- Take-Two Interactive (TTWO, Financial) sees a 4% stock dip after announcing a $1 billion public stock offering.

- Analysts predict an average price target of $244.35, suggesting modest upside potential.

- Consensus rating of "Outperform" with a GF Value estimate indicating potential downside.

Take-Two Interactive (TTWO) recently faced a 4% drop in its stock price, following the announcement of a $1 billion public offering of common stock. The company has also proposed an additional $150 million offering to underwriters. The proceeds from this offering are intended for various general corporate purposes.

Wall Street Analysts' Predictions

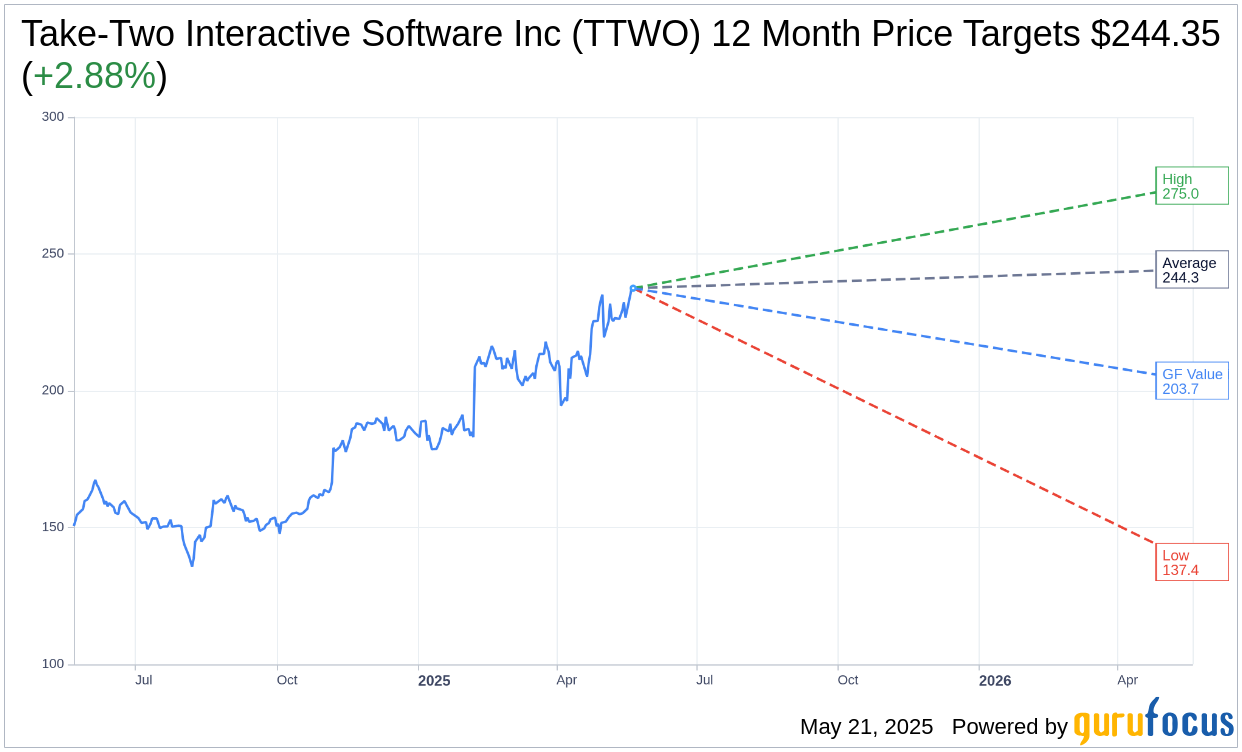

According to the latest information from 28 analysts, the average one-year price target for Take-Two Interactive Software Inc (TTWO, Financial) stands at $244.35. This forecast includes a high estimate of $275.00 and a low estimate of $137.43, suggesting an upside potential of 2.88% from its present price of $237.50. For a more comprehensive look at these projections, please visit the Take-Two Interactive Software Inc (TTWO) Forecast page.

Analyst Recommendations

Among 29 brokerage firms, the average brokerage recommendation for Take-Two Interactive Software Inc (TTWO, Financial) is 1.9, which indicates an "Outperform" status. This rating is derived from a scale of 1 to 5, where 1 signifies a Strong Buy and 5 indicates a Sell.

Assessing the GF Value

The GF Value for Take-Two Interactive Software Inc (TTWO, Financial) is projected to be $203.71 in a year's time. This indicates a potential downside of 14.23% from the current price of $237.50. The GF Value is GuruFocus' estimate of the fair value at which the stock should be traded, based on its historical multiples, past business growth, and future performance estimates. For detailed insights, see the Take-Two Interactive Software Inc (TTWO) Summary page.