Summary:

- Palo Alto Networks beat earnings and revenue expectations in its third-quarter report.

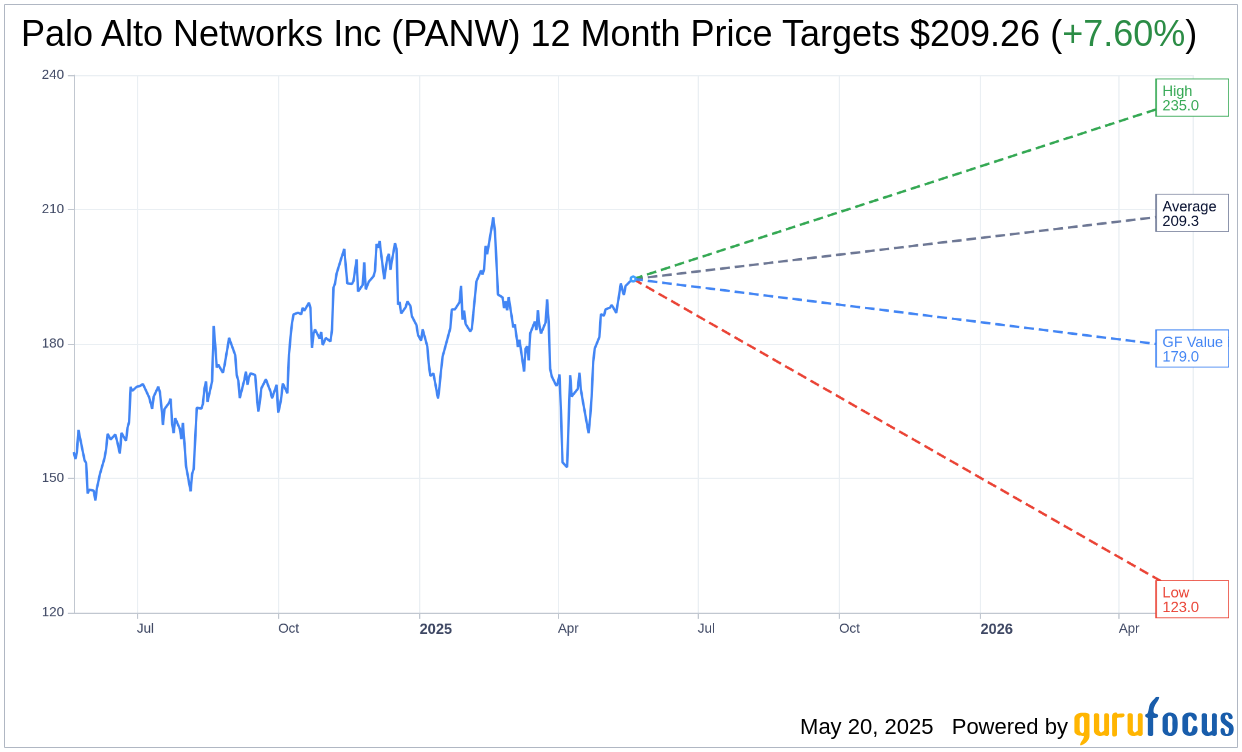

- Analysts project an average price target ~7.60% higher than the current stock price.

- GuruFocus estimates suggest a potential downside in the stock's fair value.

Palo Alto Networks (PANW, Financial) recently delivered an impressive performance in its third-quarter results. The company's non-GAAP earnings per share reached $0.80, surpassing projections by $0.03. Revenue figures were equally outstanding, totaling $2.29 billion, exceeding expectations by $10 million. This success was largely driven by significant growth in its Next-Gen Security offerings.

Wall Street Analysts Forecast

According to insights from 49 analysts who have provided one-year price targets for Palo Alto Networks Inc (PANW, Financial), the average target price is set at $209.26. This estimate includes a high of $235.00 and a low of $123.00. At the current price of $194.48, the average target suggests a potential upside of 7.60%. Investors can explore more detailed estimates at the Palo Alto Networks Inc (PANW) Forecast page.

The consensus among 55 brokerage firms assigns an "Outperform" status to Palo Alto Networks Inc (PANW, Financial), with an average brokerage recommendation of 2.1. This rating operates on a scale from 1 to 5, where 1 represents a Strong Buy and 5 indicates Sell.

Meanwhile, GuruFocus' analysis estimates a GF Value for Palo Alto Networks Inc (PANW, Financial) in one year at $178.98. This suggests a potential downside of 7.97% from the current market price of $194.48. The GF Value represents GuruFocus' assessment of a stock's fair trading value, calculated based on historical trading multiples, past business growth, and future projections. For more in-depth data, visit the Palo Alto Networks Inc (PANW) Summary page.