- Goldman Sachs (GS, Financial) capitalizes on Middle East growth prospects with new regional offices.

- Analysts present a mixed forecast with average price target suggesting a slight downside.

- GF Value indicates a significant deviation from current market prices, suggesting caution.

Goldman Sachs (GS) is charting a strategic course for expansion by opening new offices in the Middle East. This move aims to harness the wealth and robust investment climate of the region, which has been attracting numerous Western banks due to its advantageous risk-return dynamics.

Analyst Price Targets and Recommendations

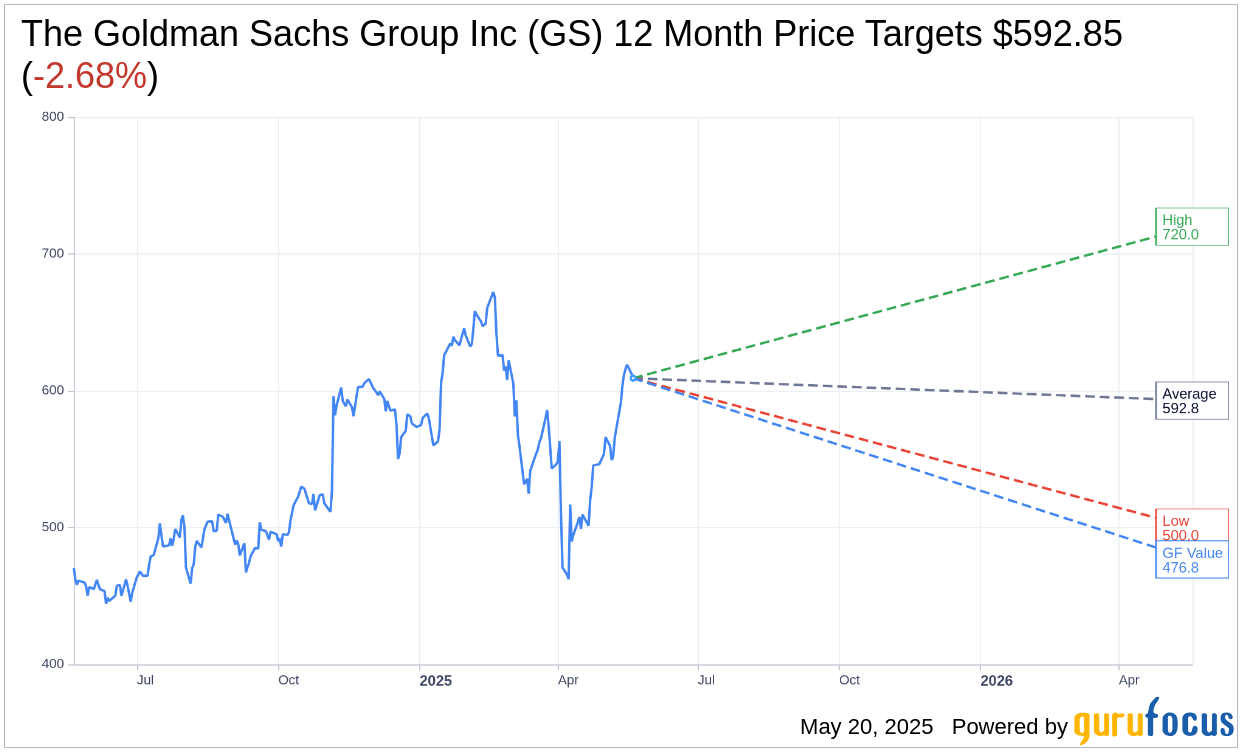

Investor interest is piqued with the latest one-year price targets from 18 analysts for The Goldman Sachs Group Inc (GS, Financial). The average target price stands at $592.85, fluctuating between a high of $720.00 and a low of $500.00. This average target suggests a potential downside of 2.68% from the current stock price of $609.18. For a comprehensive dive into these price targets, visit the The Goldman Sachs Group Inc (GS) Forecast page.

When evaluating analyst recommendations, the consensus from 23 brokerage firms for Goldman Sachs (GS, Financial) registers at 2.4, which translates to an "Outperform" rating. This scale ranges from 1, indicating a Strong Buy, to 5, signaling a Sell.

GF Value Assessment

According to GuruFocus metrics, the projected GF Value of The Goldman Sachs Group Inc (GS, Financial) is pegged at $476.75 for the upcoming year. This figure implies a significant downside risk of 21.74% from the present market price of $609.18. The GF Value provides an estimate of a stock's fair trading value, derived from historical multiples, past business performance, and future growth projections. Delve deeper into these figures on the The Goldman Sachs Group Inc (GS) Summary page.

In summary, while Goldman Sachs is poised to capitalize on Middle Eastern opportunities, investors are advised to consider the mixed signals from current analyst forecasts and GF Value assessments when contemplating their investment strategies.