Cognyte (CGNT, Financial) has entered into a significant three-year subscription deal exceeding $10 million annually with a key national security entity in the EMEA region. This agreement grants the security agency access to Cognyte's advanced AI-driven technologies and a broadened range of solutions, with ongoing improvements anticipated. The partnership includes an upgrade to Cognyte's latest investigative analytics platform, enhancing the agency's capability to tackle intricate and evolving security issues.

The upgraded platform is designed to extract actionable insights from extensive and diverse datasets, thereby streamlining investigations, enhancing decision-making processes, and boosting operational effectiveness.

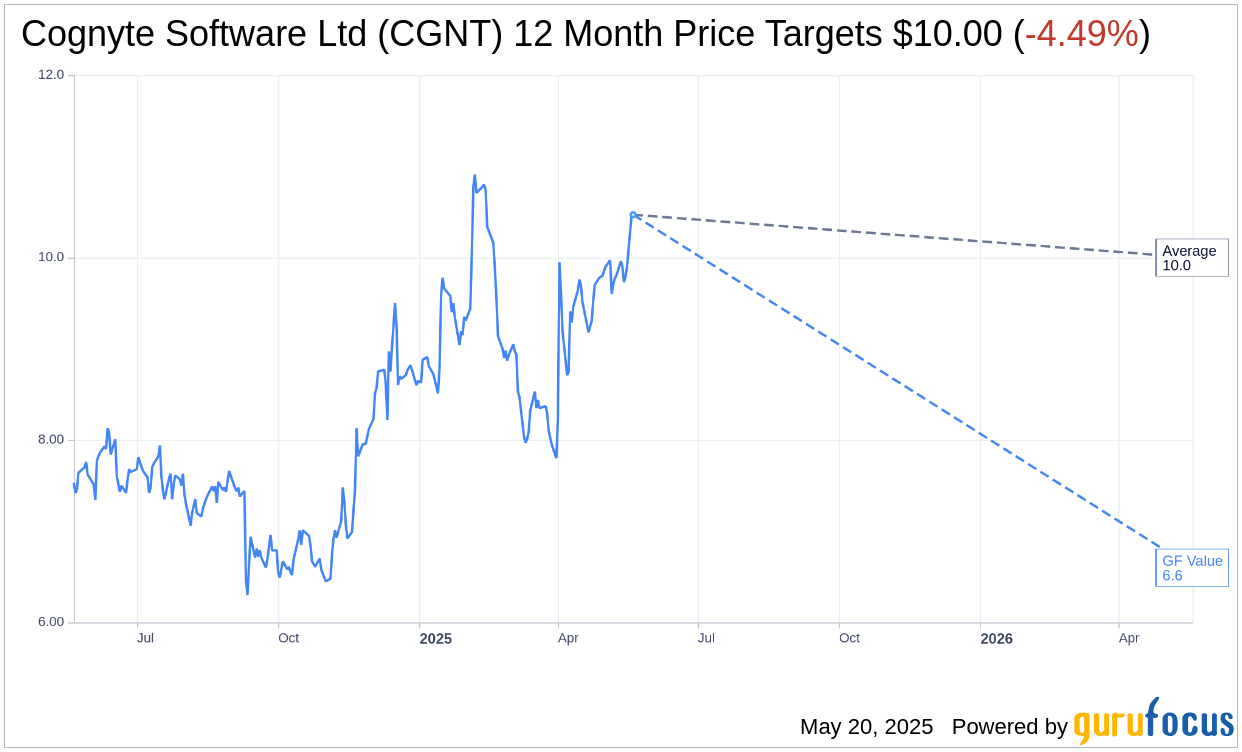

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Cognyte Software Ltd (CGNT, Financial) is $10.00 with a high estimate of $10.00 and a low estimate of $10.00. The average target implies an downside of 4.49% from the current price of $10.47. More detailed estimate data can be found on the Cognyte Software Ltd (CGNT) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Cognyte Software Ltd's (CGNT, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Cognyte Software Ltd (CGNT, Financial) in one year is $6.60, suggesting a downside of 36.96% from the current price of $10.47. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Cognyte Software Ltd (CGNT) Summary page.

CGNT Key Business Developments

Release Date: April 02, 2025

- Q4 Revenue: $94.5 million, a 12.9% year-over-year increase.

- Full-Year Revenue: $350.6 million, approximately 12% year-over-year growth.

- Non-GAAP Gross Profit: $67.6 million for Q4, a 17% year-over-year increase.

- Adjusted EBITDA: $9.3 million for Q4, a 140% year-over-year increase.

- Cash Flow from Operations: $18.7 million for Q4 and $47 million for the full year.

- Non-GAAP Operating Income: $6 million for Q4, over 500% increase year-over-year.

- Non-GAAP Gross Margin: 71.5% for Q4, an improvement of 150 basis points year-over-year.

- Recurring Revenue: $47.3 million for Q4, representing 50% of total revenue.

- Cash Position: $113.3 million at year-end, with no debt.

- Fiscal '26 Revenue Guidance: Approximately $392 million, representing about 12% year-over-year growth.

- Fiscal '26 Adjusted EBITDA Guidance: Approximately $43 million, a 45% year-over-year growth.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Cognyte Software Ltd (CGNT, Financial) reported double-digit revenue growth of 13% year over year for Q4, reaching $94.5 million.

- The company achieved a significant year-over-year increase in profitability, with non-GAAP gross profit rising by 17%.

- Adjusted EBITDA for the quarter grew by 114% year over year, amounting to over $9 million.

- Cognyte Software Ltd (CGNT) secured several significant deals, including a $10 million technology upgrade and multi-year support agreement with a law enforcement agency in EMEA.

- The company added over 60 new customers across multiple regions during the fiscal year, doubling the number from the previous year.

Negative Points

- Revenue from the Americas region declined modestly last year, despite an increase in revenue from the US.

- Total RPO (Remaining Performance Obligations) decreased by about $45 million compared to the previous year.

- The sales cycle in the US is longer than in other territories, impacting the speed of market penetration.

- Billing for Q4 was consistent with last year, indicating no growth in this metric.

- Cash flow from operations is expected to decline slightly in fiscal '26 compared to the previous year.