Highlights:

- First-quarter net profit of $40.4 million for CMB.Tech NV (CMBT, Financial), with EPS of $0.21.

- Contract backlog surged by $921 million, totaling $2.94 billion.

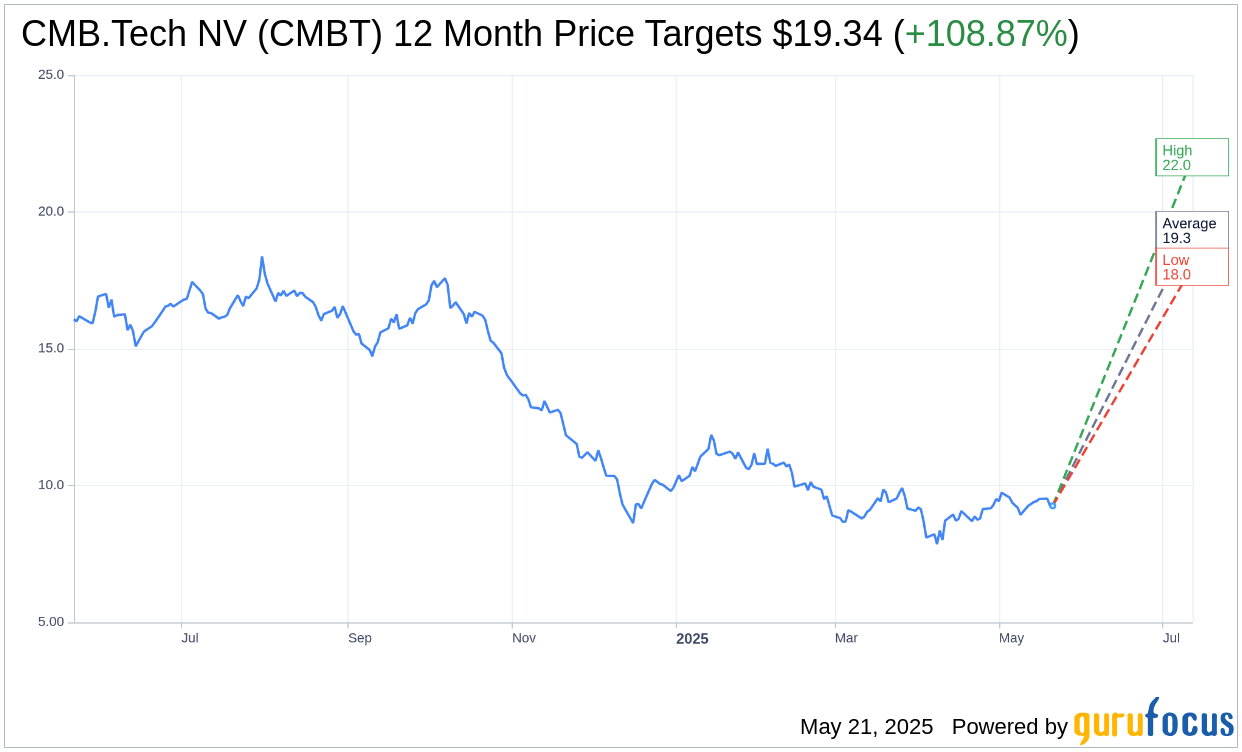

- Stock forecast shows significant upside potential from current price.

CMB.Tech NV (CMBT) has made a strong start in 2025, delivering a robust first-quarter net profit of $40.4 million and earnings per share reaching $0.21. Additionally, the company significantly increased its contract backlog by $921 million, bringing the total to an impressive $2.94 billion. With an EBITDA of $158.4 million, the company's financial performance in this period underscores its growth trajectory and operational efficiency.

Wall Street Analysts Forecast

CMB.Tech NV's (CMBT, Financial) stock is drawing attention with its one-year price targets from six analysts, positioning the average target price at $19.34. The projections vary, with a high estimate of $22.00 and a low estimate of $18.00. This suggests a potential upside of 108.87% from the current trading price of $9.26. Interested investors can explore more detailed forecast data on the CMB.Tech NV (CMBT) Forecast page.

The consensus from four brokerage firms rates CMB.Tech NV (CMBT, Financial) at an average of 2.5, which corresponds to an "Outperform" recommendation. This rating scale ranges from 1, indicating a Strong Buy, to 5, representing a Sell, reflecting analysts' bullish outlook on the stock's future performance.

GuruFocus GF Value Analysis

According to GuruFocus estimates, the one-year GF Value for CMB.Tech NV (CMBT, Financial) stands at $18.65, indicating an upside of 101.4% from the current price of $9.26. The GF Value is GuruFocus' fair value estimation of the stock, calculated by considering historical trading multiples, past business growth, and future performance predictions. Investors looking for in-depth data can visit the CMB.Tech NV (CMBT) Summary page for more insights.

Overall, CMB.Tech NV (CMBT, Financial) presents an attractive investment opportunity for investors seeking growth, backed by strong financial results and favorable analyst ratings.