- Take-Two Interactive plans a public offering to raise $1 billion, potentially impacting its stock price.

- Analysts provide varied target prices, with an overall "Outperform" recommendation for TTWO.

- GuruFocus estimates suggest a potential downside based on GF Value, inviting investor caution.

Take-Two Interactive Software Inc. (NASDAQ: TTWO), a leading video game developer, has announced a public stock offering aimed at generating $1 billion. This strategic move may also involve permitting underwriters to purchase an additional $150 million in shares. The proceeds from this offering are earmarked for various corporate purposes, including debt repayment and possible future acquisitions. Following the announcement, TTWO shares experienced a 4% drop in post-market trading on Tuesday.

Wall Street Analysts Forecast

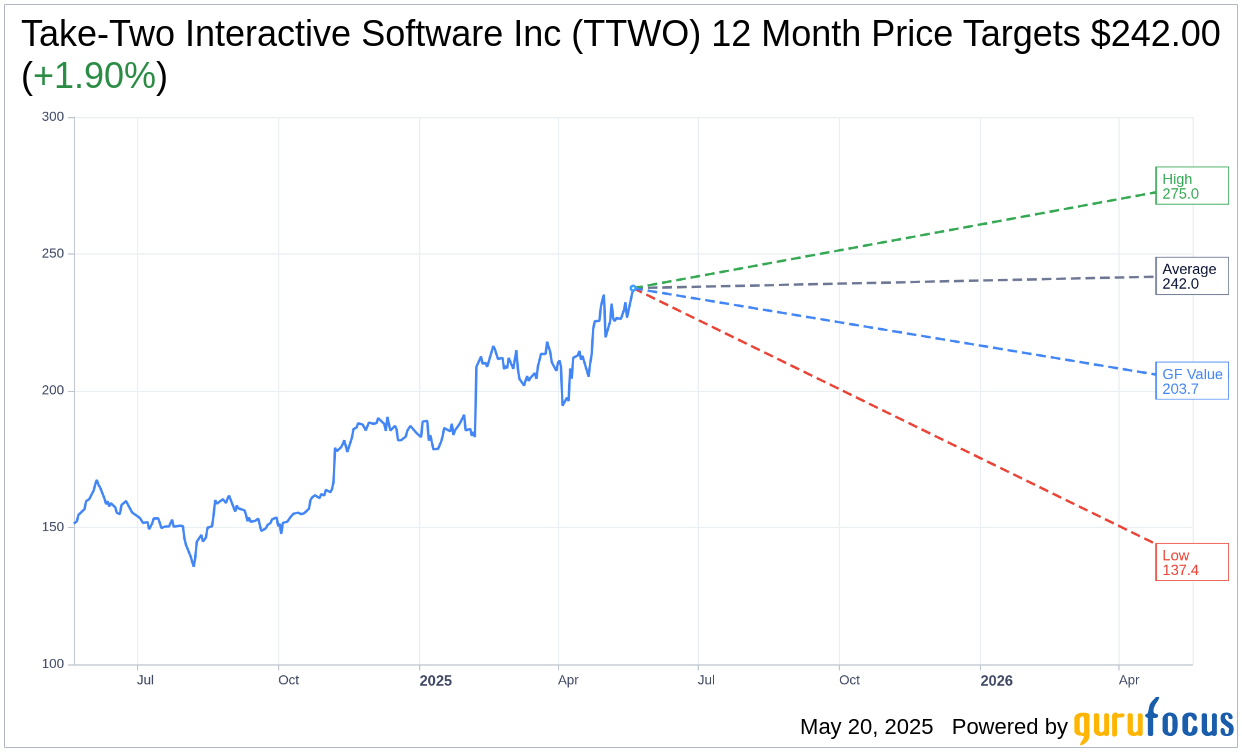

Wall Street analysts have set their sights on Take-Two Interactive's future pricing, with 28 analysts offering one-year price targets. The average target price stands at $242.00, with predictions ranging from a high of $275.00 to a low of $137.43. This average target price suggests a modest upside of 1.90% from the current trading price of $237.50. Investors looking for more detailed estimate data are encouraged to visit the Take-Two Interactive Software Inc (TTWO, Financial) Forecast page.

Brokerage Firms' Consensus

Take-Two Interactive enjoys an average recommendation of 1.8 from 30 brokerage firms, indicating an "Outperform" status. This recommendation is derived from a rating scale where 1 denotes a Strong Buy and 5 signifies a Sell. The majority consensus leans towards optimism, reflecting confidence in the company's strategic initiatives and market position.

GuruFocus's GF Value Estimation

According to GuruFocus estimates, the one-year GF Value for Take-Two Interactive Software Inc. is $203.71, suggesting a potential downside of 14.23% from its current price of $237.50. The GF Value represents GuruFocus's assessment of the stock's fair trading value, calculated based on historical trading multiples, past business growth, and future business performance projections. To explore more detailed data, please visit the Take-Two Interactive Software Inc (TTWO, Financial) Summary page.