JPMorgan analyst Samik Chatterjee has elevated the price target for Keysight Technologies (KEYS, Financial) from $172 to $177, while maintaining an Overweight rating. This decision follows the company's impressive financial results for fiscal Q2, surpassing both revenue and earnings expectations. Despite its usual cautious approach, Keysight has provided better-than-anticipated guidance for Q3 and has adjusted its full-year outlook upwards. The strong organic revenue growth has led the firm to assign a higher earnings multiple to Keysight's fiscal 2026 earnings estimate.

Wall Street Analysts Forecast

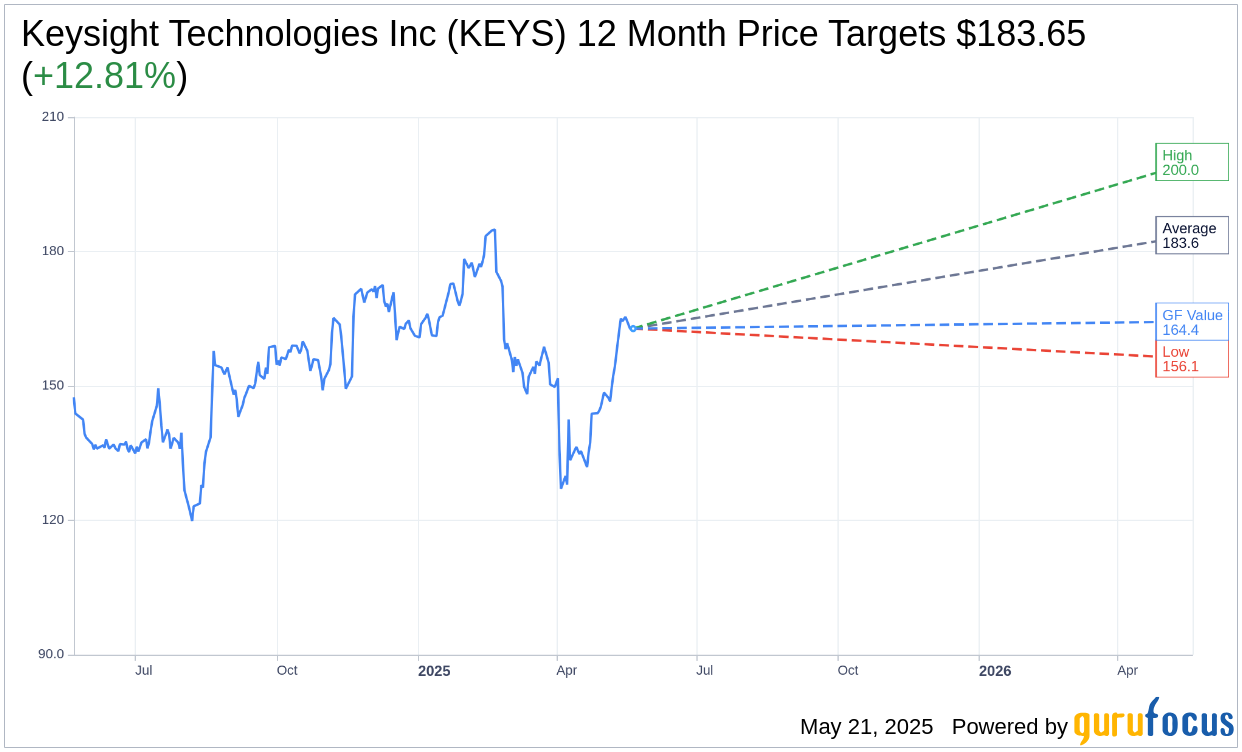

Based on the one-year price targets offered by 11 analysts, the average target price for Keysight Technologies Inc (KEYS, Financial) is $183.65 with a high estimate of $200.00 and a low estimate of $156.12. The average target implies an upside of 12.81% from the current price of $162.80. More detailed estimate data can be found on the Keysight Technologies Inc (KEYS) Forecast page.

Based on the consensus recommendation from 13 brokerage firms, Keysight Technologies Inc's (KEYS, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Keysight Technologies Inc (KEYS, Financial) in one year is $164.36, suggesting a upside of 0.96% from the current price of $162.8. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Keysight Technologies Inc (KEYS) Summary page.

KEYS Key Business Developments

Release Date: May 20, 2025

- Revenue: $1.306 billion, above the high end of guidance, 7% reported growth, 8% core growth.

- Earnings Per Share (EPS): $1.70, exceeding guidance.

- Orders: $1.316 billion, up 8% year-over-year and sequentially.

- Gross Margin: 65%.

- Operating Expenses: $516 million, up 4%.

- Operating Margin: 25%, increased by 100 basis points year-over-year.

- Net Income: $295 million.

- Communications Solutions Group Revenue: $913 million, up 9%.

- Commercial Communications Revenue: $612 million, up 9%.

- Aerospace, Defense & Government Revenue: $301 million, up 9%.

- Electronic Industrial Solutions Group Revenue: $393 million, up 5%.

- Cash and Cash Equivalents: $3.118 billion.

- Free Cash Flow: $457 million.

- Share Repurchase: 1,042,000 shares at an average price of $144, totaling $150 million.

- Annual Revenue Growth Expectation: Midpoint of 5% to 7% target.

- Annual EPS Growth Expectation: Slightly above 10% target.

- Q3 Revenue Guidance: $1.305 billion to $1.325 billion.

- Q3 EPS Guidance: $1.63 to $1.69.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Keysight Technologies Inc (KEYS, Financial) delivered revenue of $1.3 billion and earnings per share of $1.70, both exceeding the high end of guidance.

- Orders grew 8% year over year and 4% sequentially, indicating strong demand.

- The company has a diversified global supply chain with minimal exposure to China, enhancing resilience.

- Commercial Communications orders grew double digits, driven by data center infrastructure expansion and new technology deployments.

- Aerospace, Defense & Government orders grew, with significant deals in Europe and ongoing investment in spectrum operations and space applications.

Negative Points

- The Electronic Industrial Solutions Group experienced mixed demand, with automotive orders and revenues down.

- The company faces a gross annualized tariff exposure of $75 to $100 million, impacting margins.

- Despite strong performance, the macroeconomic environment remains uncertain, with potential risks from tariffs and geopolitical tensions.

- The smartphone-related business remains soft, particularly in China.

- The company anticipates a significant tariff impact in Q3, with full mitigation expected by the end of the fiscal year.