Scotiabank (BNS, Financial) has seen an increase in its price target set by CIBC, which adjusted the figure to C$77 from the previous C$75. Despite this upward revision, CIBC maintains its Neutral rating on the shares.

Wall Street Analysts Forecast

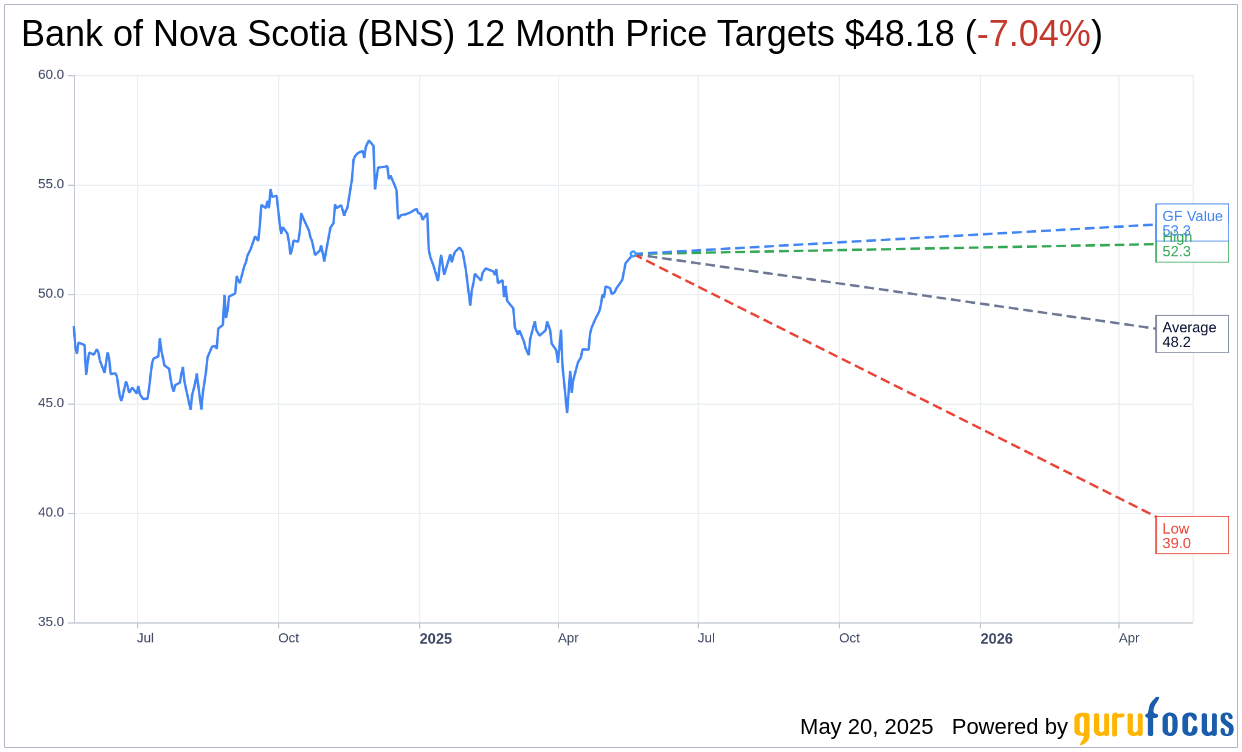

Based on the one-year price targets offered by 4 analysts, the average target price for Bank of Nova Scotia (BNS, Financial) is $48.18 with a high estimate of $52.31 and a low estimate of $38.99. The average target implies an downside of 7.04% from the current price of $51.83. More detailed estimate data can be found on the Bank of Nova Scotia (BNS) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Bank of Nova Scotia's (BNS, Financial) average brokerage recommendation is currently 3.5, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Bank of Nova Scotia (BNS, Financial) in one year is $53.27, suggesting a upside of 2.78% from the current price of $51.83. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Bank of Nova Scotia (BNS) Summary page.

BNS Key Business Developments

Release Date: February 25, 2025

- Adjusted Earnings: $2.2 billion, or $1.76 per share.

- Noninterest Revenue Growth: 15% year-over-year.

- Provisions for Credit Losses: Approximately $1.2 billion, PCL ratio of 60 basis points.

- Capital Ratio Improvement: Improved by approximately 140 basis points since the end of 2022.

- Additional Allowances for Credit Losses: $1.6 billion built since the end of 2022, with $350 million added this quarter.

- Return on Equity (ROE): 11.8% for Q1.

- Global Wealth Management Earnings: $414 million.

- Assets Under Administration (AUA): Exceeded $730 billion.

- Global Banking and Markets Earnings: $517 million, up 33% year-over-year.

- Canadian Banking Earnings: $914 million, down 6% year-over-year.

- International Banking Earnings: $657 million, down 7% year-over-year.

- Common Equity Tier 1 (CET1) Ratio: 12.9%.

- Net Interest Income Growth: 8% year-over-year.

- Noninterest Income: $4.2 billion, up 15% year-over-year.

- Operating Leverage: Positive 2.8%.

- Productivity Ratio: 54.5%, improved 160 basis points sequentially.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Bank of Nova Scotia (BNS, Financial) reported adjusted earnings of $2.2 billion, or $1.76 per share, with a 15% year-over-year growth in noninterest revenue.

- The bank improved its capital ratio by approximately 140 basis points since the end of 2022 and built $1.6 billion in additional allowances for credit losses.

- Global Wealth Management delivered $414 million in earnings, with assets under administration exceeding $730 billion.

- Global Banking and Markets had a strong start to the year, with earnings up 33% year over year, driven by capital markets businesses.

- The bank's productivity ratio improved to 51%, with a 4% revenue growth and disciplined 1% expense growth year over year.

Negative Points

- Provisions for credit losses remain elevated due to higher interest rates, inflation, and geopolitical uncertainty.

- Canadian Banking faced higher credit provisions due to portfolio migration and a cautious consumer outlook.

- The bank's CET1 capital ratio decreased by 20 basis points quarter over quarter.

- International Banking earnings were down 7% from last year, despite a 5% sequential increase.

- The potential impact of tariffs and geopolitical uncertainty poses risks to future economic growth and financial performance.