TD Cowen has initiated coverage on Zymeworks (ZYME, Financial) with a Buy rating, highlighting the company's innovative platform that includes antibody-drug conjugates and multi-specific T cell engagers. These technologies are being utilized in the fields of oncology, autoimmune, and inflammatory diseases. The firm sees significant potential in Zymeworks' Ziihera, considering it a possible blockbuster with crucial data expected to be revealed in the second half of 2025. TD Cowen anticipates that royalties from Ziihera will help support the company's pipeline over the next two years.

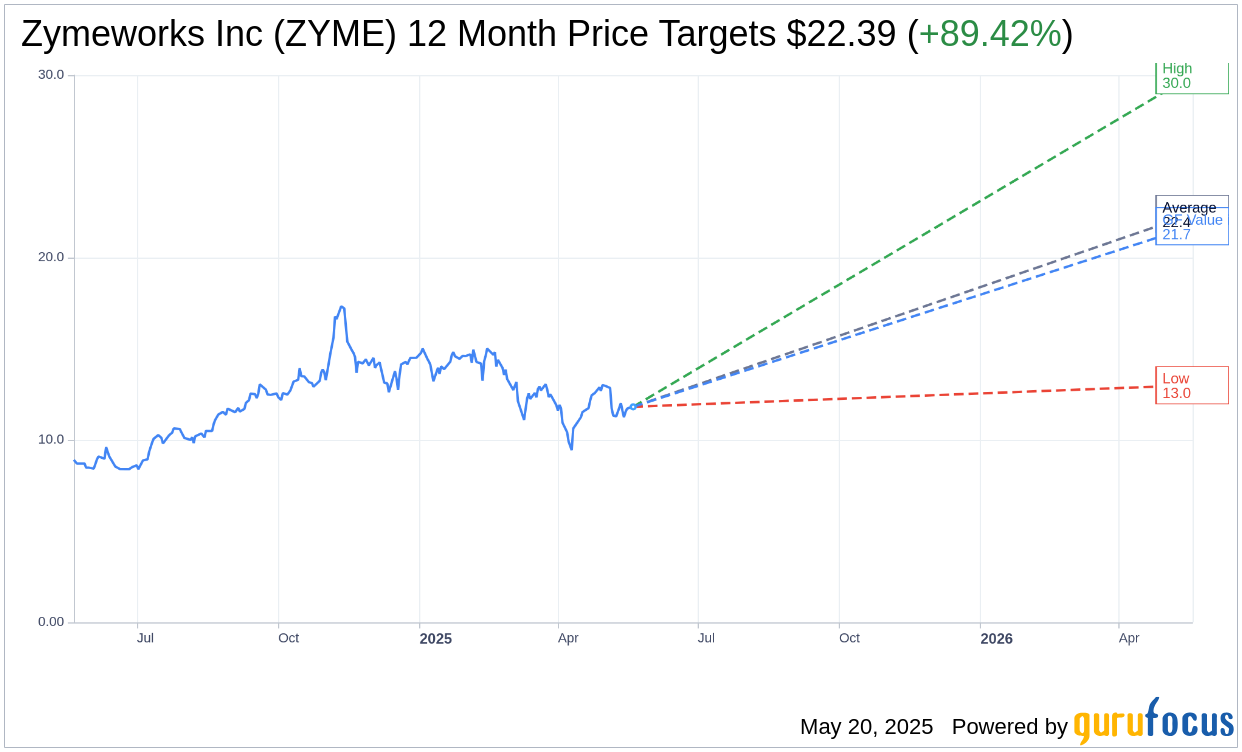

Wall Street Analysts Forecast

Based on the one-year price targets offered by 9 analysts, the average target price for Zymeworks Inc (ZYME, Financial) is $22.39 with a high estimate of $30.00 and a low estimate of $13.00. The average target implies an upside of 89.42% from the current price of $11.82. More detailed estimate data can be found on the Zymeworks Inc (ZYME) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Zymeworks Inc's (ZYME, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Zymeworks Inc (ZYME, Financial) in one year is $21.72, suggesting a upside of 83.76% from the current price of $11.82. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Zymeworks Inc (ZYME) Summary page.

ZYME Key Business Developments

Release Date: May 08, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Zymeworks Inc (ZYME, Financial) reported a significant increase in revenue for Q1 2025, reaching $27.1 million compared to $10 million in the same period in 2024.

- The company achieved a decrease in net loss from $31.7 million in Q1 2024 to $22.6 million in Q1 2025, primarily due to increased revenue.

- Zymeworks Inc (ZYME) has a strong cash position with $321.6 million in cash resources, expected to fund operations into the second half of 2027.

- The company presented six posters at the AACR annual meeting, showcasing progress in their antibody drug conjugate and T-cell engager pipeline.

- Zymeworks Inc (ZYME) is eligible for significant milestone payments and royalties from partnerships, including up to $86 million in development milestones and $373 million in commercial milestone payments from J&J.

Negative Points

- Operating expenses increased by 10% to $52.7 million in Q1 2025 compared to $47.3 million in Q1 2024.

- Research and development expenses rose to $35.7 million in Q1 2025 from $32 million in Q1 2024, driven by increased preclinical research expenses.

- General and administrative expenses increased to $17 million in Q1 2025 from $15.8 million in Q1 2024, primarily due to higher stock-based compensation.

- The company faces uncertainties related to the approval of Zanadatimab for HER2+ biliary tract cancer, which could impact future royalty revenues.

- Zymeworks Inc (ZYME) has not provided specific guidance on the timing of data releases for key clinical programs, which may concern investors seeking near-term updates.