General Motors (GM) has introduced a redesigned GM Rewards loyalty program in collaboration with Barclays US Consumer Bank (BCS, Financial), featuring the new GM Rewards Mastercard. This upgraded program aims to provide a straightforward approach for customers to accumulate and utilize GM Rewards points. These points can be applied towards a variety of GM products and services, including new vehicles, parts, and accessories.

Barclays executives highlight the value of this partnership, emphasizing that the GM Rewards Mastercard offers extensive benefits and flexible redemption choices. This collaboration seeks to enhance the purchasing experience for GM customers across the United States by integrating industry-leading incentives.

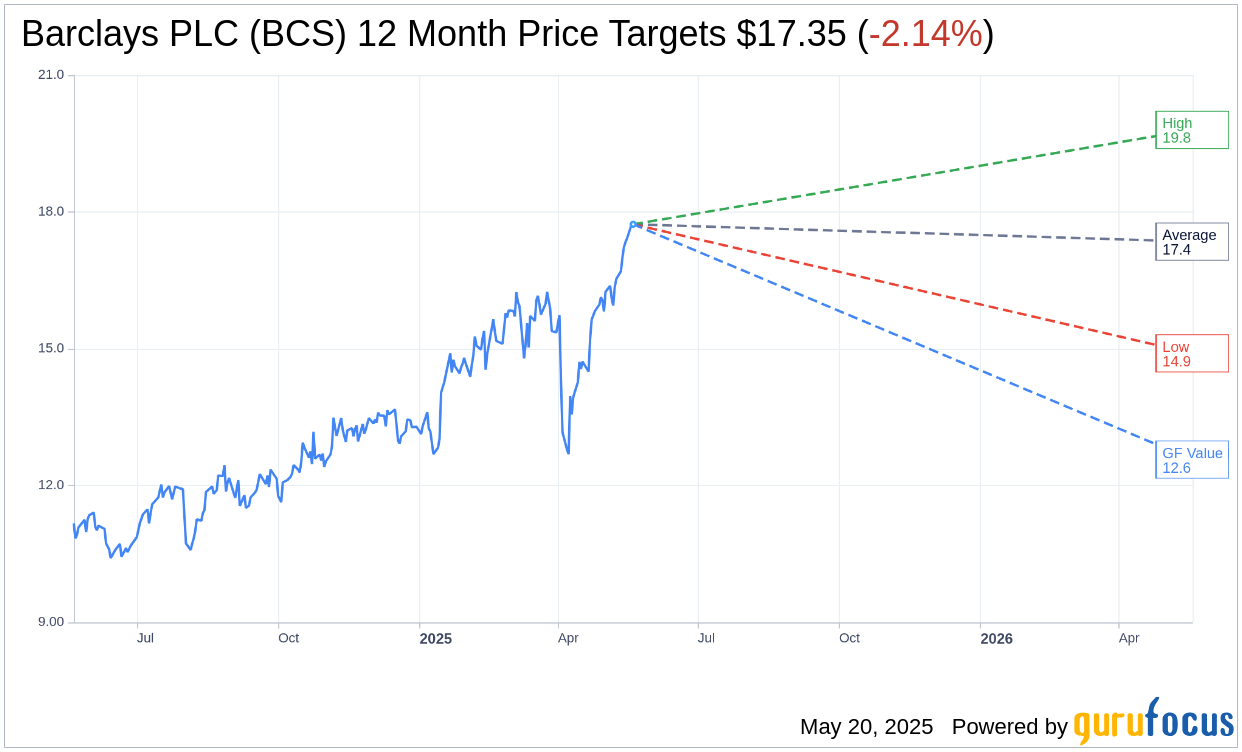

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for Barclays PLC (BCS, Financial) is $17.35 with a high estimate of $19.80 and a low estimate of $14.90. The average target implies an downside of 2.14% from the current price of $17.73. More detailed estimate data can be found on the Barclays PLC (BCS) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Barclays PLC's (BCS, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Barclays PLC (BCS, Financial) in one year is $12.57, suggesting a downside of 29.1% from the current price of $17.73. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Barclays PLC (BCS) Summary page.

BCS Key Business Developments

Release Date: April 30, 2025

- Return on Tangible Equity (RoTE): 14% for Q1 2025.

- Total Income: GBP7.7 billion for Q1 2025.

- Cost-Income Ratio: 57% for Q1 2025.

- Net Interest Income (NII): Increased 13% year-on-year to GBP3 billion.

- Profit Before Tax: GBP2.7 billion, a 19% increase year-on-year.

- Earnings Per Share: Increased by 26% due to share buybacks.

- Common Equity Tier 1 (CET1) Ratio: 13.9% at the end of Q1 2025.

- Loan Loss Rate: 61 basis points for Q1 2025.

- Impairment Charge: GBP0.6 billion for Q1 2025.

- Barclays UK RoTE: 17.4% for Q1 2025.

- Investment Bank RoTE: 16.2% for Q1 2025.

- US Consumer Bank RoTE: 4.5% for Q1 2025.

- Structural Hedge Income: GBP10.2 billion locked in over the next two years.

- Liquidity Coverage Ratio (LCR): 175%.

- Net Stable Funding Ratio (NSFR): 136%.

- Loan Growth: GBP1.9 billion net lending driven by mortgages in Barclays UK.

- Net New Assets Under Management: GBP1 billion in Private Bank and Wealth Management.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Barclays PLC (BCS, Financial) achieved a return on tangible equity of 14% in Q1 2025, surpassing the target of approximately 11% for the year.

- The company's total income for Q1 2025 was GBP7.7 billion, with an 11% increase year-on-year, driven by growth across all divisions.

- Barclays PLC (BCS) reported a strong capital position with a CET1 ratio of 13.9%, at the top end of their target range.

- The company upgraded its 2025 net interest income guidance for Barclays UK and the group, reflecting favorable deposit volumes and mix.

- Barclays PLC (BCS) is making progress in cost efficiency, releasing GBP150 million of the expected GBP500 million growth cost efficiency savings for the year.

Negative Points

- The US Consumer Bank's return on tangible equity fell to 4.5% year-on-year, indicating challenges in this segment.

- Weaker client confidence is delaying investment banking transactions, impacting the investment banking fees.

- The Q1 group impairment charge was GBP0.6 billion, slightly above the 50 to 60 basis points guidance, reflecting economic uncertainties.

- Barclays PLC (BCS) faces potential headwinds from regulatory changes, particularly concerning SRT transactions and ring-fencing regulations.

- The company noted that transactional and lending income could slow as companies and individuals become more cautious in the current economic environment.