On March 31, 2025, Prosight Management, LP (Trades, Portfolio) made a strategic decision to reduce its stake in MeiraGTx Holdings PLC by 34,266 shares. The transaction was executed at a trade price of $6.78 per share. This reduction reflects a minor adjustment in the firm's portfolio, which now holds a total of 4,356,571 shares in MeiraGTx. The transaction had a slight impact on the firm's portfolio, decreasing its position in MeiraGTx by 0.06%.

Prosight Management, LP (Trades, Portfolio): A Value Investing Firm

Prosight Management, LP (Trades, Portfolio) is a well-regarded firm in the value investing community, known for its strategic and diversified investment approach. Based in Dallas, Texas, the firm operates from 2301 Cedar Springs Road, Suite 355. With a portfolio comprising 38 stocks, Prosight Management's top holdings include Galapagos NV (GLPG, Financial), MeiraGTx Holdings PLC (MGTX, Financial), and BridgeBio Pharma Inc (BBIO, Financial). The firm's investment philosophy focuses on identifying undervalued opportunities in the market, aiming to generate long-term returns for its investors.

About MeiraGTx Holdings PLC

MeiraGTx Holdings PLC is a clinical-stage gene therapy company headquartered in the USA. The company is dedicated to developing treatments for disorders affecting the eye, salivary gland, and central nervous system. MeiraGTx operates across the United States, United Kingdom, and European Union, focusing on innovative genetic medicine solutions. The company's pipeline includes promising products such as AAV-CNGB3, AAV-CNGA3, and AAV-RPGR, which are in various stages of development.

Financial Metrics and Valuation of MeiraGTx Holdings PLC

As of May 21, 2025, MeiraGTx Holdings PLC has a market capitalization of $442.011 million and a current stock price of $5.50. The company's [GF Value](https://www.gurufocus.com/term/gf-value/MGTX) is estimated at $9.86, classifying it as a "Possible Value Trap" with a Price to GF Value ratio of 0.56. This suggests that the stock is trading significantly below its intrinsic value, warranting caution for potential investors.

Performance and Growth Indicators

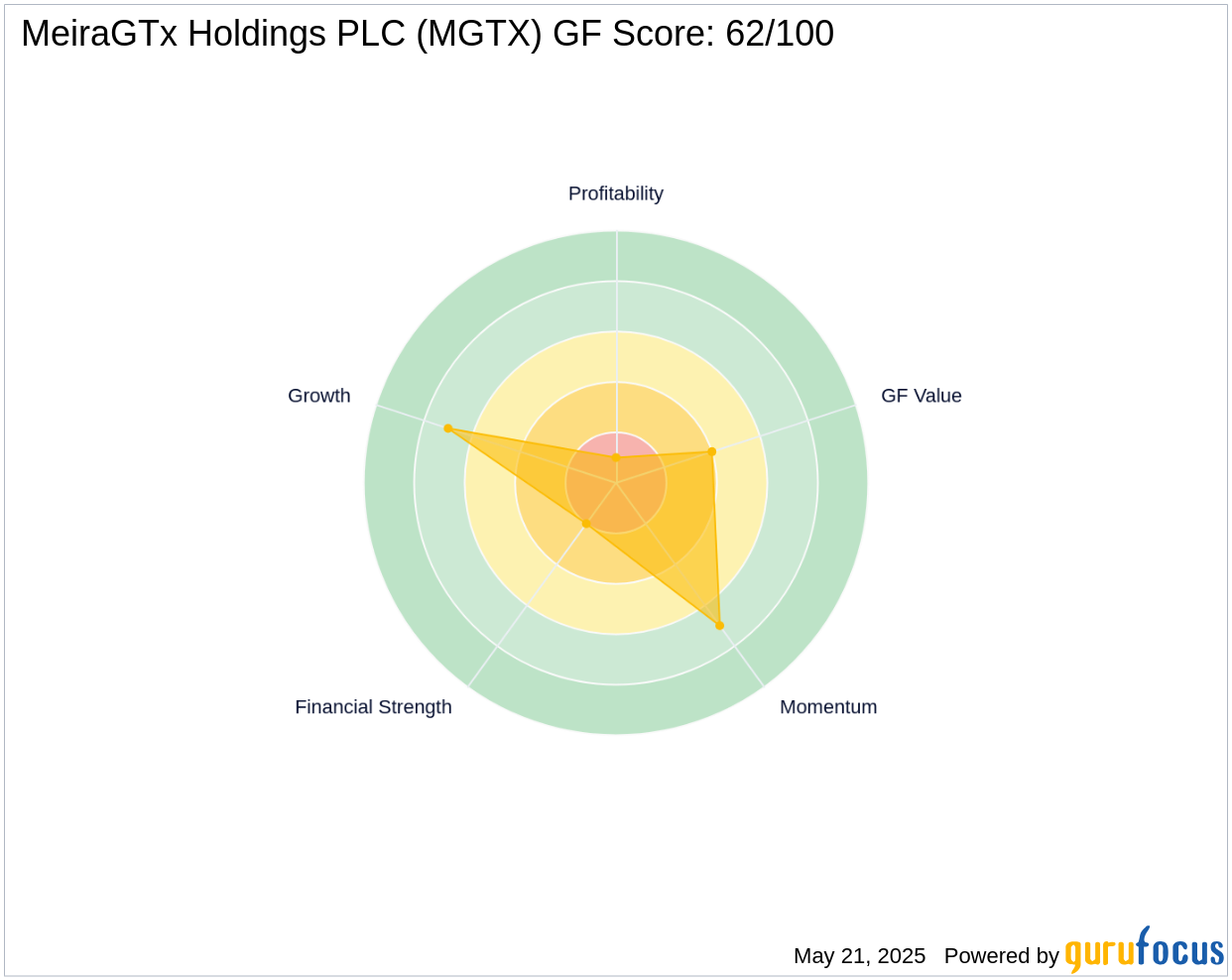

MeiraGTx's stock has experienced a year-to-date price change of -12.28% and a substantial decline of -63.36% since its IPO in 2018. The company's [GF Score](https://www.gurufocus.com/term/gf-score/MGTX) is 62 out of 100, indicating poor future performance potential. These metrics highlight the challenges faced by the company in achieving sustainable growth and profitability.

Financial Health and Profitability

MeiraGTx's financial health is concerning, with a [Balance Sheet Rank](https://www.gurufocus.com/term/rank-balancesheet/MGTX) of 2/10 and a [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/MGTX) of 1/10. The company's [Cash to Debt](https://www.gurufocus.com/term/interest-coverage/MGTX) ratio stands at 0.82, indicating limited financial flexibility. Additionally, the company has a negative ROE of -209.98% and ROA of -61.11%, reflecting significant challenges in generating returns on equity and assets.

Market and Industry Context

Operating within the Biotechnology industry, MeiraGTx has faced a bearish trend in recent months, as indicated by its RSI indicators. The company's revenue and earnings growth have been negative over the past three years, with a revenue growth rate of -17.60% and an [Operating Margin](https://www.gurufocus.com/term/operating-margin/MGTX) growth of -14.00%. These factors contribute to the company's current market position and valuation challenges.

Implications for Value Investors

The recent reduction in shares by Prosight Management, LP (Trades, Portfolio) may signal caution to value investors. Given MeiraGTx's financial health and market position, investors should carefully analyze the company's current valuation and performance metrics. While the stock's low price relative to its [GF Value](https://www.gurufocus.com/term/gf-value/MGTX) may appear attractive, the potential risks associated with its financial and operational challenges should not be overlooked.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.