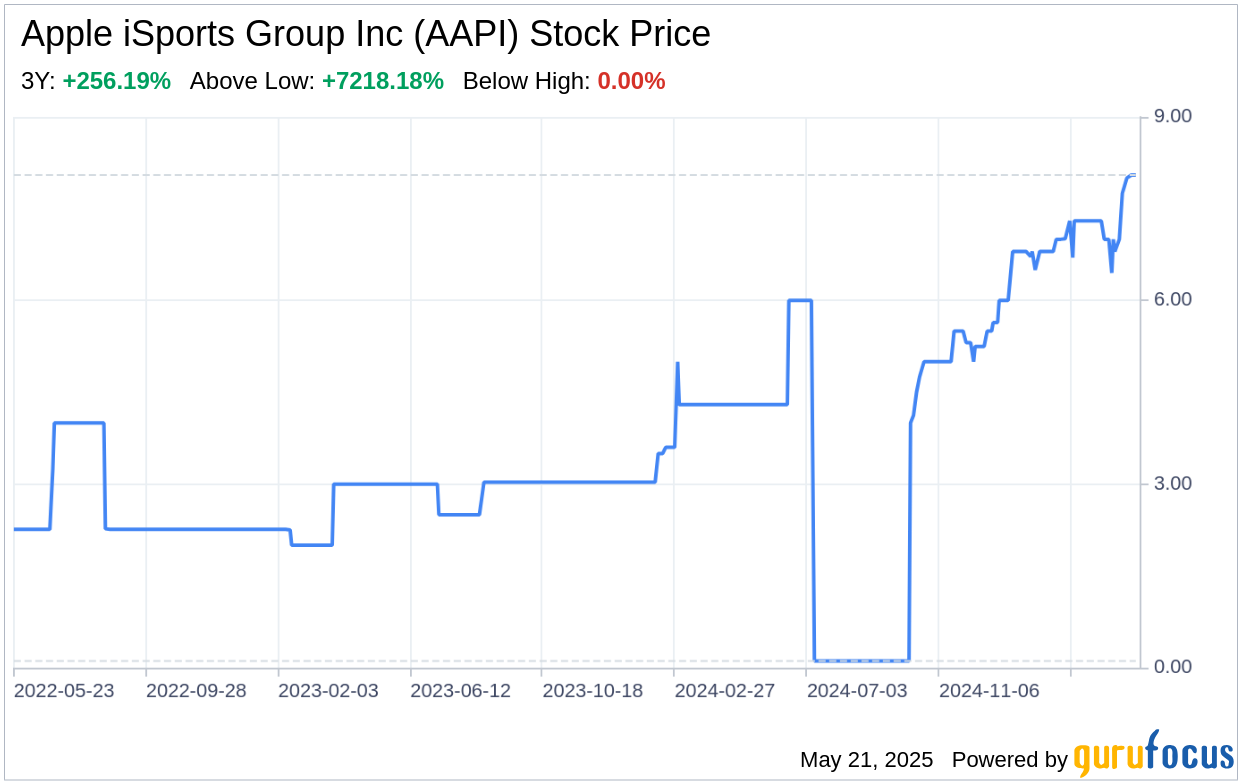

Apple iSports Group Inc (AAPI, Financial), a digital sports entertainment and gaming company, recently filed its 10-Q report on May 20, 2025. This SWOT analysis delves into the company's financial health and strategic positioning based on its latest SEC filing. AAPI is engaged in developing an online sports engagement portal, including racing and sports betting, fantasy sports, and sports content. With operations in both the U.S. and Australia, AAPI is poised to capitalize on the growing digital entertainment market. However, the company reported a net loss of $3.19 million for the quarter ended March 31, 2025, a negative working capital of $4.09 million, and an accumulated deficit of $16.45 million, indicating financial challenges that need to be addressed.

Strengths

Brand and Market Presence: Apple iSports Group Inc (AAPI, Financial) has established a significant presence in the digital sports entertainment industry. With a provisional Northern Territory Online Bookmaking License in Australia and an ADW provider license in North Dakota, AAPI has secured a foothold in two of the most mature legal betting markets. The company's strategic acquisitions and infrastructure investments have positioned it to capitalize on the convergence of technology, media, and entertainment. AAPI's commitment to enhancing sports fandom through its platform is a testament to its brand strength and customer engagement strategies.

Technological Infrastructure: AAPI's investment in proprietary technology and intellectual property rights is a cornerstone of its competitive advantage. The company's focus on acquiring third-party intellectual property and enhancing its proprietary technology positions it well for innovation and differentiation in the market. AAPI's platform is designed to deliver seamless streaming and interactive experiences, which are critical in today's digital landscape where high-speed access to content is in high demand.

Weaknesses

Financial Performance: The company's financial health is a concern, as evidenced by its net loss of $3.19 million and negative working capital of $4.09 million for the quarter ended March 31, 2025. The accumulated deficit of $16.45 million raises questions about AAPI's ability to sustain operations and achieve profitability. These financial challenges underscore the need for strategic initiatives to improve revenue streams and manage operating costs effectively.

Dependence on Financing: AAPI's ongoing operations and business plan execution are heavily reliant on capital investment and financing. The company's dependence on advances from significant stockholders and third-party equity or debt financing to meet its minimal operating expenses indicates a vulnerability in its financial strategy. The uncertainty surrounding the company's ability to secure necessary funding could impede its growth and operational scalability.

Opportunities

Market Expansion: AAPI's licenses in Australia and select U.S. states present significant opportunities for market expansion. The company's plans to seek market access licenses for sports betting in additional U.S. states over a three-year timeline could drive growth and increase its market share. AAPI's dual-market approach, with separate websites for the U.S. and Australia, allows for targeted marketing and customer acquisition strategies that can be tailored to each region's unique regulatory and consumer landscape.

Industry Growth: The global sports betting and digital entertainment sectors are experiencing rapid growth, driven by technological advancements and changing consumer behaviors. AAPI's focus on developing a multi-faceted sports betting platform positions it to capitalize on these industry trends. The company's ability to innovate and adapt to market demands will be crucial in leveraging growth opportunities and enhancing its value proposition to users.

Threats

Regulatory Challenges: The sports betting and gaming industry is subject to stringent regulations that vary by jurisdiction. AAPI's operations in the U.S. and Australia require compliance with a complex regulatory framework that can impact its business model and expansion plans. Changes in regulations or failure to obtain necessary licenses could adversely affect AAPI's ability to operate and grow in its target markets.

Competitive Landscape: AAPI operates in a highly competitive industry with numerous established and emerging players. The company must continuously innovate and differentiate its offerings to maintain a competitive edge. Intense competition could lead to increased marketing costs, pricing pressures, and the need for continuous investment in technology and content to retain and attract users.

In conclusion, Apple iSports Group Inc (AAPI, Financial) exhibits a mix of strengths, including a strong brand presence and technological infrastructure, which are counterbalanced by financial weaknesses and dependence on external financing. The company's opportunities for market expansion and industry growth are promising, yet it must navigate regulatory challenges and a competitive landscape. AAPI's ability to address its financial vulnerabilities and capitalize on its strengths will be critical in achieving long-term success and profitability.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.