CIBC has revised its price target for Bank of Montreal (BMO, Financial), increasing it from C$141 to C$150. Despite this adjustment, the financial institution has retained its Neutral rating on the bank's shares. This suggests CIBC sees a balanced outlook for BMO, indicating neither significant growth nor decline in the near term.

Wall Street Analysts Forecast

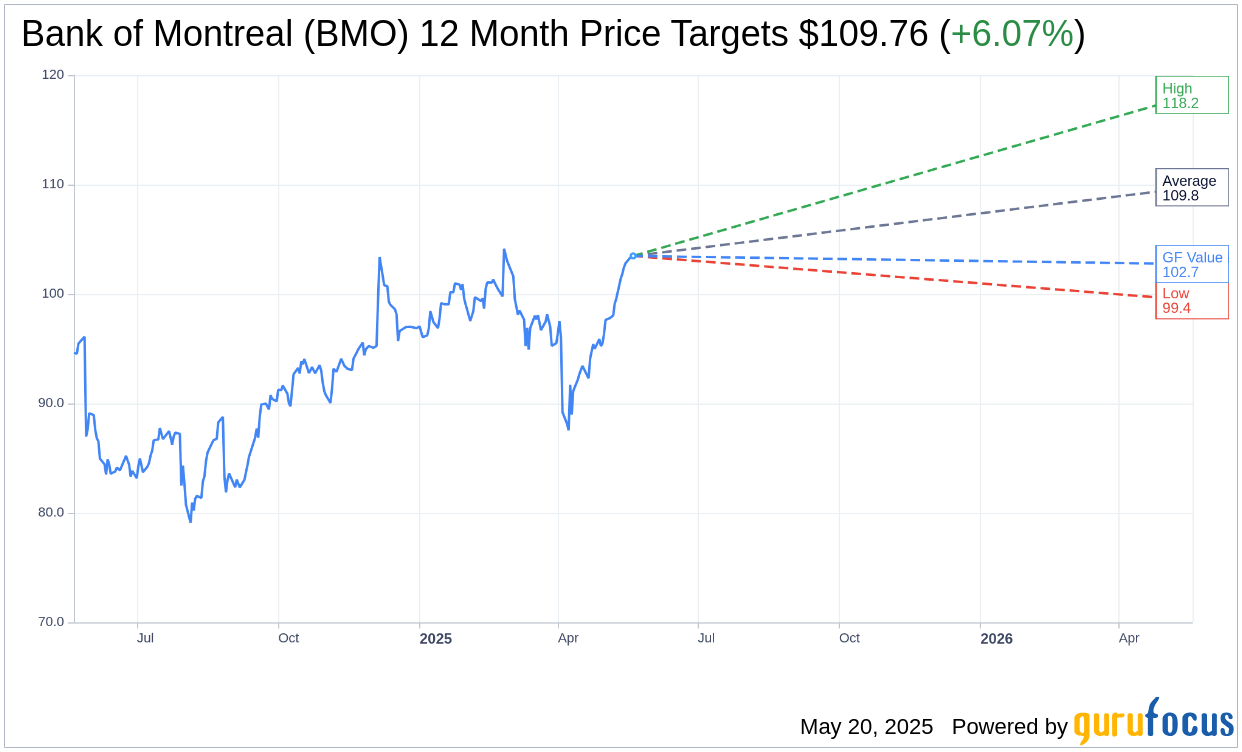

Based on the one-year price targets offered by 5 analysts, the average target price for Bank of Montreal (BMO, Financial) is $109.76 with a high estimate of $118.20 and a low estimate of $99.44. The average target implies an upside of 6.07% from the current price of $103.48. More detailed estimate data can be found on the Bank of Montreal (BMO) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Bank of Montreal's (BMO, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Bank of Montreal (BMO, Financial) in one year is $102.74, suggesting a downside of 0.72% from the current price of $103.48. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Bank of Montreal (BMO) Summary page.

BMO Key Business Developments

Release Date: February 25, 2025

- Adjusted Net Income: $2.3 billion.

- Adjusted Earnings Per Share (EPS): $3.04.

- Pre-Provision Pretax Earnings (PPPT): $4 billion, up 32% from last year.

- Revenue Growth: 18% increase.

- Operating Leverage: 8.9% positive.

- Common Equity Tier 1 (CET1) Ratio: 13.6%.

- Return on Equity (ROE): 11.3%.

- Share Buyback: 1.2 million shares repurchased this quarter, 3.2 million shares in total.

- Canadian P&C Revenue: Record $3 billion, PPPT up 13%.

- US P&C PPPT Growth: 6%.

- BMO Wealth Management PPPT Growth: 48%.

- BMO Capital Markets PPPT Growth: 67%.

- Provisions for Credit Losses (PCLs): $1 billion, 58 basis points.

- Effective Tax Rate: 24.5%.

- Average Loan Growth: 4% year over year on a constant currency basis.

- Average Deposit Growth: 8% year over year, excluding the impact of the stronger US dollar.

- Net Interest Income (NII) Growth: 11% year over year.

- Noninterest Revenue Growth: 24% year over year.

- Expense Growth: 9% year over year.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Bank of Montreal (BMO, Financial) reported a strong start to the year with first-quarter adjusted net income of $2.3 billion and earnings per share of $3.04.

- Revenue growth was broad-based, up 18%, driving strong all-bank operating leverage of 8.9%.

- The CET1 ratio remained robust at 13.6%, providing ample opportunity for organic growth and investment while returning capital to shareholders.

- BMO Wealth Management saw a 48% increase in pre-provision pretax earnings, with strong revenue growth in wealth and asset management.

- BMO Capital Markets experienced a 67% growth in pre-provision pretax earnings, driven by strong Global Markets trading performance and client flows in the US business.

Negative Points

- Provisions for credit losses were $1 billion, reflecting higher delinquencies in credit cards and other unsecured personal loans.

- The economic outlook is uncertain due to potential tariffs, which could impact client activity and lead to variability in future quarters.

- US Commercial Banking loan growth remains subdued, consistent with industry trends.

- Higher performance-based compensation and technology costs contributed to a 9% increase in expenses.

- The effective tax rate increased to 24.5% due to the implementation of the global minimum tax.