Palo Alto Networks (PANW, Financial) has announced a substantial increase in its Annual Recurring Revenue (ARR) for Next-Generation Security, which surged by 34% year-over-year, reaching $5.1 billion. This growth reflects the company's continued success in expanding its advanced security solutions portfolio. Investors are keenly observing this progress as PANW demonstrates robust performance in the cybersecurity market. The company's strategic focus on innovation and effective solutions seems to be paying off, securing a solid position in the industry.

Wall Street Analysts Forecast

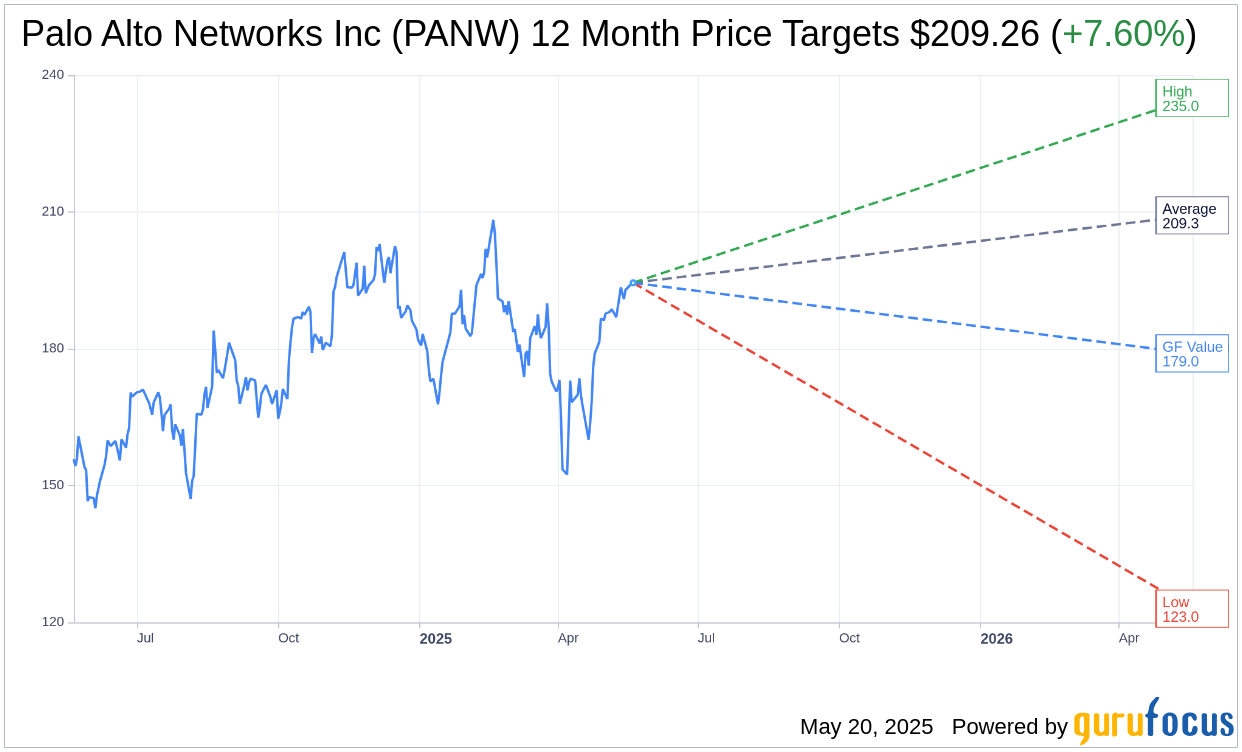

Based on the one-year price targets offered by 49 analysts, the average target price for Palo Alto Networks Inc (PANW, Financial) is $209.26 with a high estimate of $235.00 and a low estimate of $123.00. The average target implies an upside of 7.60% from the current price of $194.48. More detailed estimate data can be found on the Palo Alto Networks Inc (PANW) Forecast page.

Based on the consensus recommendation from 55 brokerage firms, Palo Alto Networks Inc's (PANW, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Palo Alto Networks Inc (PANW, Financial) in one year is $178.98, suggesting a downside of 7.97% from the current price of $194.48. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Palo Alto Networks Inc (PANW) Summary page.