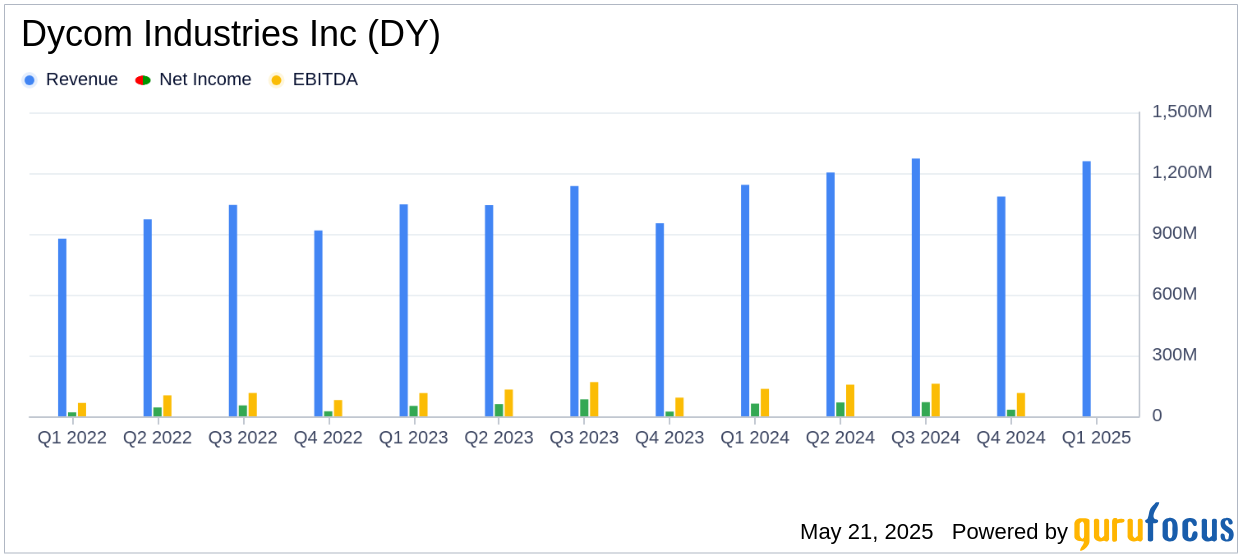

On May 21, 2025, Dycom Industries Inc (DY, Financial) released its 8-K filing for the first quarter of fiscal 2026, showcasing a robust financial performance. The company, a leading provider of specialty contracting services to the telecommunications infrastructure and utility industries across the United States, reported contract revenues of $1.259 billion, marking a 10.2% increase compared to the same quarter last year. This figure exceeded the analyst estimate of $1.194 billion, reflecting Dycom's strong market position and operational efficiency.

Financial Achievements and Strategic Outlook

Dycom Industries Inc (DY, Financial) reported a net income of $61.0 million, or $2.09 per diluted share, slightly below the previous year's $62.6 million, or $2.12 per share. However, the company's adjusted EBITDA rose to $150.4 million, representing 11.9% of contract revenues, up from $130.9 million, or 11.5%, in the prior year. This improvement underscores the company's effective cost management and operational leverage.

The company also achieved a record backlog of $8.127 billion as of April 26, 2025, indicating strong future demand for its services. Dycom's strategic decision to repurchase 200,000 shares for $30.2 million during the quarter reflects confidence in its long-term growth prospects.

Key Financial Metrics and Balance Sheet Insights

Dycom's balance sheet reveals total assets of $3.105 billion, up from $2.945 billion at the end of January 2025. The increase in accounts receivable to $1.528 billion from $1.374 billion indicates higher sales activity. Meanwhile, total liabilities rose to $1.839 billion from $1.706 billion, primarily due to an increase in long-term debt to $1.018 billion from $933.2 million, which may be used to support growth initiatives.

Important metrics such as the company's cash and equivalents decreased to $16.1 million from $92.7 million, reflecting the share repurchase and other strategic investments. The company's equity also increased to $1.266 billion from $1.239 billion, highlighting a solid financial foundation.

Performance Analysis and Industry Context

Dycom Industries Inc (DY, Financial)'s performance is significant given the competitive nature of the construction and telecommunications sectors. The company's ability to grow revenues organically by 0.7% and through acquisitions demonstrates its strategic acumen in expanding market share. The increase in adjusted EBITDA margin to 11.9% from 11.5% indicates improved operational efficiency, which is crucial for maintaining competitiveness in the industry.

In the words of Dan Peyovich, Dycom’s President and CEO,

“Dycom had a strong start to fiscal 2026 with continued progress against our goals, excellent financial and operational performance, and a record backlog. Based on our first quarter results and a favorable demand outlook, we are increasing our full year fiscal 2026 contract revenue outlook and remain positioned for continued success.”

Future Outlook and Strategic Initiatives

Looking ahead, Dycom Industries Inc (DY, Financial) has raised its fiscal 2026 revenue outlook, now expecting contract revenues to range from $5.290 billion to $5.425 billion, representing a growth of 12.5% to 15.4% over the previous year. This optimistic outlook is supported by a favorable demand environment and the company's strategic initiatives to capitalize on industry opportunities.

For the second quarter of fiscal 2026, Dycom anticipates contract revenues between $1.38 billion and $1.43 billion, with non-GAAP adjusted EBITDA projected to be between $185 million and $200 million. The company also expects diluted earnings per share to range from $2.74 to $3.05, indicating continued strong performance.

Overall, Dycom Industries Inc (DY, Financial)'s first quarter results and strategic outlook position it well for sustained growth in the competitive telecommunications infrastructure and utility services market.

Explore the complete 8-K earnings release (here) from Dycom Industries Inc for further details.