Jefferies analyst David Chiaverini has started coverage on Atlantic Union Bankshares (AUB, Financial) by assigning a Buy rating and setting a price target of $37. The analyst holds an optimistic view for 32 regional and mid-cap banks, suggesting various positive elements could benefit these institutions. Factors such as anticipated loan growth recovery as the U.S. sidesteps a recession, potential net interest margin improvements from a steeper yield curve, robust credit metrics, and excess capital available for strategic use bolster this outlook, according to Chiaverini's insights.

Wall Street Analysts Forecast

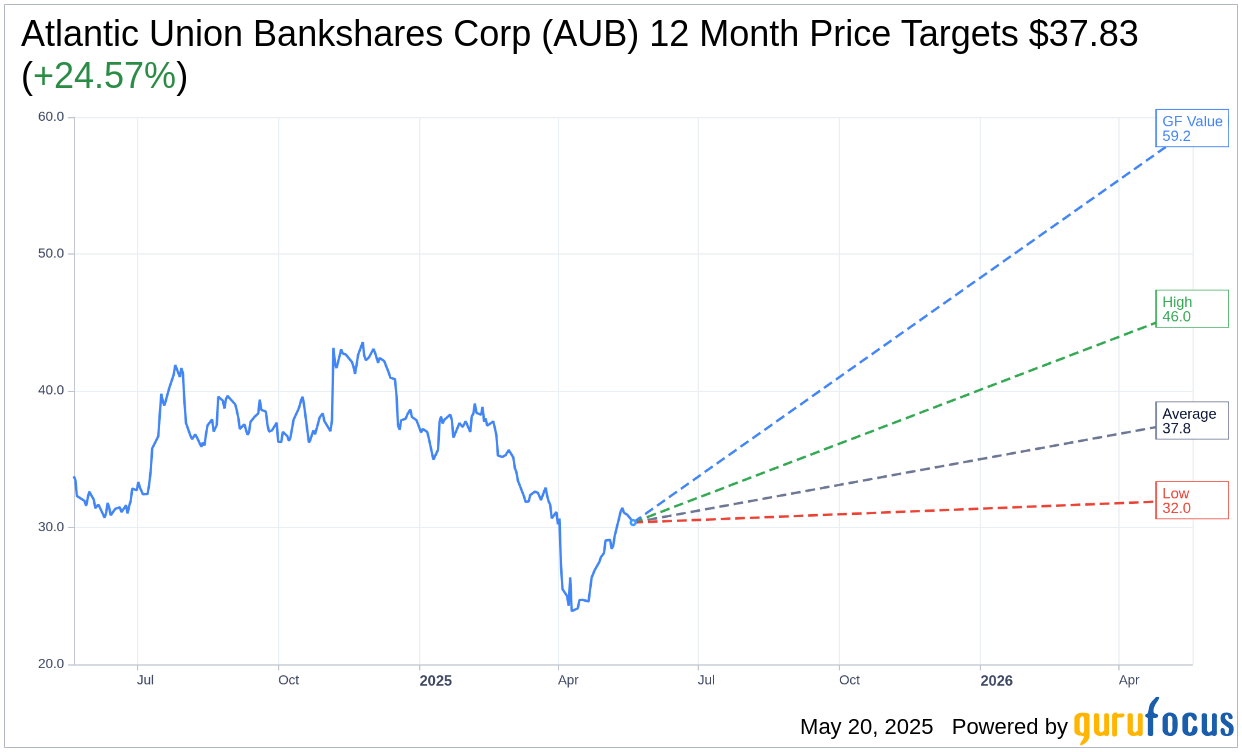

Based on the one-year price targets offered by 6 analysts, the average target price for Atlantic Union Bankshares Corp (AUB, Financial) is $37.83 with a high estimate of $46.00 and a low estimate of $32.00. The average target implies an upside of 24.57% from the current price of $30.37. More detailed estimate data can be found on the Atlantic Union Bankshares Corp (AUB) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Atlantic Union Bankshares Corp's (AUB, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Atlantic Union Bankshares Corp (AUB, Financial) in one year is $59.20, suggesting a upside of 94.93% from the current price of $30.37. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Atlantic Union Bankshares Corp (AUB) Summary page.