Key Insights for Investors:

- Qualcomm (QCOM, Financial) has earned a revised "buy" rating from expert analyst Kevin Anthony D. Arroyo, highlighting its potential value in an expensive sector.

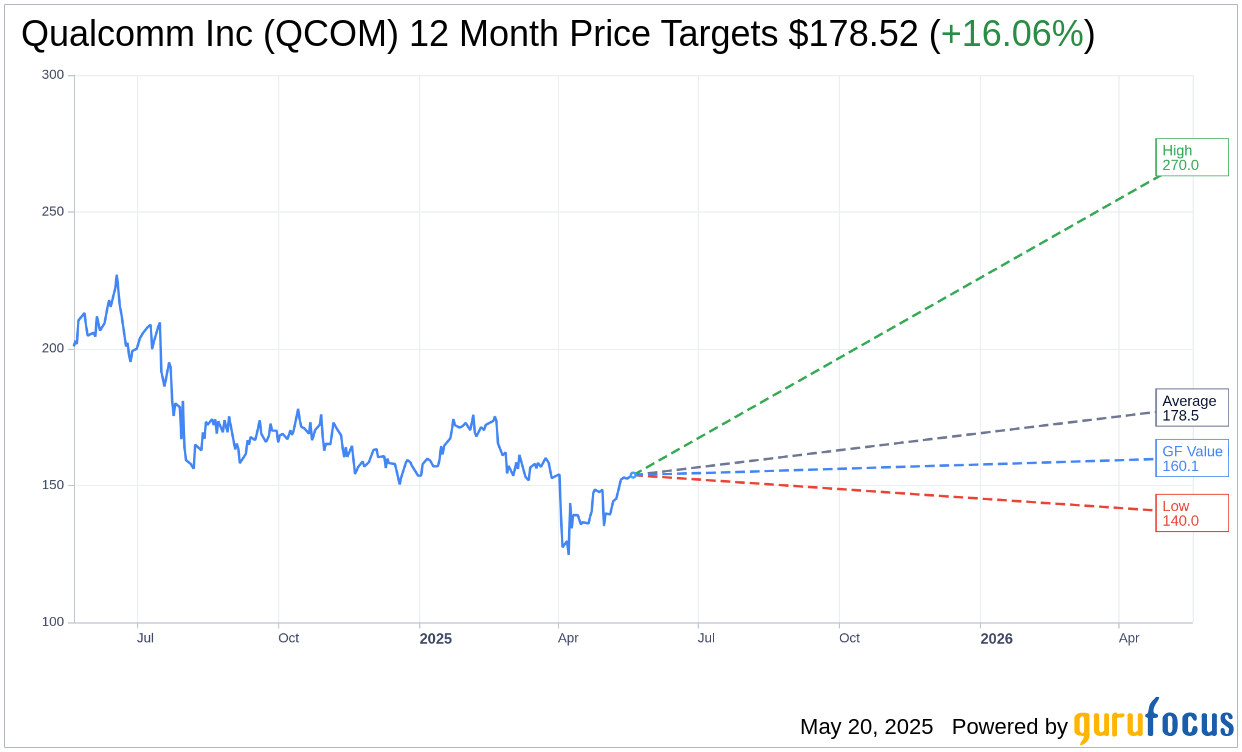

- Forecasts suggest a notable upside of 16.06% based on analysts' price targets.

- GuruFocus estimates reveal a 4.08% growth potential for Qualcomm, reflecting confidence in its market positioning.

Analyst Upgrade: A Strategic Move

Renowned analyst Kevin Anthony D. Arroyo has elevated Qualcomm (NASDAQ: QCOM) from a "hold" to a "buy" rating. This strategic upgrade is attributed to Qualcomm’s competitive pricing strategy and robust management team, making it an enticing option for investors navigating the high-stakes semiconductor industry.

Wall Street's Projection for Qualcomm

Thirty-one analysts have weighed in with one-year price targets for Qualcomm Inc (QCOM, Financial), setting an average target of $178.52. With estimates ranging from a high of $270.00 to a low of $140.00, the average suggests a promising upside of 16.06% from the current price of $153.82. For a comprehensive analysis, visit the Qualcomm Inc (QCOM) Forecast page.

Market Consensus: Outperform

Qualcomm Inc (QCOM, Financial) has received an average brokerage recommendation of 2.4 from 42 firms, classifying it under the "Outperform" category. This rating indicates strong performance prospects, with the evaluation scale ranging from 1 (Strong Buy) to 5 (Sell).

GF Value Assessment

According to GuruFocus projections, Qualcomm Inc (QCOM, Financial) boasts a one-year estimated GF Value of $160.09. This estimate suggests a potential upside of 4.08% from its current trading price of $153.82. The GF Value is derived from historical trading multiples, past growth patterns, and future performance forecasts, providing a well-rounded view of Qualcomm's market valuation. For further details, explore the Qualcomm Inc (QCOM) Summary page.