On May 20, 2025, Goldman Sachs, a leading global investment banking firm, initiated coverage on NuScale Power (SMR, Financial) with a 'Neutral' rating. The coverage was announced by analyst Brian Lee.

This initiation includes a price target announcement, setting the target at $24.00 USD for NuScale Power (SMR, Financial). As this is an initiation of coverage, there are no prior ratings or price targets for comparison.

The current 'Neutral' rating reflects Goldman Sachs' measured approach to NuScale Power's market performance and potential, according to the latest analyst briefing. This coverage provides investors with a starting perspective on the company's valuation and future prospects in the market.

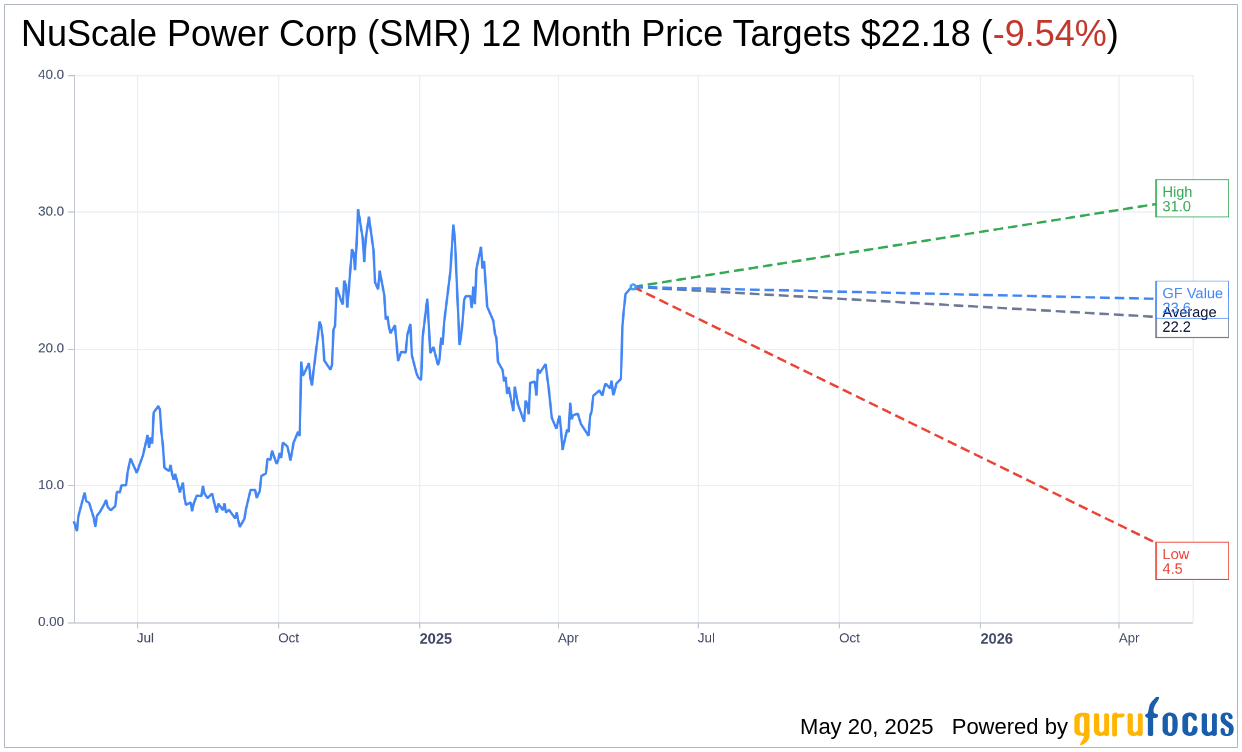

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for NuScale Power Corp (SMR, Financial) is $22.18 with a high estimate of $31.00 and a low estimate of $4.50. The average target implies an downside of 9.54% from the current price of $24.52. More detailed estimate data can be found on the NuScale Power Corp (SMR) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, NuScale Power Corp's (SMR, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for NuScale Power Corp (SMR, Financial) in one year is $23.59, suggesting a downside of 3.79% from the current price of $24.52. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the NuScale Power Corp (SMR) Summary page.