Jefferies has commenced coverage on First Citizens (FCNCA, Financial) with a 'Hold' rating and established a target price of $2,050. The analysis comes as part of a broader assessment of 32 regional and mid-cap banks, which Jefferies views with a positive outlook. Despite uncertainties in tariffs, the firm identifies several promising factors for banks, such as expected improvements in loan growth if the U.S. economy stays resilient against a recession. Additionally, potential gains in net interest margins due to a steeper yield curve, stable credit metrics, and surplus capital which banks could leverage strategically, are highlighted as favorable conditions. The analysis indicates that these factors, along with appealing valuations, could enhance the financial prospects of banks like First Citizens.

Wall Street Analysts Forecast

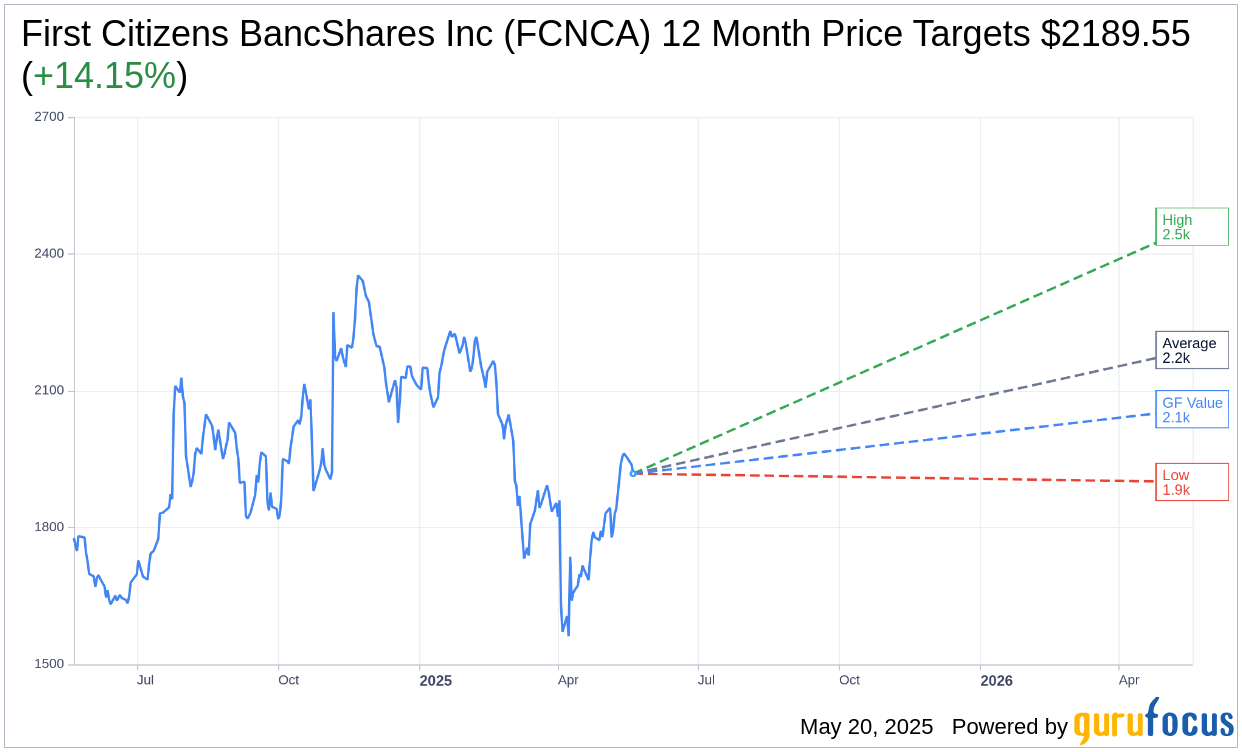

Based on the one-year price targets offered by 11 analysts, the average target price for First Citizens BancShares Inc (FCNCA, Financial) is $2,189.55 with a high estimate of $2,460.00 and a low estimate of $1,900.00. The average target implies an upside of 14.15% from the current price of $1,918.20. More detailed estimate data can be found on the First Citizens BancShares Inc (FCNCA) Forecast page.

Based on the consensus recommendation from 13 brokerage firms, First Citizens BancShares Inc's (FCNCA, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for First Citizens BancShares Inc (FCNCA, Financial) in one year is $2059.43, suggesting a upside of 7.36% from the current price of $1918.2. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the First Citizens BancShares Inc (FCNCA) Summary page.