IHS Towers (IHS, Financial) reported a robust start to 2025, with first-quarter revenue reaching $439.6 million, surpassing the market expectation of $408.98 million. This performance reflects solid growth in their key metrics, including revenue, Adjusted EBITDA, and Adjusted Levered Free Cash Flow (ALFCF). The company has also successfully reduced its total capital expenditure.

Building on the momentum from 2024, IHS is maintaining its positive outlook for the full year of 2025. Effective financial management and strategic capital allocation have enhanced profitability and cash flow, further reducing the company's consolidated net leverage ratio to 3.4x from 3.7x at the end of the previous year.

Additionally, IHS has announced the sale of its Rwanda operations for an enterprise value of $274.5 million. This divestment is part of a broader strategy to boost shareholder value and underscores the intrinsic value within its portfolio. The focus on such strategic initiatives continues to position IHS favorably in the market.

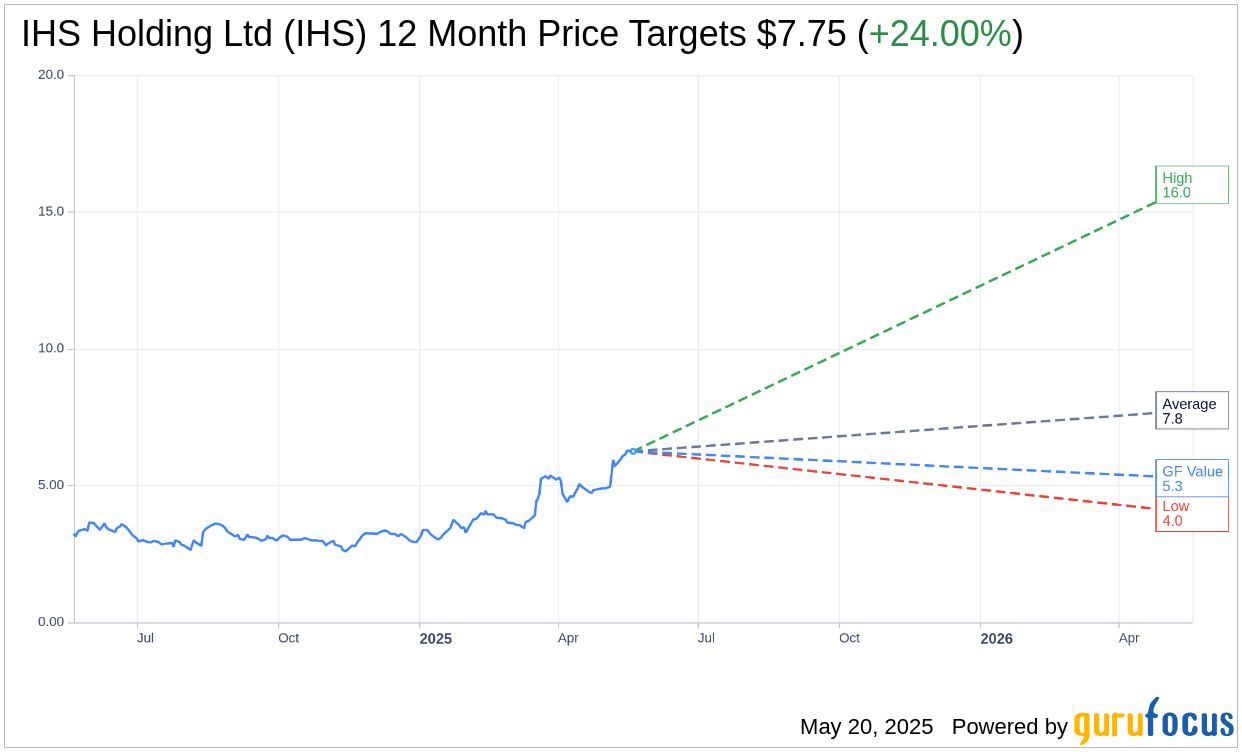

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for IHS Holding Ltd (IHS, Financial) is $7.75 with a high estimate of $16.00 and a low estimate of $4.00. The average target implies an upside of 24.00% from the current price of $6.25. More detailed estimate data can be found on the IHS Holding Ltd (IHS) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, IHS Holding Ltd's (IHS, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for IHS Holding Ltd (IHS, Financial) in one year is $5.27, suggesting a downside of 15.68% from the current price of $6.25. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the IHS Holding Ltd (IHS) Summary page.

IHS Key Business Developments

Release Date: March 18, 2025

- Revenue Growth: 48% organic growth in 2024, with 6.5% constant currency growth.

- Adjusted EBITDA: $928 million in 2024, with a margin of 54.3%, up 100 basis points from 2023.

- ALFCF (Adjusted Levered Free Cash Flow): $304 million in 2024, ahead of guidance.

- Net Leverage Ratio: Reduced to 3.7 times at the end of 2024 from 3.9 times in Q3 2024.

- CapEx: Decreased by 56% for the year, with a focus on cash generation.

- Fourth Quarter Revenue: Declined by approximately 14% year-on-year due to FX environment and new financial terms with MTN Nigeria.

- Fourth Quarter Adjusted EBITDA Margin: 56.3%, up 250 basis points year-on-year.

- 2025 Guidance: Revenue of $1.68 billion to $1.71 billion, adjusted EBITDA of $960 million to $980 million, ALFCF of $350 million to $370 million.

- Debt Refinancing: $1.6 billion refinanced in Q4 2024, extending maturities and shifting debt into local currency.

- Cash and Liquidity: Over $900 million of available liquidity at the end of 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- IHS Holding Ltd (IHS, Financial) reported strong financial performance in 2024, with key metrics such as revenue, adjusted EBITDA, and ALFCF exceeding guidance.

- The company achieved 48% organic revenue growth, driven by 6.5% constant currency growth and benefits from Forex resets and power indexation.

- Adjusted EBITDA reached $928 million in 2024, with a margin of 54.3%, up 100 basis points from 2023, highlighting financial resilience.

- IHS Holding Ltd (IHS) successfully reduced its net leverage ratio to 3.7 times by the end of 2024, down from 3.9 times in Q3 2024.

- The company made significant progress in strategic initiatives, including extending commercial contracts with key customers and completing asset disposals, such as the sale of its Kuwait operations.

Negative Points

- Revenue in the fourth quarter of 2024 declined by approximately 14% year-on-year due to Forex challenges and new financial terms with MTN Nigeria.

- Adjusted EBITDA decreased by 10% year-on-year, impacted by Forex volatility and higher interest costs following bond refinancing.

- The company's CapEx investment decreased by 37% in Q4 and 56% for the year, reflecting a pullback in CapEx across all segments.

- IHS Holding Ltd (IHS) faces ongoing challenges with currency devaluation, particularly in Nigeria, which affected financial results.

- The company is still in the process of asset disposals, with a target of raising $500 million to $1 billion, indicating ongoing strategic adjustments.