Jefferies has commenced coverage of Fifth Third (FITB, Financial) by assigning a Buy rating and setting a price target of $47. The firm has expressed a positive outlook on a range of regional and mid-cap banks. Their analysis suggests that various factors could boost banks, such as a recovery in loan growth as the U.S. steers clear of a recession, expansion in net interest margins due to a steeper yield curve, and stable credit metrics. Moreover, banks are believed to have surplus capital, allowing them to respond effectively to market conditions, whether expanding or safeguarding their assets. Currently, the bank's valuations are considered appealing.

Wall Street Analysts Forecast

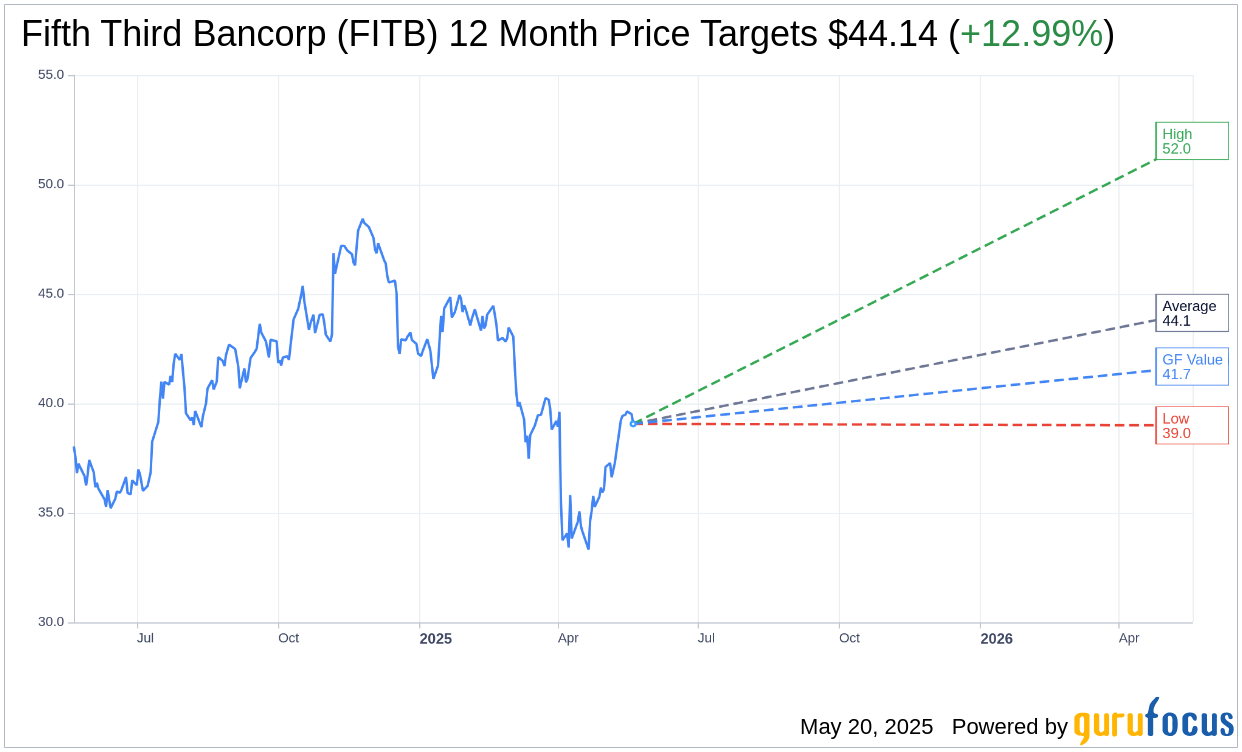

Based on the one-year price targets offered by 19 analysts, the average target price for Fifth Third Bancorp (FITB, Financial) is $44.14 with a high estimate of $52.00 and a low estimate of $39.00. The average target implies an upside of 12.99% from the current price of $39.07. More detailed estimate data can be found on the Fifth Third Bancorp (FITB) Forecast page.

Based on the consensus recommendation from 23 brokerage firms, Fifth Third Bancorp's (FITB, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Fifth Third Bancorp (FITB, Financial) in one year is $41.69, suggesting a upside of 6.71% from the current price of $39.07. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Fifth Third Bancorp (FITB) Summary page.

FITB Key Business Developments

Release Date: April 17, 2025

- Earnings Per Share (EPS): $0.71, or $0.73 excluding certain items.

- Pre-Provision Net Revenue (PPNR): Increased by 5% year over year.

- Adjusted Return on Equity: 11.2%.

- Tangible Book Value Per Share: Grew 15% over the prior year.

- Total Loans Growth: 3% year over year.

- Net Interest Income (NII): Grew 4% over the prior year.

- Net Interest Margin: Expanded for the fifth consecutive quarter.

- Commercial Payments Revenue: Grew 6% year over year.

- Wealth and Asset Management Revenue: Grew 7%, supported by 10% growth in AUM.

- Adjusted Non-Interest Income: Increased 1% compared to the prior year.

- Adjusted Non-Interest Expense: Flat compared to the prior year.

- Net Charge-Off Ratio: 46 basis points, flat sequentially.

- Allowance for Credit Losses (ACL) Coverage Ratio: 2.07%.

- Common Equity Tier 1 (CET1) Ratio: 10.5%.

- Share Repurchase: $225 million executed, reducing share count by 5.2 million shares.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Fifth Third Bancorp (FITB, Financial) reported earnings per share of $0.71, or $0.73 excluding certain items, exceeding consensus estimates.

- The company achieved a 5% year-over-year growth in pre-provision net revenue (PPNR) and an adjusted return on equity of 11.2%.

- Total loans grew 3% year over year, driven by strong middle market C&I production and balanced growth across consumer secured lending categories.

- Net interest income (NII) grew 4% over the prior year as net interest margins expanded for the fifth consecutive quarter.

- Fifth Third Bancorp (FITB) maintained a strong liquidity profile with a loan to core deposit ratio of 75% and full Category 1 LCR compliance at 127%.

Negative Points

- Average core deposits decreased 2% sequentially, driven primarily by normal seasonality in commercial deposits.

- Capital markets fees declined by 7% from the year-ago period, primarily due to a slowdown in loan syndications and M&A advisory revenue.

- The net charge-off ratio was 46 basis points, with commercial charge-offs increasing by 3 basis points sequentially.

- The company's NPA ratio increased 10 basis points sequentially to 81 basis points, driven by two ABL credits in the C&I portfolio.

- Fifth Third Bancorp (FITB) anticipates continued economic uncertainty impacting wealth and capital markets revenue, with a cautious outlook on fee income growth.