On May 21, 2025, VF Corp (VFC, Financial) released its 8-K filing for the fourth quarter of fiscal 2025. VF Corp, a company known for designing, producing, and distributing branded apparel, footwear, and accessories, operates through a portfolio of 11 brands including Vans, The North Face, Timberland, Altra, and Dickies. The company markets its products across the Americas, Europe, and Asia-Pacific through various channels such as wholesale, e-commerce, and branded stores.

Performance Overview and Challenges

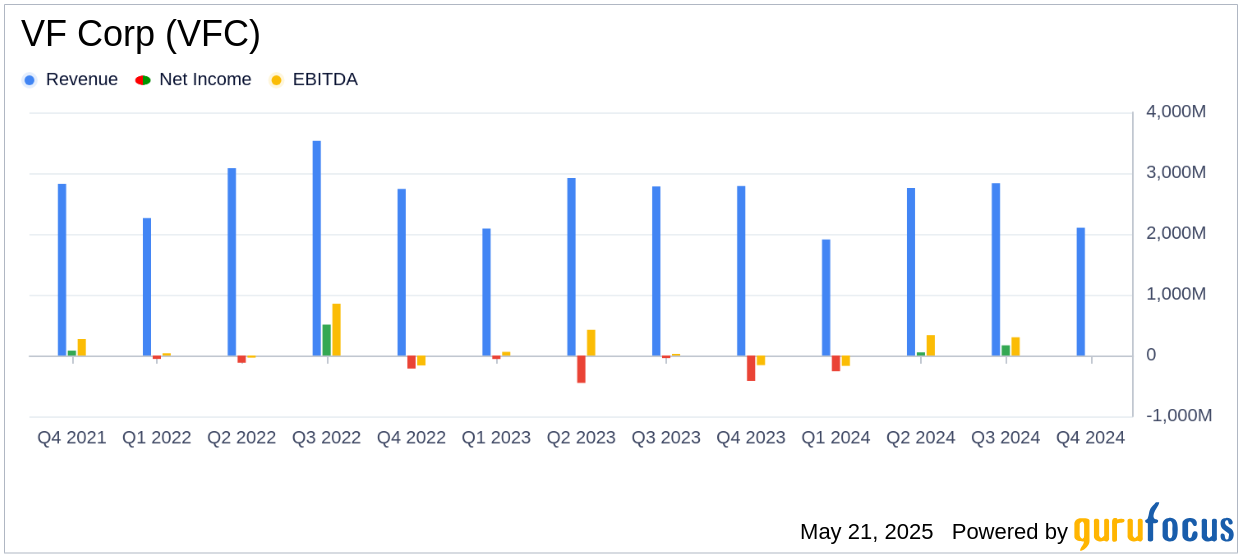

VF Corp reported a revenue of $2.1 billion for Q4'25, aligning with its guidance but reflecting a 5% decrease compared to the previous year. The North Face and Timberland brands showed growth, while Vans and Dickies experienced declines. The company faced regional challenges, with growth in the Asia-Pacific region offset by declines in the Americas and EMEA. The operating loss for the quarter was $73 million, but the adjusted operating income was $22 million, surpassing the guidance range of a $30 million to $0 million loss.

Financial Achievements and Industry Significance

VF Corp's gross margin improved significantly to 53.3%, up 550 basis points from the previous year, highlighting effective cost management and inventory quality improvements. The adjusted gross margin was slightly higher at 53.4%. These achievements are crucial in the apparel and accessories industry, where margin improvements can significantly impact profitability.

Key Financial Metrics and Statements

The company's net debt was reduced by $1.8 billion, ending the fiscal year with a leverage ratio of 4.1x, a full turn lower than the previous year. This reduction is part of VF Corp's strategy to strengthen its balance sheet. The free cash flow for FY'25 was $313 million, with an additional $88 million from non-core asset sales, totaling $401 million.

| Metric | Q4'25 | Q4'24 | % Change |

|---|---|---|---|

| Revenue | $2.1 billion | $2.25 billion | -5% |

| Operating Income (Loss) | ($73) million | ($373) million | N/A |

| Adjusted Operating Income | $22 million | N/A | N/A |

| EPS (Loss) | ($0.39) | ($1.06) | N/A |

Analysis and Strategic Insights

VF Corp's strategic initiatives, including the Reinvent transformation program, are showing positive results. The company achieved its target of $300 million in gross cost savings and is on track to reach its medium-term goal of $500 to $600 million in net operating income expansion. The deliberate actions taken to stabilize the Vans brand are expected to lay a strong foundation for future growth.

Bracken Darrell, President and CEO, stated, "We exceeded our Q4'25 operating income guidance, reflecting results from our Reinvent transformation program. Revenue for the quarter was in-line with our guidance and excluding Vans, was up versus last year, led by growth at The North Face and Timberland."

Overall, VF Corp's Q4'25 results demonstrate resilience in a challenging market environment, with strategic initiatives beginning to bear fruit. The company's focus on cost management and debt reduction positions it well for future growth and value creation.

Explore the complete 8-K earnings release (here) from VF Corp for further details.