Jefferies has begun coverage on Western Alliance (WAL, Financial) with a "Buy" rating, setting a price target of $95. The firm has a favorable outlook for 32 regional and mid-cap banks despite external uncertainties. Analysts believe factors such as a resurgence in loan growth, as the U.S. economy steers clear of a recession, could benefit these banks. Additionally, a steeper yield curve may lead to an expansion in net interest margins. Jefferies also notes the strength of credit metrics, surplus capital that can be strategically deployed, and appealing valuations.

Western Alliance (WAL, Financial) stands out among Jefferies' top picks for mid-cap banks, alongside others like Flagstar Financial and Axos Financial. The analysis suggests a robust environment for these financial institutions, positioning them well for both offense and defense strategies.

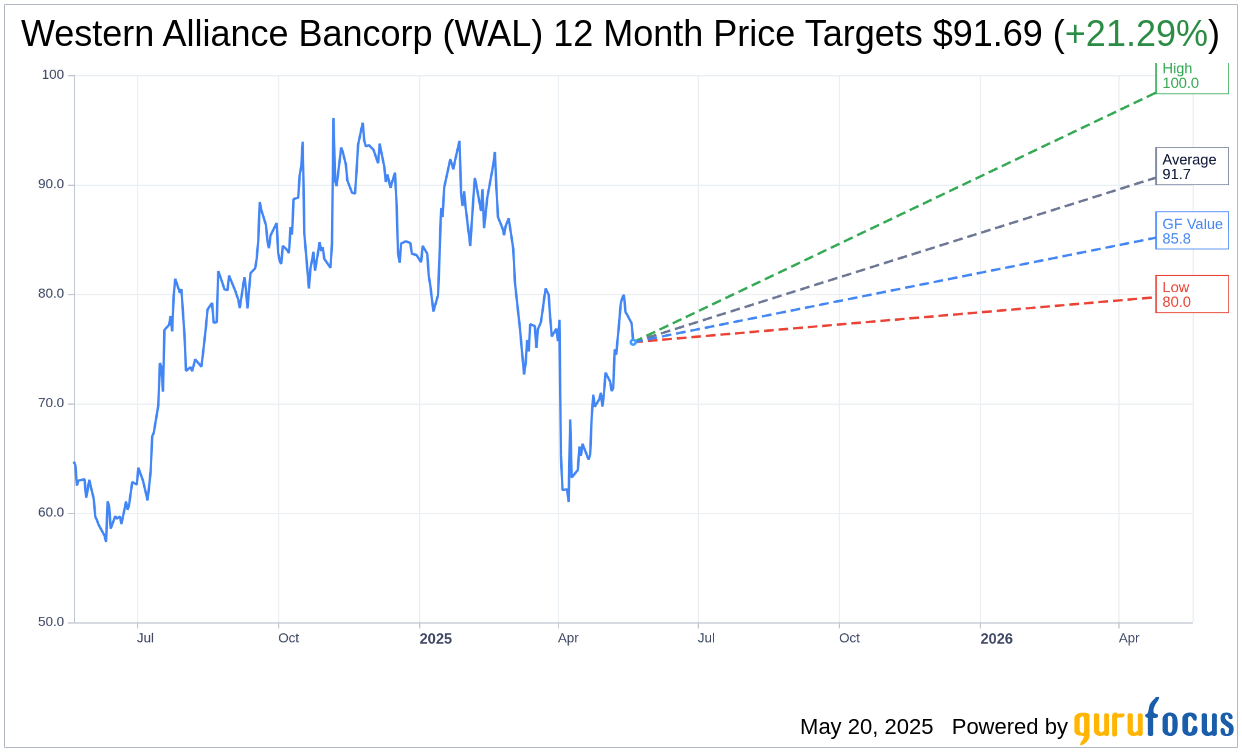

Wall Street Analysts Forecast

Based on the one-year price targets offered by 13 analysts, the average target price for Western Alliance Bancorp (WAL, Financial) is $91.69 with a high estimate of $100.00 and a low estimate of $80.00. The average target implies an upside of 21.29% from the current price of $75.60. More detailed estimate data can be found on the Western Alliance Bancorp (WAL) Forecast page.

Based on the consensus recommendation from 13 brokerage firms, Western Alliance Bancorp's (WAL, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Western Alliance Bancorp (WAL, Financial) in one year is $85.82, suggesting a upside of 13.52% from the current price of $75.6. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Western Alliance Bancorp (WAL) Summary page.

WAL Key Business Developments

Release Date: April 22, 2025

- Pre-Provision Net Revenue: $278 million, a $31 million or 12% year-over-year increase.

- Net Interest Income: Grew 9% year-over-year to $651 million, declined $16 million quarter-over-quarter.

- Net Interest Margin: Held steady at 3.47%, declining only one basis point from the prior quarter.

- Adjusted Net Interest Margin: Expanded 17 basis points to 2.75%.

- Noninterest Income: Stable year-over-year at $127 million.

- Noninterest Expense: Reduced $19 million to $500 million from the prior quarter.

- Provision Expense: $31 million, significantly below Q4 levels of $60 million.

- Net Charge-Offs: Declined 5 basis points in the quarter to 20 basis points.

- Nonaccrual Loans: Declined by $25 million quarter-over-quarter to $451 million.

- Loan Growth: Ending held for investment balances $1.1 billion higher quarter-over-quarter.

- Deposit Growth: Grew $3 billion in Q1, mostly in noninterest-bearing accounts.

- Tangible Book Value Per Share: Increased 14% year-over-year.

- Common Equity Tier 1 (CET1) Ratio: Decreased approximately 13 basis points to 11.1%.

- Effective Tax Rate for 2025: Expected to be approximately 20%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Western Alliance Bancorp (WAL, Financial) reported a solid pre-provision net revenue of $278 million, marking a 12% year-over-year increase.

- Net interest income grew by 9% year-over-year to $651 million, driven by effective cost management and loan growth.

- The company maintained a stable net interest margin at 3.47%, with an adjusted net interest margin increasing by 17 basis points to 2.75%.

- Deposits grew by $3 billion in the first quarter, with significant contributions from noninterest-bearing accounts and specialty escrow services.

- Western Alliance Bancorp (WAL) achieved a 14% year-over-year increase in tangible book value per share, supported by organic profitability and improved AOCI positions.

Negative Points

- Noninterest income remained relatively stable year-over-year, with a decline in mortgage banking revenue due to lower gain on sale margins.

- The company experienced a $186 million increase in classified assets, indicating potential credit quality concerns.

- Provision expense was $31 million, reflecting the need to bolster reserves for commercial real estate amidst macroeconomic volatility.

- Loan yields decreased by 14 basis points, reflecting pricing pressures and the impact of rate cuts on variable rate loans.

- Western Alliance Bancorp (WAL) faces ongoing challenges in managing interest rate sensitivity, with expectations of two rate cuts before the end of 2025 impacting net interest income.