Cirrus Logic (CRUS, Financial) has entered into a strategic alliance with Compal Electronics, a Taiwanese company, to develop advanced AI technology targeting audio quality issues in laptops. This partnership aims to combine Cirrus Logic's proficiency in audio processing with Compal's manufacturing capabilities to tackle longstanding problems of mechanical rattle and audio distortion in the PC industry.

This venture introduces Cirrus Logic’s initial AI audio technology specifically crafted for the PC sector. Plans are in place to showcase prototypes of this technology at Computex 2025 in Taipei, marking a significant step in enhancing laptop audio performance.

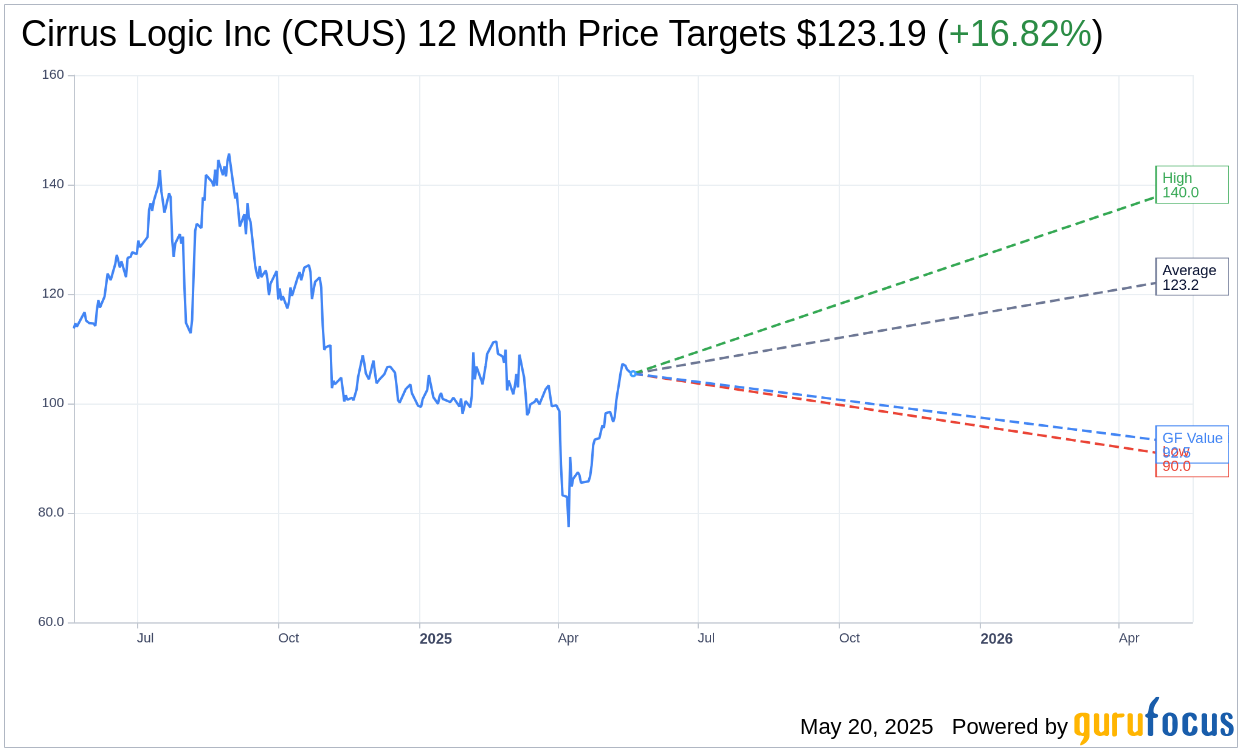

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Cirrus Logic Inc (CRUS, Financial) is $123.19 with a high estimate of $140.00 and a low estimate of $90.00. The average target implies an upside of 16.82% from the current price of $105.45. More detailed estimate data can be found on the Cirrus Logic Inc (CRUS) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Cirrus Logic Inc's (CRUS, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Cirrus Logic Inc (CRUS, Financial) in one year is $92.52, suggesting a downside of 12.26% from the current price of $105.45. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Cirrus Logic Inc (CRUS) Summary page.

CRUS Key Business Developments

Release Date: May 06, 2025

- Q4 Revenue: $424.5 million, above guidance range.

- Full Fiscal Year 2025 Revenue: $1.9 billion, up 6% year-over-year.

- Non-GAAP Gross Profit (Q4): $227.1 million.

- Non-GAAP Gross Margin (Q4): 53.5%.

- Non-GAAP Gross Profit (Fiscal Year 2025): $997.4 million.

- Non-GAAP Gross Margin (Fiscal Year 2025): 52.6%.

- Non-GAAP Operating Expenses (Q4): $120 million.

- Non-GAAP Operating Income (Q4): $107.1 million, 25.2% of revenue.

- Non-GAAP Operating Expenses (Fiscal Year 2025): $494.1 million.

- Non-GAAP Operating Income (Fiscal Year 2025): $503.3 million, 26.5% operating margin.

- Non-GAAP Net Income (Q4): $90.6 million, $1.67 per share.

- Non-GAAP Net Income (Fiscal Year 2025): $416.6 million, $7.54 per share.

- Cash and Investments: $835 million at fiscal year-end.

- Inventory (Q4): $299.1 million, 138 days of inventory.

- Cash Flow from Operations (Q4): $130.4 million.

- CapEx (Q4): $9.2 million.

- Non-GAAP Free Cash Flow Margin (Q4): 29%.

- Share Repurchases (Fiscal Year 2025): $261 million, 2.3 million shares.

- Q1 Fiscal Year 2026 Revenue Guidance: $330 million to $390 million.

- Q1 Fiscal Year 2026 Gross Margin Guidance: 51% to 53%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Cirrus Logic Inc (CRUS, Financial) delivered revenue of $424.5 million in the March quarter, exceeding the top end of their guidance range.

- For the full fiscal year 2025, the company achieved revenue of $1.9 billion, marking a 6% year-over-year increase.

- The company reported record GAAP and non-GAAP earnings per share for the full fiscal year.

- Cirrus Logic Inc (CRUS) returned $261 million to shareholders through share repurchases, setting a new record for a full fiscal year.

- The company made significant progress in expanding its product portfolio, including new generation products in the smartphone audio business and high-performance mixed signal areas.

Negative Points

- Revenue in Q4 fiscal year 2025 was down 24% sequentially, primarily due to a reduction in smartphone volumes.

- The company is facing uncertainties related to the macroeconomic environment and potential impacts from tariffs.

- Non-GAAP operating expenses for the fiscal year 2025 increased by $23.7 million, primarily due to higher employee-related expenses and variable compensation.

- Inventory levels increased, with days of inventory rising to 138 days, up 40 days sequentially.

- Guidance for Q1 fiscal year 2026 indicates a revenue decline of 15% sequentially and 4% year-over-year at the midpoint.