Jefferies has begun coverage on Cullen/Frost Bankers (CFR, Financial), assigning it an Underperform rating with a price target of $105. The analyst highlights various positive factors influencing regional and mid-cap banks, such as potential improvements in loan growth if the U.S. economy avoids a recession, along with net interest margin benefits from a steeper yield curve. Additionally, CFR's credit metrics remain robust, and it holds excess capital for strategic flexibility, whether in offensive or defensive maneuvers. Despite these aspects, Jefferies has positioned CFR among its less favored picks in this sector.

Wall Street Analysts Forecast

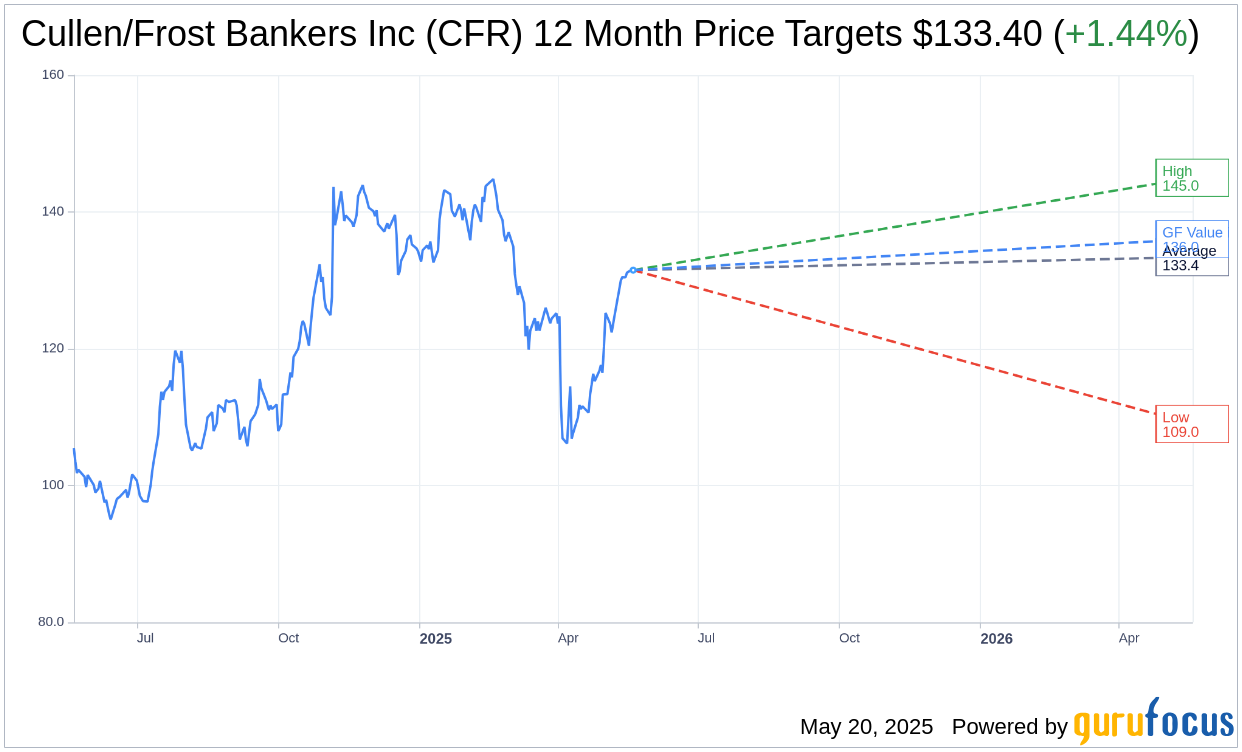

Based on the one-year price targets offered by 10 analysts, the average target price for Cullen/Frost Bankers Inc (CFR, Financial) is $133.40 with a high estimate of $145.00 and a low estimate of $109.00. The average target implies an upside of 1.44% from the current price of $131.50. More detailed estimate data can be found on the Cullen/Frost Bankers Inc (CFR) Forecast page.

Based on the consensus recommendation from 13 brokerage firms, Cullen/Frost Bankers Inc's (CFR, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Cullen/Frost Bankers Inc (CFR, Financial) in one year is $136.02, suggesting a upside of 3.44% from the current price of $131.5. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Cullen/Frost Bankers Inc (CFR) Summary page.

CFR Key Business Developments

Release Date: May 01, 2025

- Earnings: $149.3 million or $2.30 per share, compared to $134 million or $2.06 per share in the same quarter last year.

- Return on Average Assets: 1.19%, up from 1.09% last year.

- Return on Average Common Equity: 15.54%, compared to 15.22% last year.

- Average Deposits: $41.7 billion, a 2.3% increase from $40.7 billion last year.

- Average Loans: $20.8 billion, an 8.8% increase from $19.1 billion last year.

- Net Interest Margin: 3.60%, up 7 basis points from 3.53% last quarter.

- Net Charge-Offs: $9.7 million, compared to $14 million last quarter and $7.3 million a year ago.

- Nonperforming Assets: $85 million, down from $93 million at year-end.

- New Loan Commitments: $1.28 billion, up 1.5% from $1.26 billion last year.

- Consumer Loan Growth: 20.5% year-over-year.

- Commercial Loan Growth: $1.1 billion or 6.6% year-over-year.

- CRE Balances Growth: 8.9% year-over-year.

- Energy Balances Growth: 19.8% year-over-year.

- Consumer Checking Customer Growth: 5.7% year-over-year.

- Financial Centers: Reached 200 locations, up from around 130 in late 2018.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Cullen/Frost Bankers Inc (CFR, Financial) reported a significant increase in earnings, with $149.3 million or $2.30 per share, compared to $134 million or $2.06 per share in the same quarter last year.

- The company achieved a return on average assets of 1.19% and a return on average common equity of 15.54%, both showing improvement from the previous year.

- Cullen/Frost Bankers Inc (CFR) continues to expand its presence, with plans to open its 200th financial center, marking a 50% increase in locations since 2018.

- The consumer banking segment showed strong growth, with average consumer loan balances increasing by 20.5% year-over-year.

- The company was recognized by J.D. Power as number one in Texas for consumer banking satisfaction for the 16th consecutive year, highlighting its strong customer service reputation.

Negative Points

- Average total deposits decreased by $228 million from the previous quarter, primarily due to lower noninterest-bearing accounts, following normal seasonal trends.

- The company faces headwinds from commercial real estate (CRE) payoffs, impacting loan growth despite a strong pipeline.

- Net charge-offs increased to $9.7 million from $7.3 million a year ago, indicating some deterioration in credit quality.

- The cost of interest-bearing deposits remains a concern, although it decreased to 1.94% from 2.14% in the previous quarter.

- Cullen/Frost Bankers Inc (CFR) anticipates four rate cuts in 2025, which could impact net interest income growth if fewer cuts occur.