ZTO Express (ZTO, Financial) announced a notable increase in its financial and operational metrics for the first quarter. The company's revenue reached $1.50 billion, marking a 9.4% rise compared to the previous year. Parcel volume surged by 19.1%, totaling 8,539 million parcels, up from 7,171 million in the same quarter of 2024.

As of March 31, 2025, ZTO had expanded its infrastructure significantly, with over 31,000 pickup and delivery outlets, and approximately 6,000 direct network partners. The company operated more than 10,000 self-owned line-haul vehicles, with over 9,400 being high-capacity models ranging from 15 to 17 meters in length, compared to 9,100 such vehicles the previous year. ZTO managed over 3,900 line-haul routes connecting sorting hubs, which totaled 95, out of which 91 were company-operated.

ZTO's strategic approach includes focusing on service quality, penetrating further into reverse logistics, and collaborating with e-commerce platforms and enterprise clients to offer differentiated services like time-definite delivery. Despite intense competition in China's express delivery market, ZTO remains committed to leveraging its competitive edge and pursuing long-term growth and profitability.

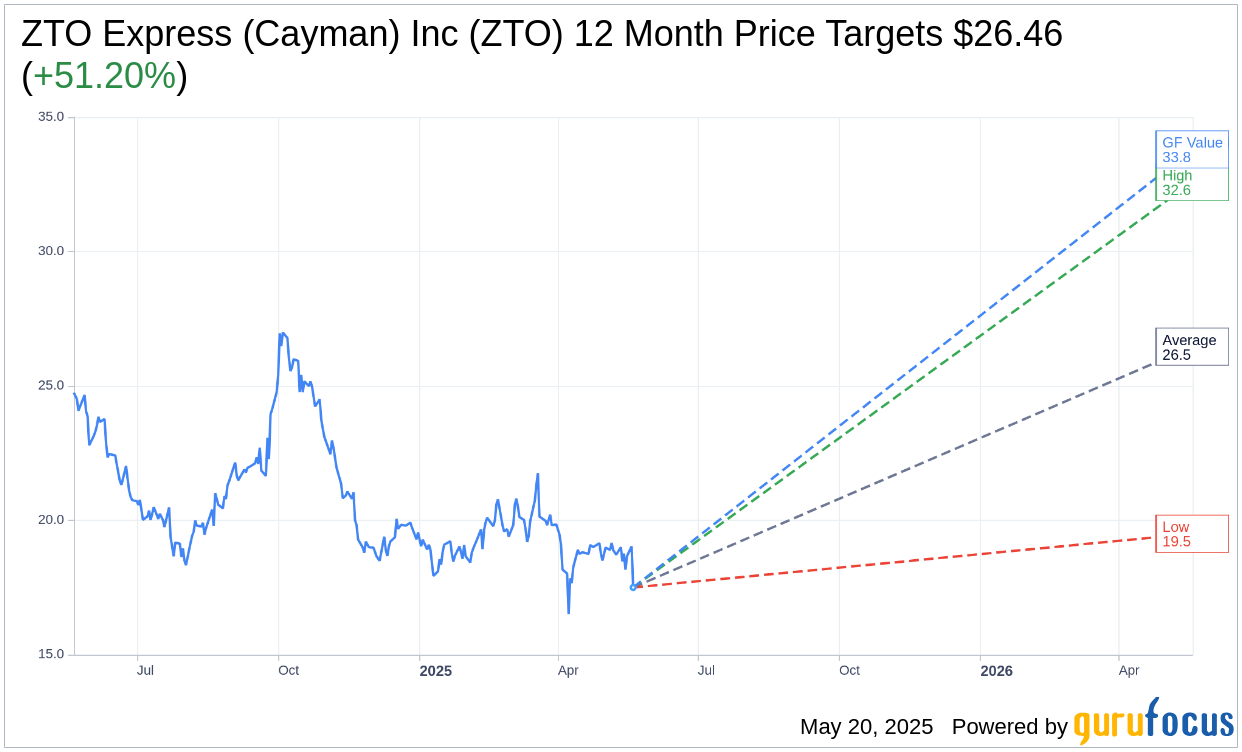

Wall Street Analysts Forecast

Based on the one-year price targets offered by 19 analysts, the average target price for ZTO Express (Cayman) Inc (ZTO, Financial) is $26.46 with a high estimate of $32.59 and a low estimate of $19.50. The average target implies an upside of 51.20% from the current price of $17.50. More detailed estimate data can be found on the ZTO Express (Cayman) Inc (ZTO) Forecast page.

Based on the consensus recommendation from 20 brokerage firms, ZTO Express (Cayman) Inc's (ZTO, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for ZTO Express (Cayman) Inc (ZTO, Financial) in one year is $33.80, suggesting a upside of 93.14% from the current price of $17.5. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the ZTO Express (Cayman) Inc (ZTO) Summary page.

ZTO Key Business Developments

Release Date: March 19, 2025

- Parcel Volume (Q4 2024): RMB9.67 billion, up 11% year-over-year.

- Annual Parcel Volume (2024): RMB34 billion, growing 12.6% year-over-year.

- Adjusted Net Income (Q4 2024): RMB2.73 billion, up 23.4% year-over-year.

- Adjusted Annual Net Income (2024): RMB10.15 billion, increasing by 12.7% year-over-year.

- Total Revenue (Q4 2024): RMB12.9 billion, up 21.7% year-over-year.

- Total Revenue (2024): RMB44 billion, up 15.3% year-over-year.

- ASP Increase (Q4 2024): 10.3% or RMB0.13.

- ASP Increase (2024): 2.7% or RMB0.04.

- Total Cost of Revenue (Q4 2024): RMB9.2 billion, up 22.3% year-over-year.

- Total Cost of Revenue (2024): RMB30.6 billion, up 14.2% year-over-year.

- Gross Profit (Q4 2024): RMB3.8 billion, up 20.2% year-over-year.

- Gross Profit (2024): RMB13.7 billion, up 17.6% year-over-year.

- Gross Profit Margin (Q4 2024): 29.1%, decreased by 0.4 points.

- Gross Profit Margin (2024): 31%, increased by 0.6 points.

- Operating Cash Flow (Q4 2024): RMB2.8 billion, decreased by 28.5% year-over-year.

- Operating Cash Flow (2024): RMB11.4 billion, decreased by 14.5% year-over-year.

- Adjusted EBITDA (Q4 2024): RMB4.6 billion.

- Adjusted EBITDA (2024): RMB16.4 billion.

- Capital Expenditure (Q4 2024): RMB1.2 billion.

- Capital Expenditure (2024): RMB5.9 billion.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- ZTO Express (Cayman) Inc (ZTO, Financial) achieved an 11% year-over-year increase in parcel volume for Q4 2024, reaching RMB9.67 billion.

- The company reported a 23.4% year-over-year growth in adjusted net income for Q4 2024, amounting to RMB2.73 billion.

- ZTO Express (Cayman) Inc (ZTO) maintained high service quality and improved end-to-end timeliness, reducing loss, damage, and complaint rates.

- The company successfully increased its annual parcel volume by 12.6% year-over-year, reaching RMB34 billion.

- ZTO Express (Cayman) Inc (ZTO) plans to grow its parcel volume by 20% to 24% in 2025, aiming to exceed industry growth expectations.

Negative Points

- The express delivery industry faces downward pressure on logistics pricing due to increased lower-value parcels and intense price competition.

- Operating cash flow decreased by 28.5% for Q4 and 14.5% for the year, primarily due to a one-time refund of franchise deposits and other factors.

- The company anticipates continued intense price competition in the express delivery industry in 2025.

- ZTO Express (Cayman) Inc (ZTO) faces challenges from consumption downgrades and the need to align closely with market dynamics.

- The company incurred additional costs for sorting activities conducted on behalf of franchise partners, impacting overall cost efficiency.