Key Highlights:

- CRISPR Therapeutics partners with Sirius Therapeutics for RNA therapies.

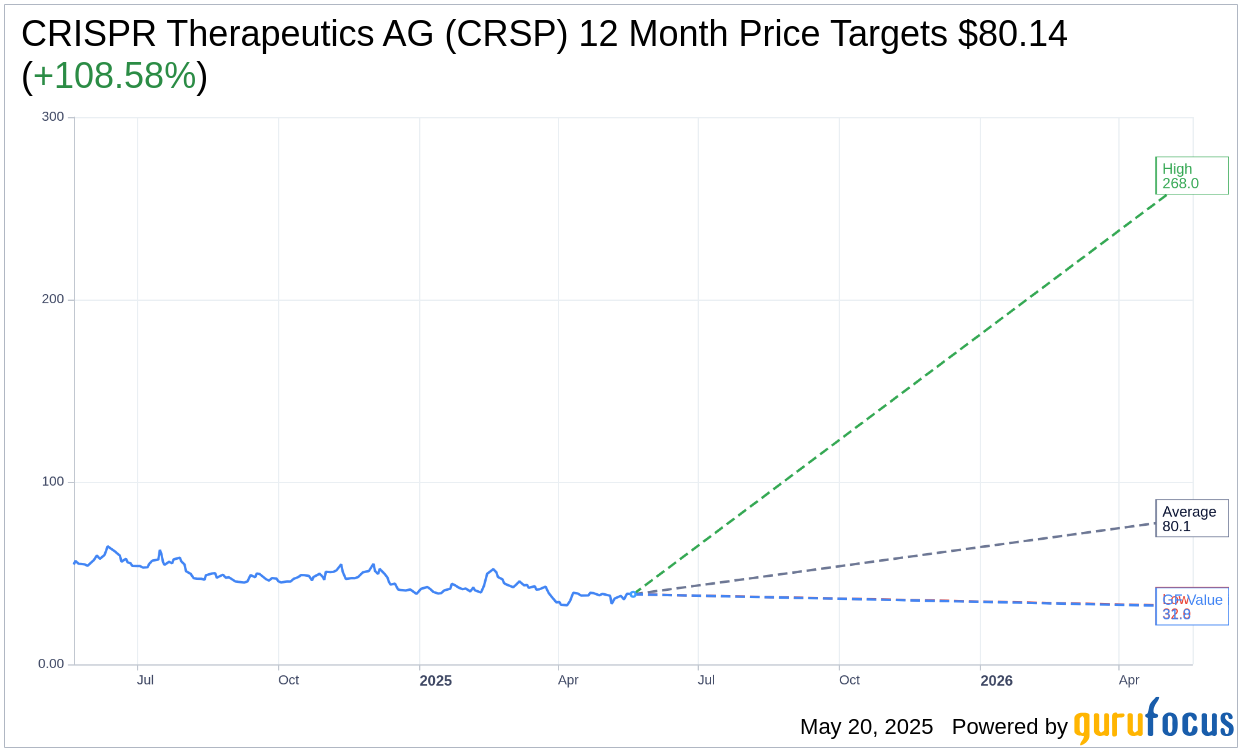

- Analysts project a 108.58% potential upside for CRSP stock.

- GuruFocus GF Value suggests a 17.31% downside in one year.

CRISPR Therapeutics' Strategic Partnership

CRISPR Therapeutics (CRSP, Financial) has embarked on an innovative partnership with Sirius Therapeutics, aiming to develop and commercialize small interfering RNA therapies. This strategic collaboration focuses initially on SRSD107, a promising treatment targeting factor XI for thromboembolic disorders. As part of the agreement, CRISPR is committing $25 million in cash alongside a $70 million investment in Sirius equity, demonstrating a robust commitment to the partnership's potential.

Wall Street Analysts' Forecast

Looking at the one-year projections from 22 analysts, the average target price for CRISPR Therapeutics AG (CRSP, Financial) stands at $80.14. This range includes a high estimate of $268.00 and a low of $32.00, indicating a potential upside of 108.58% from the current price of $38.42. Investors can explore more detailed estimates on the CRISPR Therapeutics AG (CRSP) Forecast page.

Further insights from 28 brokerage firms reveal a consensus recommendation for CRISPR Therapeutics AG (CRSP, Financial) as 2.3, suggesting an "Outperform" status. This rating is part of a scale from 1 to 5, where 1 means Strong Buy and 5 indicates Sell.

GuruFocus GF Value Analysis

According to GuruFocus estimates, the projected GF Value for CRISPR Therapeutics AG (CRSP, Financial) in the coming year is $31.77. This estimate hints at a possible downside of 17.31% from the current price point of $38.42. The GF Value represents an estimate of the fair market value for the stock, calculated based on the stock's historical trading multiples, past business growth, and anticipated future performance. More comprehensive data is available on the CRISPR Therapeutics AG (CRSP) Summary page.