A recent development in the energy sector could prove advantageous for Coterra Energy (CTRA, Financial). The Trump administration has decided to lift a previous halt on the Empire Wind project, a $5 billion initiative situated off New York's coastline. This decision emerged from a compromise with the state, which might also lead to the revival of a gas pipeline project that was previously canceled. New York Governor Hochul has indicated a willingness not to obstruct new energy undertakings, paving the way for potential future pipeline construction.

This shift in policy bodes well for companies like Coterra Energy (CTRA, Financial), which stand to gain from the acceleration of these energy infrastructure projects. The anticipated developments could provide significant opportunities for the company as it looks to expand its operations aligned with the ongoing energy initiatives.

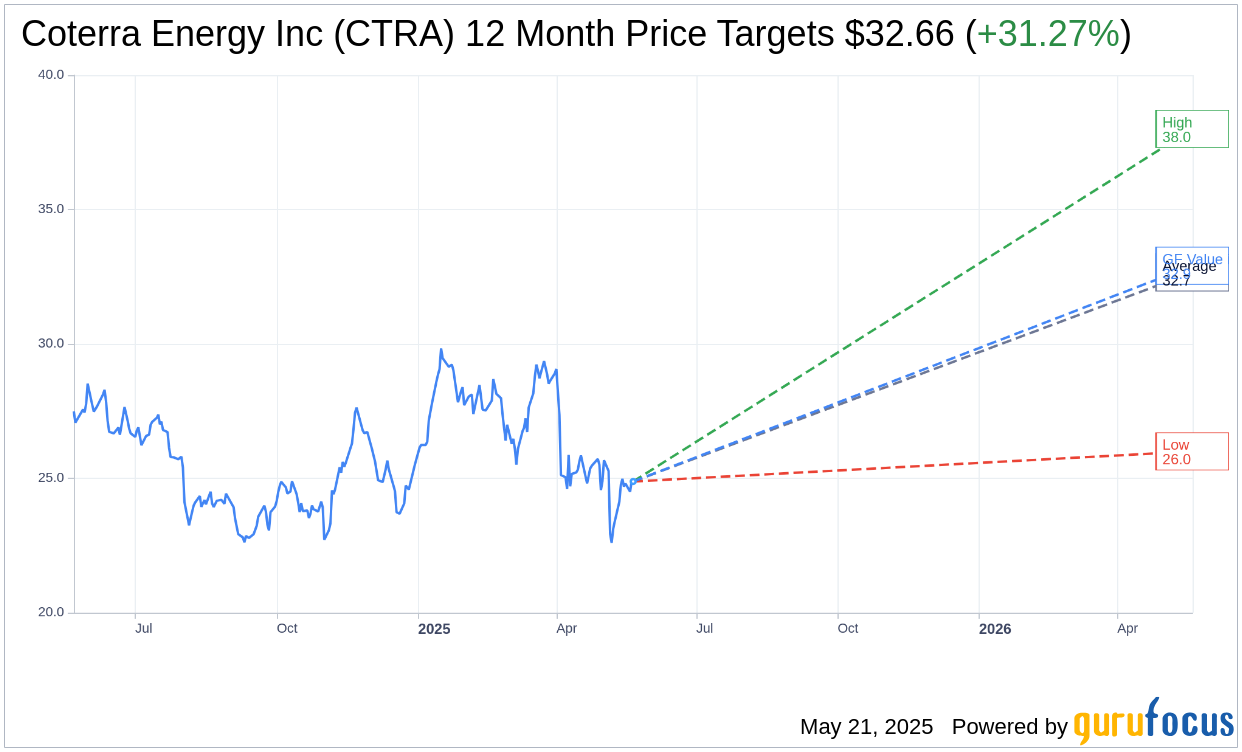

Wall Street Analysts Forecast

Based on the one-year price targets offered by 25 analysts, the average target price for Coterra Energy Inc (CTRA, Financial) is $32.66 with a high estimate of $38.00 and a low estimate of $26.00. The average target implies an upside of 31.27% from the current price of $24.88. More detailed estimate data can be found on the Coterra Energy Inc (CTRA) Forecast page.

Based on the consensus recommendation from 25 brokerage firms, Coterra Energy Inc's (CTRA, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Coterra Energy Inc (CTRA, Financial) in one year is $32.91, suggesting a upside of 32.27% from the current price of $24.88. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Coterra Energy Inc (CTRA) Summary page.

CTRA Key Business Developments

Release Date: May 06, 2025

- Oil Production: 2% above the midpoint of guidance.

- Natural Gas Production: Exceeded the high end of guidance.

- Revenue: $2 billion, up from $1.4 billion in Q4 2024.

- Net Income: $516 million or $0.68 per share.

- Adjusted Net Income: $608 million or $0.80 per share.

- Free Cash Flow: $663 million after cash capital expenditures.

- Cash Operating Cost per Unit: $9.97 per BOE.

- Capital Expenditures: 4% below the midpoint of guidance.

- Dividend: $0.22 per share for the quarter.

- Term Loan Repayment: $250 million repaid.

- Total Liquidity: $2.2 billion, including a $2 billion undrawn credit facility.

- 2025 CapEx Reduction: Reduced by $100 million.

- Production Guidance for Q2 2025: 710 to 760 MBoe per day.

- Oil Production Guidance for Q2 2025: 147 to 157 MBoe per day.

- Natural Gas Production Guidance for Q2 2025: 2.7 to 2.85 Bcf per day.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Coterra Energy Inc (CTRA, Financial) delivered oil production near the high end of guidance and natural gas production that exceeded expectations.

- The company successfully closed on the Franklin Mountain and Avant acquisitions, integrating these assets efficiently.

- Coterra Energy Inc (CTRA) generated excellent financial results, returning a substantial portion of free cash to shareholders and retiring $250 million of term loans.

- The company has a diversified revenue stream and a low-cost oil and natural gas supply, making it resilient in volatile markets.

- Coterra Energy Inc (CTRA) maintained a strong balance sheet with a focus on debt reduction, planning to fully repay a $1 billion term loan during 2025.

Negative Points

- Coterra Energy Inc (CTRA) encountered mechanical issues with Harkey wells, leading to increased water production and a pause in development in certain areas.

- The company is reducing projected 2025 CapEx by $100 million due to concerns over the oil market outlook.

- There is uncertainty regarding the duration and impact of current commodity market volatility and potential recession fears.

- Coterra Energy Inc (CTRA) is facing challenges in maintaining its oil production guidance due to the deferment of some projects.

- The company is experiencing a reduction in oil production by approximately 5,000 barrels per day in the second quarter relative to earlier expectations.