Itau BBA has initiated its coverage of Banco BBVA Argentina, designated with the ticker BBAR, by assigning it a Market Perform rating. The analysts have set a price target of $18 for the stock, indicating a neutral stance on its future performance. This coverage provides investors with a fresh perspective on the potential value of BBAR, reflecting a balanced view of the company's prospects.

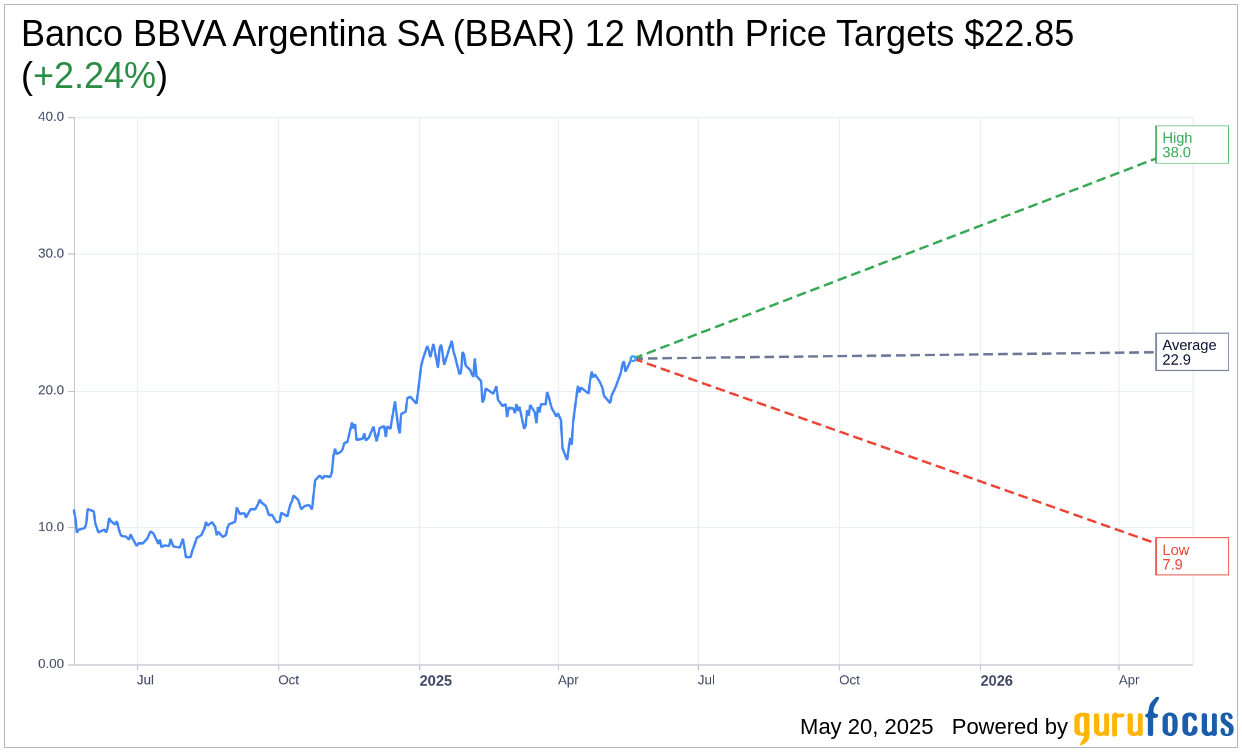

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for Banco BBVA Argentina SA (BBAR, Financial) is $22.85 with a high estimate of $38.00 and a low estimate of $7.90. The average target implies an upside of 2.24% from the current price of $22.35. More detailed estimate data can be found on the Banco BBVA Argentina SA (BBAR) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, Banco BBVA Argentina SA's (BBAR, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Banco BBVA Argentina SA (BBAR, Financial) in one year is $6.16, suggesting a downside of 72.44% from the current price of $22.35. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Banco BBVA Argentina SA (BBAR) Summary page.

BBAR Key Business Developments

Release Date: March 06, 2025

- Net Income (4Q 2024): ARS64.7 billion, a decrease of 39.6% quarter-over-quarter.

- Quarterly ROE (4Q 2024): 9.5%.

- Quarterly ROA (4Q 2024): 1.7%.

- Net Income (2024): ARS357.7 billion, a decrease of 0.4% year-over-year.

- Annualized ROE (2024): 12.5%.

- Annualized ROA (2024): 2.5%.

- Net Interest Income (2024): ARS2.9 trillion, a decrease of 17.3% year-over-year.

- Total Operating Expenses (2024): ARS1.7 trillion, a decrease of 3.9% year-over-year.

- Efficiency Ratio (4Q 2024): 61.8%, up from 59.7% in 3Q 2024.

- Total NIM (2024): 35%, down from 37.3% in 2023.

- Private Sector Loans (4Q 2024): ARS7.6 trillion, an increase of 28.7% quarter-over-quarter and 75% year-over-year.

- Total Deposits (4Q 2024): ARS9.9 trillion, an increase of 7.8% quarter-over-quarter.

- Capital Ratio (4Q 2024): 19.5%.

- Market Share of Private Sector Loans (4Q 2024): 11.31%, up from 9.35% a year ago.

- Market Share of Private Deposits (4Q 2024): 8.72%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Banco BBVA Argentina SA (BBAR, Financial) reported a significant increase in new customer acquisition through digital channels, reaching 88% by the end of 2024, up from 78% a year ago.

- The bank's retail digital sales reached 91% in the fourth quarter of 2024, representing 73.5% of total sales in monetary value.

- Private sector loans increased by 75% year-over-year, with a notable 28.7% increase quarter-over-quarter, driven by growth in credit cards, discounted instruments, and customer loans.

- The bank's consolidated market share of private sector loans improved to 11.31% as of the fourth quarter of 2024, up from 9.35% a year ago.

- BBVA Argentina continues to show strong solvency indicators with a capital ratio of 19.5% and a capital excess over regulatory requirements of 138.5%.

Negative Points

- BBVA Argentina's inflation-adjusted net income in the fourth quarter of 2024 decreased by 39.6% quarter-over-quarter, with a quarterly ROE of 9.5% and a quarterly ROA of 1.7%.

- The bank experienced a 48.1% fall in quarterly operating results due to lower operating income and higher operating expenses.

- Net interest income fell by 17.3% year-over-year, impacted by lower accrued average rates in loans and lower inflation affecting CPI-linked bonds.

- The efficiency ratio increased to 61.8% in the fourth quarter of 2024, up from 59.7% in the third quarter, due to a decrease in both fee and interest income.

- The bank's total net interest margin (NIM) decreased to 35% in 2024 from 37.3% in 2023, reflecting a 234 basis points fall due to an aggressive decline in interest rates.