Bowman Consulting Group (BWMN, Financial) has been awarded a significant $1.3 million contract by the Aerotropolis Area Coordination Metropolitan District. This contract involves the design and development of ATEC Parkway, a two-mile stretch of road within The Aurora Highlands, located in Aurora, Colorado.

As part of the agreement, Bowman Consulting will handle the creation of roadway plans, along with drainage studies, and the design of water and storm utility systems. They are also tasked with stormwater management planning, project management, and construction documentation. This initiative is a part of a broader effort that positions Bowman as a key player in over $500 million worth of infrastructure developments within The Aurora Highlands. This area is recognized as the largest community development in the Denver metro region, with the ATEC Parkway being a critical component.

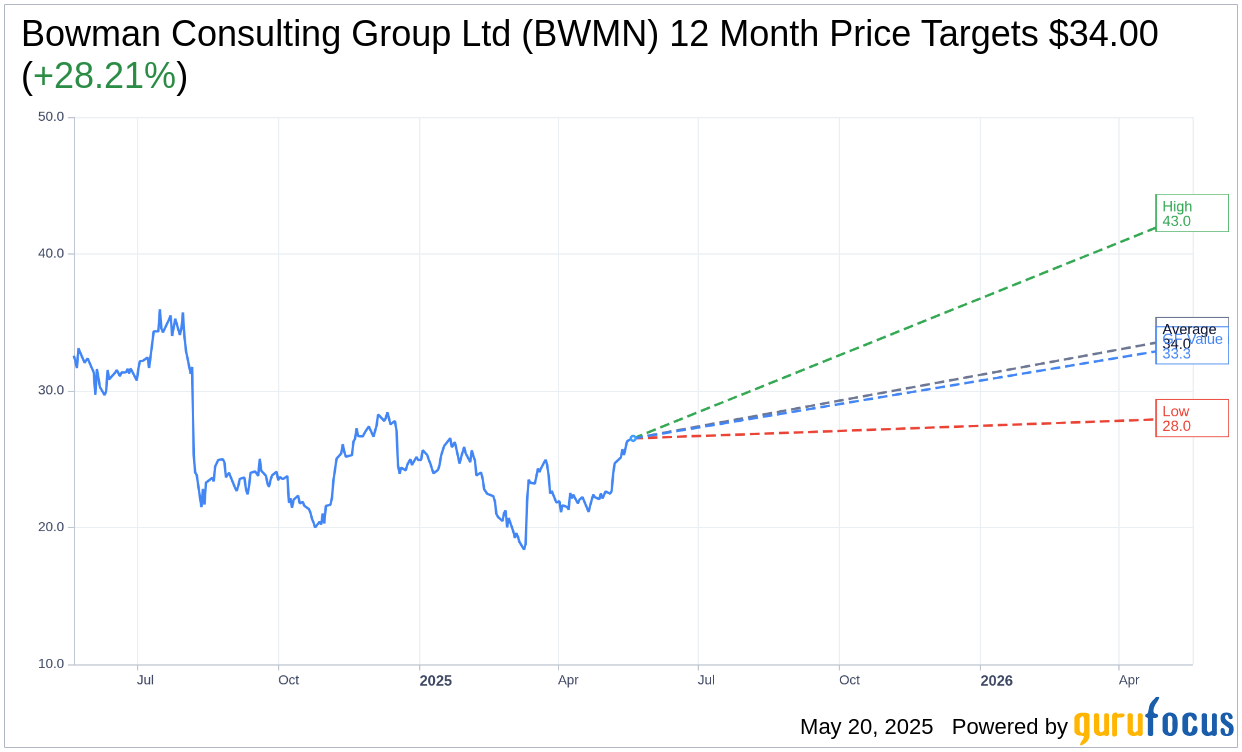

Wall Street Analysts Forecast

Based on the one-year price targets offered by 6 analysts, the average target price for Bowman Consulting Group Ltd (BWMN, Financial) is $34.00 with a high estimate of $43.00 and a low estimate of $28.00. The average target implies an upside of 28.21% from the current price of $26.52. More detailed estimate data can be found on the Bowman Consulting Group Ltd (BWMN) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Bowman Consulting Group Ltd's (BWMN, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Bowman Consulting Group Ltd (BWMN, Financial) in one year is $33.32, suggesting a upside of 25.64% from the current price of $26.52. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Bowman Consulting Group Ltd (BWMN) Summary page.

BWMN Key Business Developments

Release Date: May 07, 2025

- Gross Revenue: Increased 19% to $112.9 million from $94.9 million last year.

- Net Service Billing: Up 17% to $100.1 million from $85.7 million last year.

- Gross Margin: Slightly increased to 51.4% from 50.6% last year.

- SG&A Expenses: Down 240 basis points as a percentage of gross revenue, at 44.7%.

- Net Loss: Flat at $1.7 million, with pre-tax net income improving from a loss of $5 million to a loss of just under $1 million.

- Adjusted EBITDA: Increased 19.6% to $14.5 million from $12.1 million last year.

- Adjusted EBITDA Margin: On net revenue, up 30 basis points to 14.5% from 14.2% last year.

- Cash Flow from Operations: Improved to $12 million from $2.5 million last year.

- Backlog: Increased to $419 million, up $20 million from Q4 and nearly $90 million from last year.

- Share Repurchases: $6.7 million repurchased at an average price of $250 per share during the quarter.

- Net Debt: $97 million, with a leverage ratio of 1.6 times trailing four quarters adjusted EBITDA.

- Revenue by Sector: Transportation grew 30%, Power and Utilities grew 16%, Building Infrastructure grew 6%, and Emerging Markets grew 118%.

- Organic Net Revenue Growth: Approximately 6%, doubling last year's growth.

- Full Year Guidance: Net revenues expected between $428 million to $440 million, with adjusted EBITDA between $70 million and $76 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Bowman Consulting Group Ltd (BWMN, Financial) reported a strong start to 2025 with record performance in bookings, gross revenue, net service billing, and cash conversion.

- Net service billing grew by almost 17%, surpassing $100 million, and organic revenue growth more than doubled compared to Q1 of the previous year.

- Gross revenue increased by 19% to $112.9 million, and adjusted EBITDA rose by 19.6% to $14.5 million, indicating improved financial performance.

- The company's backlog increased by 27% year over year to almost $419 million, providing visibility for future revenue.

- Bowman Consulting Group Ltd (BWMN) maintains a high net to growth ratio, emphasizing internally generated revenue as the foundation for high-margin long-term growth and free cash flow.

Negative Points

- Despite improvements, the company reported a net loss of $1.7 million, indicating ongoing challenges in achieving profitability.

- Adjusted EBITDA margin on net revenue was slightly below the indicated midpoint of the company's outlook, suggesting room for improvement in margin performance.

- The transportation sector showed some lumpiness in operations, with order activity being lighter than in past quarters.

- The company faces a competitive M&A market with strong valuations, making it challenging to find larger acquisitions for inorganic growth.

- Bowman Consulting Group Ltd (BWMN) is cautiously integrating AI into its operations, indicating that it has not yet significantly impacted the company's competitive position.