Summary Highlights:

- Modine Manufacturing (MOD, Financial) posts robust fiscal Q4 results, significantly outperforming market expectations.

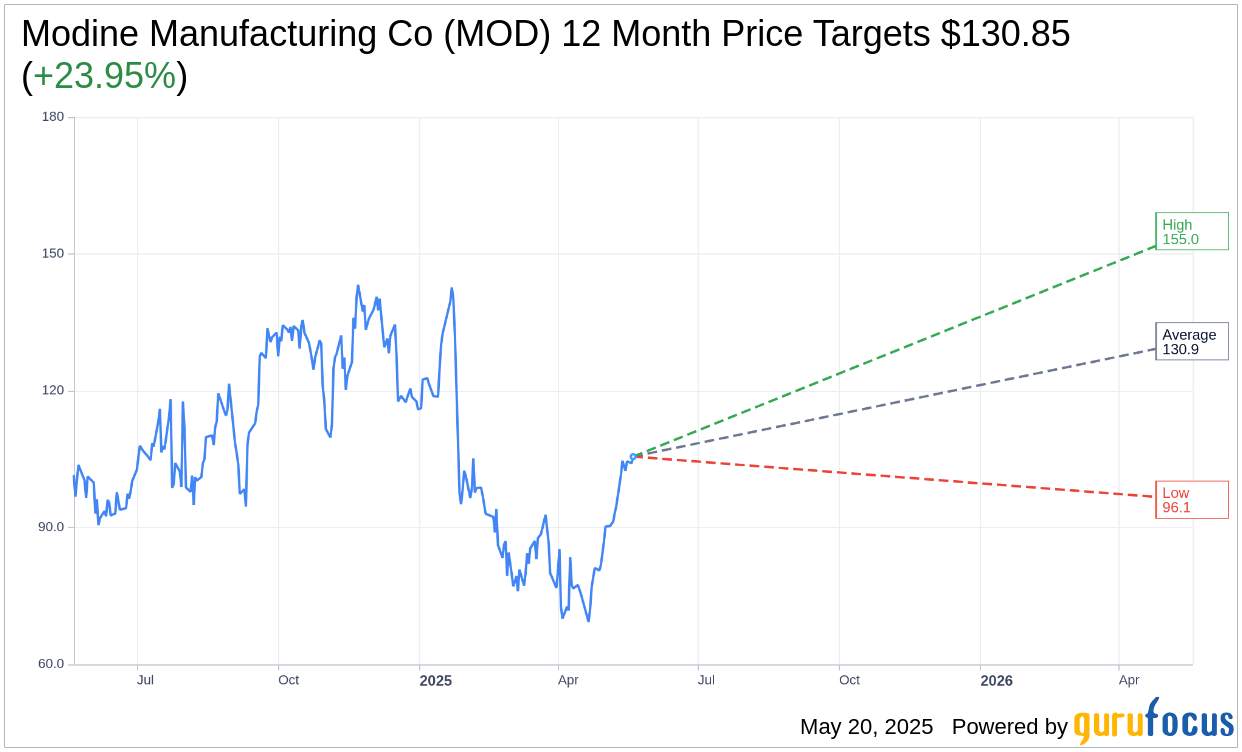

- Analyst projections suggest notable upside potential with a 23.95% increase from current stock prices.

- GuruFocus indicates a substantial downside risk based on GF Value estimations, advising caution despite positive earnings.

Modine Manufacturing (NYSE: MOD) has delivered an impressive fiscal fourth-quarter performance, which has investors buzzing. The company reported a non-GAAP earnings per share (EPS) of $1.12, beating consensus estimates by $0.17. Meanwhile, revenue grew by 7.2% year-over-year, reaching $647.2 million and exceeding forecasts by $15.74 million. As a result, Modine's stock price rose by 3.32%, buoyed by a remarkable 92% increase in net earnings to $50.1 million.

Wall Street Analysts Forecast

Analysts have been carefully evaluating Modine Manufacturing's potential, and their projections reveal a promising outlook. The average one-year price target set by six analysts stands at $130.85, with estimates ranging from a low of $96.11 to a high of $155.00. This average target price suggests a potential upside of 23.95% from the current trading price of $105.57. Investors seeking more detailed projections can visit the Modine Manufacturing Co (MOD, Financial) Forecast page.

Further insights come from the consensus recommendation of seven brokerage firms, placing Modine Manufacturing at an average brokerage recommendation of 1.9, indicating an "Outperform" status. This rating operates on a scale from 1 to 5, where 1 signifies a Strong Buy and 5 indicates a Sell.

GF Value and Investment Considerations

While analyst forecasts appear bullish, GuruFocus offers a more cautious perspective. The estimated GF Value for Modine Manufacturing Co (MOD, Financial) a year from now is pegged at $47.34. This estimation suggests a significant downside of 55.16% from the current stock price of $105.57. The GF Value is GuruFocus' calculation of a stock's intrinsic value, derived from historical trading multiples, past business performance, and future growth estimates. Investors can explore further data and insights on the Modine Manufacturing Co (MOD) Summary page.

In conclusion, while Modine Manufacturing’s recent fiscal performance might encourage investors, the contrasting views on future valuations underscore the importance of thorough due diligence. Balancing optimistic analyst targets with conservative GF Value assessments could be key for potential investors in making informed decisions.