Summary:

- Qifu Technology (QFIN, Financial) exceeds earnings expectations with a significant boost in revenue.

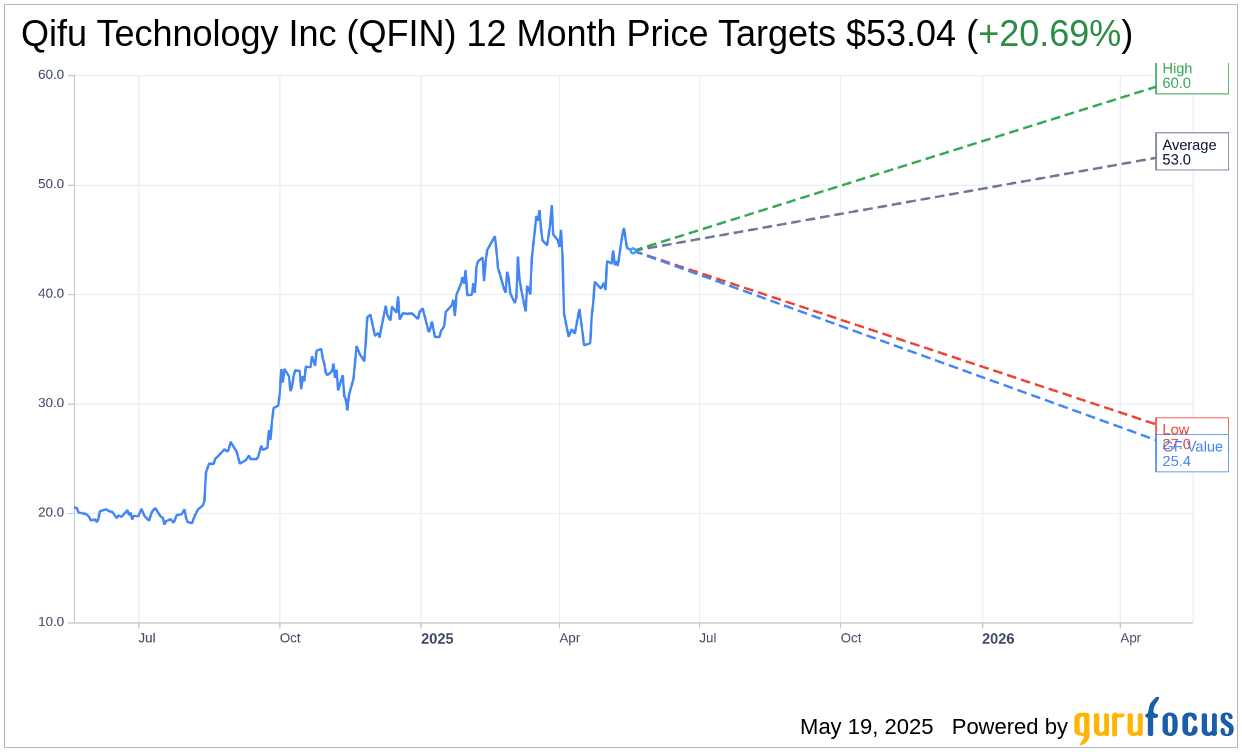

- Analysts predict an average price target that offers a 20.69% upside potential.

- The company's fair value suggests a downside, raising important considerations for investors.

Qifu Technology Inc (NASDAQ: QFIN) delivered a strong performance in the first quarter, reporting Non-GAAP earnings per ADS of $1.86. This impressive result surpassed revenue expectations, reaching $646.4 million—an achievement marked by a notable 12.4% increase from the previous year. The company's robust growth trajectory was further amplified by a proposed $600 million convertible senior notes offering and a notable rise in stock prices following an announced dividend increase.

Wall Street Analysts Forecast

According to one-year projections from 13 analysts, Qifu Technology Inc (QFIN, Financial) has an average price target of $53.04. Projections range from a high of $59.99 to a low of $26.99. This average target points to a potential upside of 20.69% from the current trading price of $43.95. For more comprehensive forecast data, visit the Qifu Technology Inc (QFIN) Forecast page.

Investor sentiment remains optimistic, as indicated by a consensus recommendation from 12 brokerage firms. Currently, the average brokerage recommendation for Qifu Technology Inc (QFIN, Financial) is 1.6, categorizing the stock as "Outperform." The recommendation scale spans from 1 (Strong Buy) to 5 (Sell), highlighting investor confidence in the stock's future performance.

Examining GF Value and Investment Considerations

Despite the optimistic analyst forecasts, GuruFocus estimates present a different perspective. The estimated GF Value for Qifu Technology Inc (QFIN, Financial) in one year is $25.45, suggesting a potential downside of 42.09% from the current price of $43.95. The GF Value assesses a stock's fair trading value by examining its historical trading multiples, previous growth trends, and future performance projections. This metric serves as a crucial tool for investors seeking to understand the stock's intrinsic value. For further insights, view the detailed metrics on the Qifu Technology Inc (QFIN) Summary page.

Investors are advised to weigh these contrasting insights carefully, considering both the promising analyst targets and the more conservative GF Value estimate, to make informed investment decisions regarding Qifu Technology.