Zapp (ZAPP, Financial) has been downgraded from a Buy to a Hold rating by Maxim analyst Tate Sullivan. This decision follows the company's move from the Nasdaq to the OTC Pink Current Market. According to Sullivan, this transition could complicate efforts to secure financing, which is essential for sustaining operations and expanding sales of electric urban motorcycles.

Maxim further notes that raising capital in this new environment may become more challenging and could potentially lead to increased dilution for current shareholders. The analyst's report underscores the financial hurdles Zapp faces in its growth trajectory within the competitive electric motorcycle market.

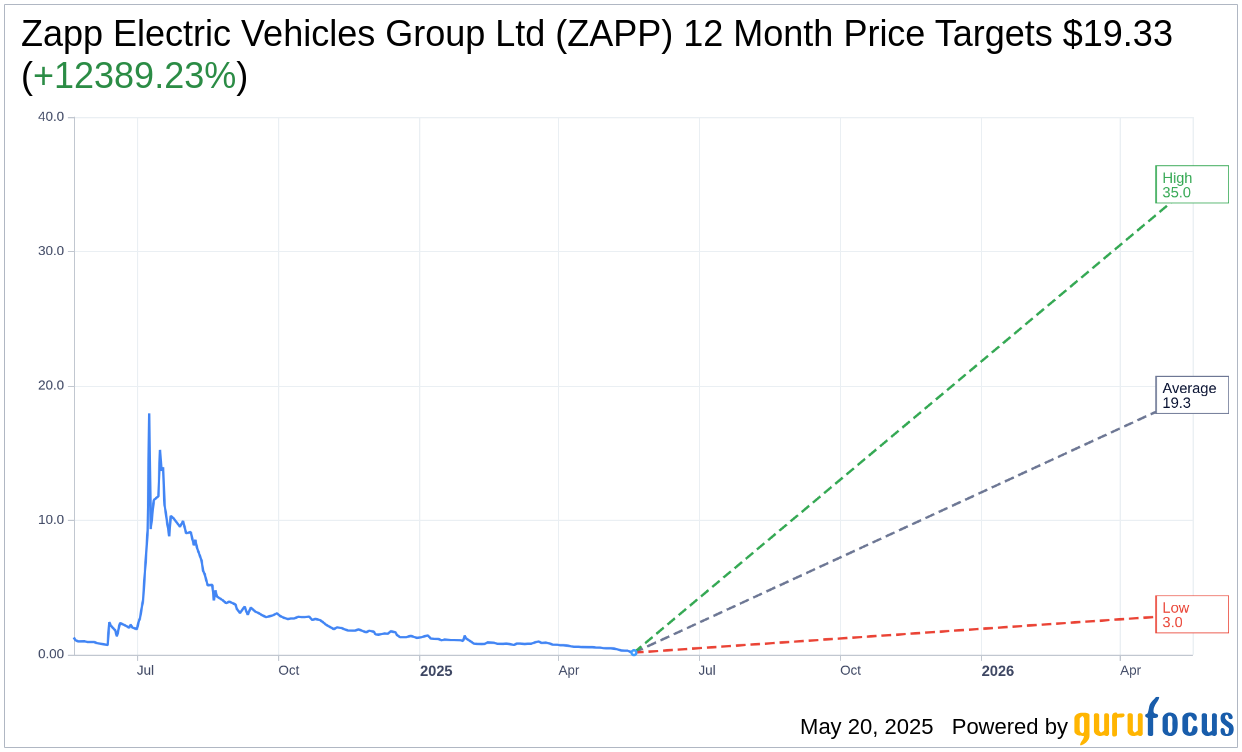

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Zapp Electric Vehicles Group Ltd (ZAPP, Financial) is $19.33 with a high estimate of $35.00 and a low estimate of $3.00. The average target implies an upside of 12,389.23% from the current price of $0.15. More detailed estimate data can be found on the Zapp Electric Vehicles Group Ltd (ZAPP) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Zapp Electric Vehicles Group Ltd's (ZAPP, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.