Summary:

- XPeng Inc (XPEV, Financial) exceeded Q1 earnings expectations amid robust growth in vehicle deliveries.

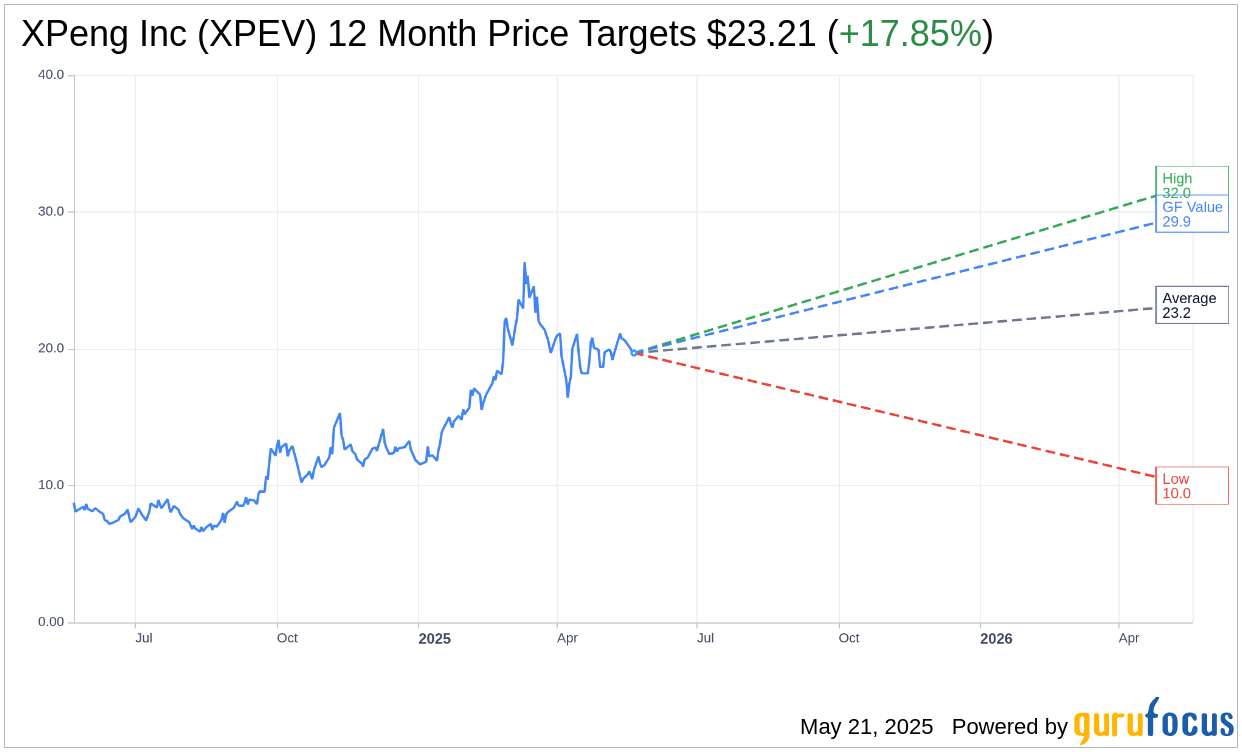

- Analysts predict a 17.85% upside potential with a target price of $23.21.

- The stock earns an "Outperform" rating with a promising future GF Value estimate.

XPeng's Impressive Q1 Performance

XPeng Inc. (XPEV) has caught the attention of investors with its latest financial report. The electric vehicle (EV) manufacturer posted a Q1 Non-GAAP EPS of -$0.03, surpassing analysts' projections by a substantial $0.18. This positive earnings surprise is bolstered by an astounding 141.5% year-over-year revenue increase, totaling $2.18 billion. The company's robust growth in vehicle deliveries, which surged by 330.8% to reach 94,008 units, further underscores its strong market position. With such momentum, XPeng anticipates continued expansion in Q2.

Wall Street Analysts' Projections

XPeng Inc. (XPEV, Financial) has garnered varied opinions from Wall Street analysts. According to price targets provided by 26 financial analysts, the average target price stands at $23.21, with projections ranging from a high of $31.99 to a low of $10.00. Considering the current stock price of $19.69, this average target reflects an upside potential of 17.85%. For a deeper dive into these estimations, visit the XPeng Inc (XPEV) Forecast page.

Brokerage Recommendations and GF Value

The consensus among 25 brokerage firms positions XPeng Inc. (XPEV, Financial) with an average recommendation of 2.3, indicative of an "Outperform" status. This rating operates on a scale from 1 to 5, where 1 signifies a Strong Buy and 5 denotes a Sell. Additionally, according to GuruFocus's GF Value estimates, the future value of XPeng Inc. (XPEV) in one year is projected at $29.88. This suggests a potentially impressive upside of 51.75% from the current price of $19.69. The GF Value represents GuruFocus's fair value estimation based on historical trading multiples, past business growth, and projected future performance. For more detailed insights, visit the XPeng Inc (XPEV) Summary page.

XPeng's recent financial performance, coupled with positive analyst sentiment, underscores its potential as a compelling opportunity in the EV market. Investors are advised to consider these metrics and projections when evaluating XPeng's future growth prospects.