Summary:

- Evercore upgrades Hewlett Packard Enterprise (HPE, Financial) to "Outperform" with a new price target of $22.

- Analysts anticipate significant growth potential following strategic partnerships.

- Current consensus suggests a moderate upside for HPE shares.

Evercore has recently upgraded Hewlett Packard Enterprise's (NYSE: HPE) rating to "Outperform" from "In Line," raising the price target to $22. This positive shift reflects analysts' confidence in the company's strategic moves, including the promising Juniper Networks deal. As a result, HPE shares saw an impressive climb of about 3% in premarket trading.

Wall Street Analysts Forecast

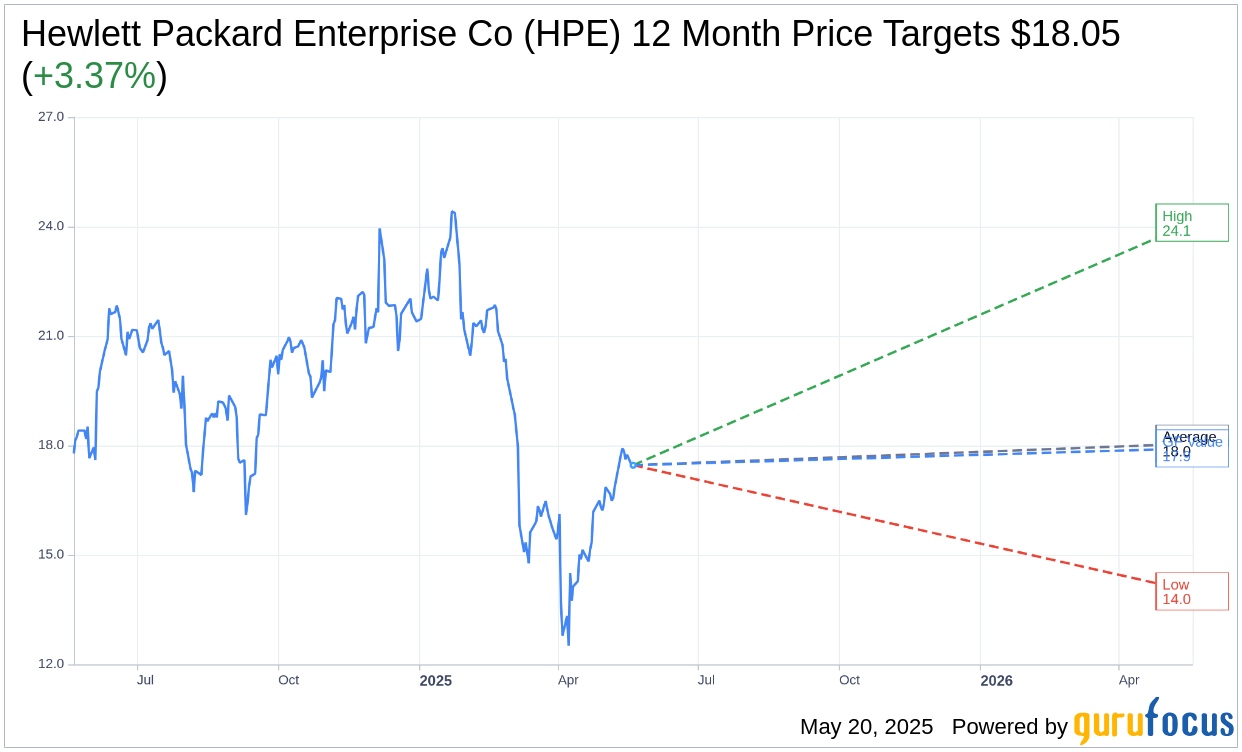

According to projections from 13 analysts, the average one-year price target for Hewlett Packard Enterprise Co (HPE, Financial) stands at $18.05, with projections ranging from a high of $24.11 to a low of $14.00. This average target suggests a potential upside of 3.37% from the current trading price of $17.46. For a deeper dive into these estimates, please visit the Hewlett Packard Enterprise Co (HPE) Forecast page.

Consensus among 15 brokerage firms indicates an average recommendation score of 2.3 for HPE, signifying an "Outperform" rating. This scoring system ranges from 1 to 5, where 1 represents a "Strong Buy" and 5 indicates a "Sell" recommendation.

Utilizing GuruFocus estimates, the projected GF Value for HPE in the upcoming year is $17.92. This suggests a modest upside of 2.63% from its current price of $17.46. The GF Value represents GuruFocus' assessment of a stock's fair trading value, derived from its historical trading multiples, past growth trajectories, and anticipated future performance. For further insights and data, explore the Hewlett Packard Enterprise Co (HPE, Financial) Summary page.