Jefferies has begun its coverage of Pinnacle Financial (PNFP, Financial) with a "Buy" rating and has set a price target of $135. In its recent analysis of 32 regional and mid-cap banks, the firm expresses a positive outlook. According to Jefferies, several factors could benefit these financial institutions, including a resurgence in loan growth as the U.S. sidesteps a recession, expansion of net interest margins due to a steeper yield curve, stable credit metrics, and the availability of excess capital for strategic maneuvers. Additionally, Jefferies notes that the current valuations make these banks attractive to investors.

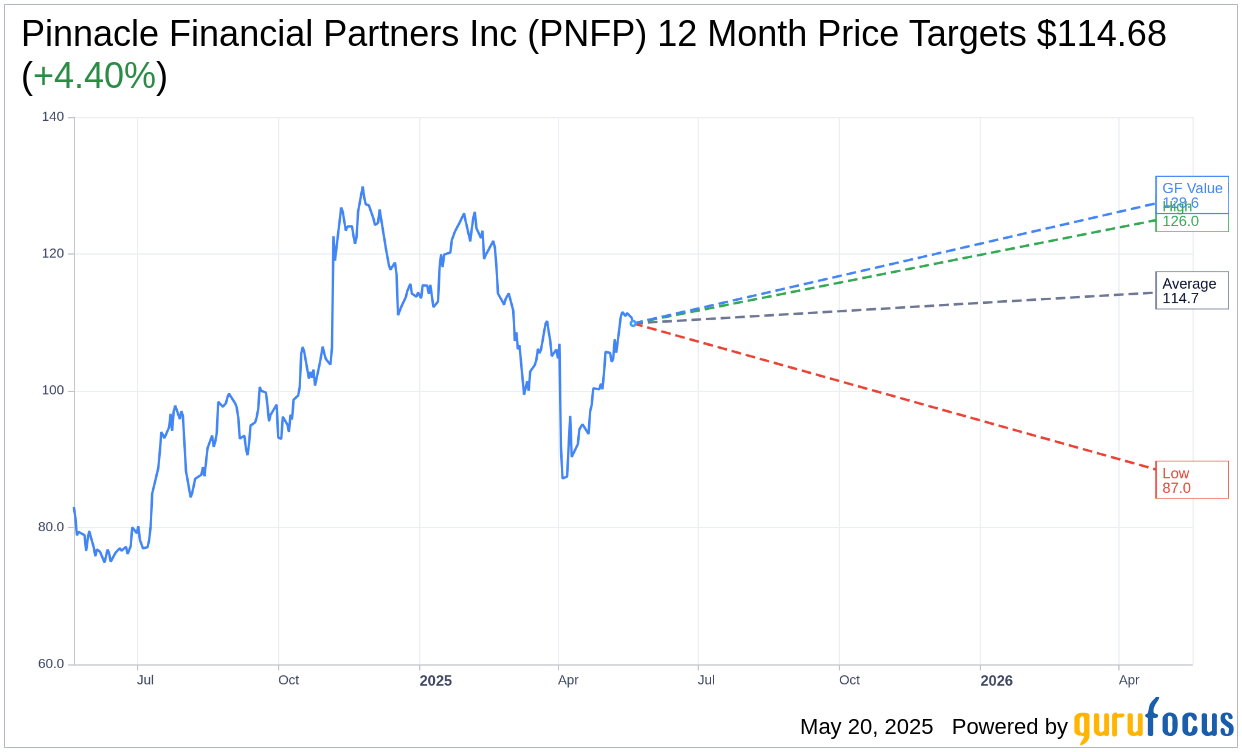

Wall Street Analysts Forecast

Based on the one-year price targets offered by 11 analysts, the average target price for Pinnacle Financial Partners Inc (PNFP, Financial) is $114.68 with a high estimate of $126.00 and a low estimate of $87.00. The average target implies an upside of 4.40% from the current price of $109.85. More detailed estimate data can be found on the Pinnacle Financial Partners Inc (PNFP) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Pinnacle Financial Partners Inc's (PNFP, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Pinnacle Financial Partners Inc (PNFP, Financial) in one year is $128.63, suggesting a upside of 17.1% from the current price of $109.85. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Pinnacle Financial Partners Inc (PNFP) Summary page.

PNFP Key Business Developments

Release Date: April 15, 2025

- Revenue Growth: 14.2% increase in Q1 2025 over Q1 2024.

- Adjusted EPS Growth: 24.2% increase in Q1 2025 over Q1 2024.

- Tangible Book Value Per Share Growth: 10.6% increase in Q1 2025 over Q1 2024.

- Loan Growth: End-of-period loans increased 7.3% linked quarter annualized.

- Deposit Growth: $1.6 billion increase in Q1 2025.

- Net Interest Margin (NIM): Flattish at 3.21% for Q1 2025.

- Net Charge-Offs: Dropped to 16 basis points in Q1 2025 from 24 basis points in Q4 2024.

- BHG Fee Revenues: Over $20 million in Q1 2025, up from $12.1 million in Q4 2024.

- Expense Outlook: Estimated expenses for 2025 between $1.3 million to $1.15 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Pinnacle Financial Partners Inc (PNFP, Financial) reported strong revenue growth, with a 14.2% increase in Q1 2025 compared to Q1 2024.

- The company achieved a 24.2% growth in adjusted EPS in Q1 2025 over Q1 2024, despite a challenging operating environment.

- Pinnacle Financial Partners Inc (PNFP) has compounded tangible book value per share at a 10.6% rate from Q1 2024 to Q1 2025.

- The firm continues to attract highly experienced revenue producers, with 37 new hires in Q1 2025, contributing to its growth.

- Deposit growth was a highlight, with a $1.6 billion increase in Q1 2025, following a $1.9 billion increase in the previous quarter.

Negative Points

- The economic environment remains volatile, which could impact future growth and performance.

- There is uncertainty regarding the broader economy, with potential impacts on pipeline development and client confidence.

- The company is facing challenges with commercial real estate concentration, which has been a drag on legacy markets.

- Pinnacle Financial Partners Inc (PNFP) downgraded an apartment loan in Atlanta, which increased non-performing assets.

- The company anticipates potential headwinds in deposit growth in Q2 2025 due to seasonal factors such as tax payments.