- Delta Air Lines (DAL, Financial) initiates legal action against CrowdStrike (CRWD) due to a major 2024 outage causing substantial financial loss.

- Analysts predict a bullish trend for Delta, with a substantial upside potential based on current price targets.

- GuruFocus metrics suggest a potential dip in DAL's valuation, contrasting with bullish analyst predictions.

Delta Air Lines (NYSE: DAL) has taken a significant legal step by obtaining court approval to pursue damages from CrowdStrike Holdings, Inc. (NASDAQ: CRWD). This move comes after a massive system outage in 2024 led to the grounding of 7,000 flights and resulted in an estimated $500 million revenue loss. The lawsuit accuses CrowdStrike of "gross negligence and computer trespass," allegations that the cybersecurity firm staunchly denies. The ripple effects of the outage extend beyond this lawsuit, as Delta also contends with a class-action suit from passengers impacted by the disruption.

Wall Street Analysts' Insights and Predictions

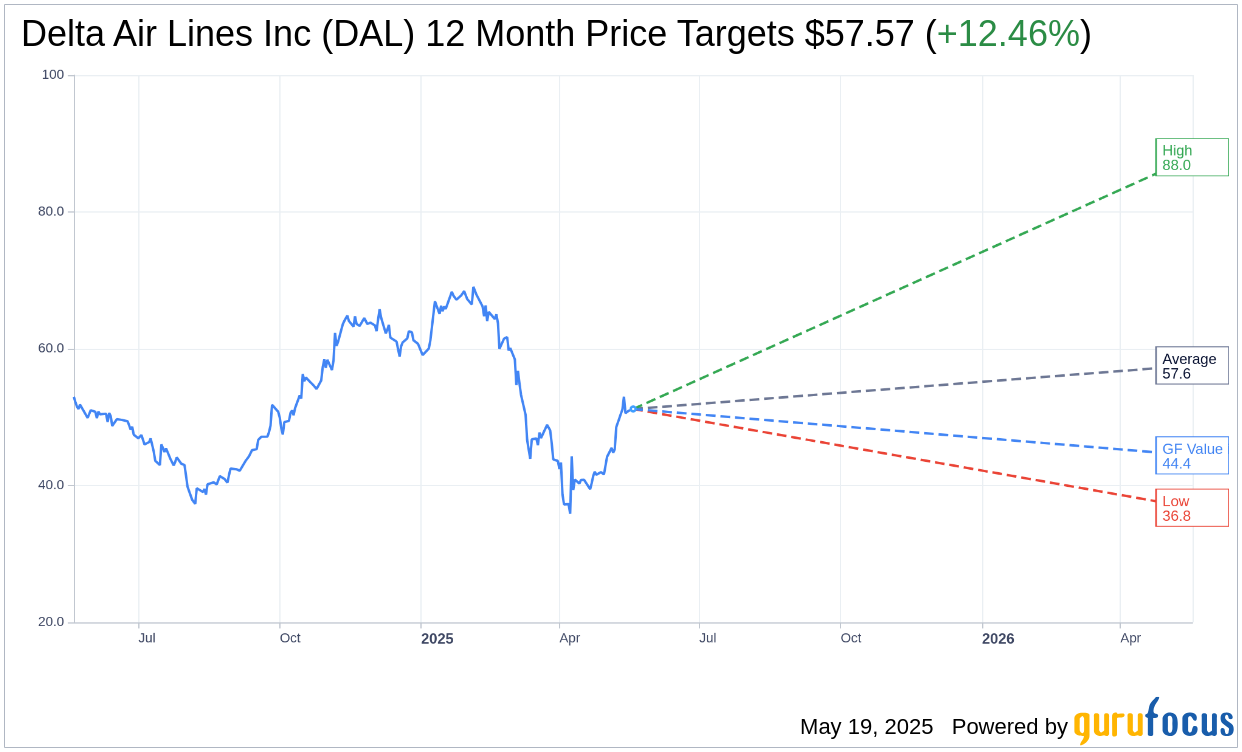

Examining the insights of 19 seasoned analysts, Delta Air Lines Inc (NYSE: DAL) presents a promising one-year price target averaging $57.57. With a high projection at $88.00 and a low of $36.77, the average target price suggests a potential upside of 12.46% from its current market value of $51.19. Investors can explore more extensive estimate data on the Delta Air Lines Inc (DAL, Financial) Forecast page.

In terms of brokerage ratings, Delta Air Lines Inc's (DAL, Financial) consensus from 23 firms is an encouraging 1.9, indicating an "Outperform" rating. Notably, the rating scale, ranging from 1 (Strong Buy) to 5 (Sell), positions DAL as a favorable investment in the eyes of market experts.

GuruFocus Valuation and Financial Forecast

Despite the optimistic outlook from Wall Street analysts, GuruFocus provides a contrasting perspective with its estimated GF Value for Delta Air Lines Inc (DAL, Financial). The forecasted GF Value stands at $44.42, suggesting a downside of 13.23% from the current trading price of $51.19. This valuation, calculated using historical trading multiples and business performance forecasts, offers investors a comprehensive assessment of the stock's fair market value. More extensive data is available on the Delta Air Lines Inc (DAL) Summary page.

In conclusion, while Delta Air Lines faces legal challenges post-outage, the stock's market outlook remains debated, with analysts and valuation models providing varied perspectives on its future trajectory.