goods (DKS, Financial) is expanding its market share with the acquisition of Foot Locker (FL, Financial). The deal, valued at $24 per share, aims to enhance Dick's footwear offerings and capitalize on the resurgence of Nike (NKE) products. Despite the strategic benefits, Dick's shares have declined 12% since the announcement.

● Shake Shack (SHAK, Financial) shares dropped 3% after TD Cowen downgraded the stock to Hold, citing valuation concerns. The restaurant chain faces challenges from urban market exposure and limited pricing tailwinds. Shake Shack reported a 10.5% revenue increase in Q1, but margins slipped slightly.

● Novavax (NVAX, Financial) surged over 17% following FDA approval of its COVID-19 vaccine, Nuvaxovid. The vaccine is approved for adults 65+ and those with underlying conditions. The approval triggers a $175 million milestone payment from Sanofi (SNY) and positions Novavax for commercial delivery in the U.S. this fall.

● Toyota Industries (OTCPK:TYIDY) is expected to accept a buyout offer from Toyota Motor (TM, Financial), valued at approximately $41 billion. The acquisition would consolidate Toyota's control over its key auto parts supplier, potentially unlocking operational synergies in Japan's automotive sector.

● Western Energy Services (TSX:WRG:CA) appointed Gavin Lane as CEO, following a comprehensive search process. Lane, previously interim CEO, will lead the company as it seeks a permanent CFO. This leadership change comes amid ongoing strategic evaluations.

● Qorvo (QRVO, Financial) plans to nominate Peter Feld of Starboard Value to its board, expanding from nine to ten members. Starboard Value holds a 7.7% stake in Qorvo, and Feld's nomination reflects confidence in the company's growth potential and industry position.

● Astera Labs (ALAB, Financial) announced an expanded collaboration with Nvidia (NVDA, Financial) to enhance connectivity solutions for the NVLink Fusion ecosystem. This partnership aims to improve market opportunities and time-to-market for hyperscaler customers.

● OraSure Technologies (OSUR, Financial) rose 6% as it is seen benefiting from Regeneron's (REGN, Financial) acquisition of 23andMe. OraSure, a diagnostics test manufacturer, is expected to maintain its relationship with 23andMe, contributing to its revenue growth.

● NWTN (NWTN, Financial) shares nearly doubled following the appointment of Benjamin Zhai as CEO. The company plans to pivot towards smart technology, expanding beyond New Energy Vehicles to include autonomous systems and smart devices, leveraging UAE's tech infrastructure.

● TransDigm Group (TDG, Financial) announced a merger agreement to acquire Servotronics (SVT, Financial) for $38.50 per share, valuing the transaction at $110 million. The acquisition, funded with cash on hand, aims to enhance TransDigm's engineered servo valve offerings.

● Gladstone Investment (GAIN, Financial) acquired Smart Chemical Solutions, a provider of production chemicals for oil and gas operators. The acquisition aligns with Gladstone's strategy to expand its portfolio and maintain a strong dividend yield.

GuruFocus Stock Analysis

- Nvidia (NVDA, Financial) Opens NVLink Fusion to Outside Chips in AI Push by Faizan Farooque

- Cathie Wood Calls Healthcare the Most Overlooked AI Winner by Faizan Farooque

- Klarna Doubles Losses in Q1 as IPO Plans Stall by Faizan Farooque

- Super Micro (SMCI) Target Raised to $40 by Mizuho on AI Tailwinds by Faizan Farooque

- AMD (AMD, Financial) Price Target Raised to $135 on AI Momentum by Faizan Farooque