Dycom Industries (DY, Financial) anticipates its second-quarter revenue to fall between $1.38 billion and $1.43 billion. This forecast notably exceeds the market consensus, which stands at $1.36 billion, indicating robust potential growth for the company in the upcoming quarter.

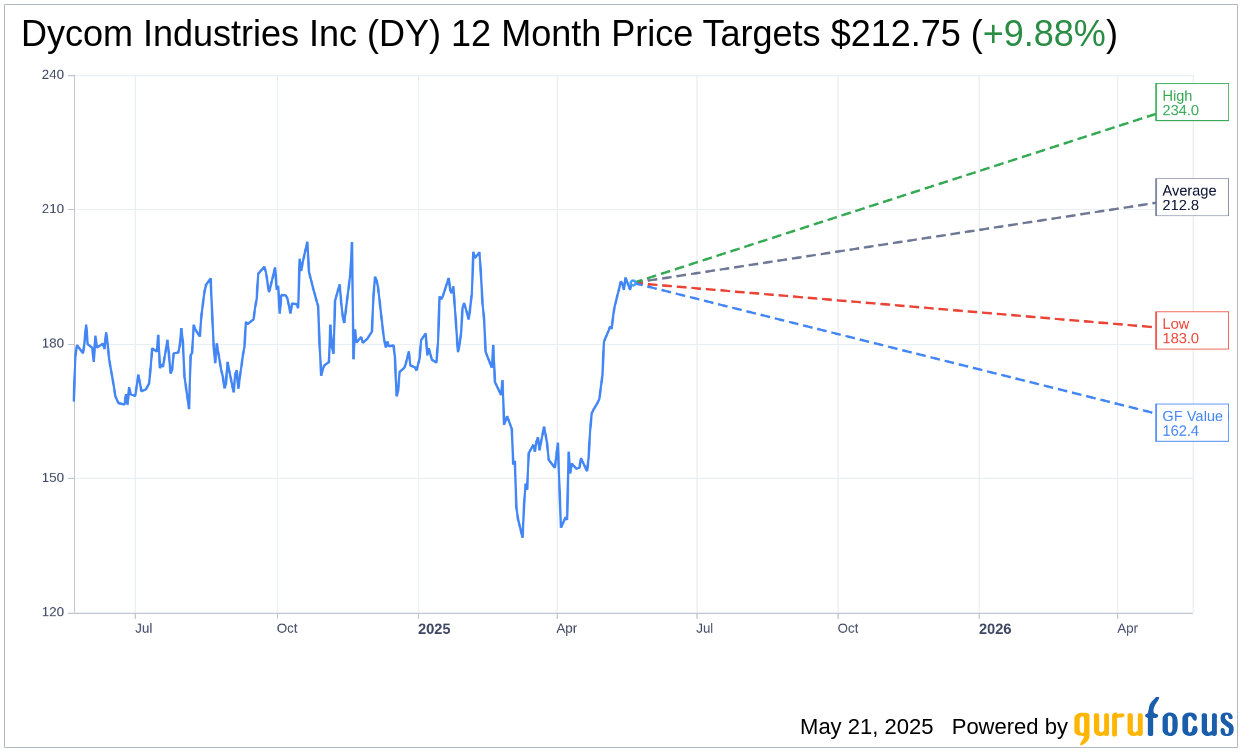

Wall Street Analysts Forecast

Based on the one-year price targets offered by 8 analysts, the average target price for Dycom Industries Inc (DY, Financial) is $212.75 with a high estimate of $234.00 and a low estimate of $183.00. The average target implies an upside of 9.88% from the current price of $193.62. More detailed estimate data can be found on the Dycom Industries Inc (DY) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Dycom Industries Inc's (DY, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Dycom Industries Inc (DY, Financial) in one year is $162.42, suggesting a downside of 16.11% from the current price of $193.62. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Dycom Industries Inc (DY) Summary page.

DY Key Business Developments

Release Date: February 26, 2025

- Q4 Revenue: $1.085 billion, a 13.9% increase over Q4 of last year.

- Q4 Adjusted EBITDA: $116.4 million, representing 10.7% of revenue.

- Fiscal 2025 Revenue: $4.702 billion, a 12.6% increase year-over-year.

- Fiscal 2025 Adjusted EBITDA Margin: 12.3%.

- Q4 Adjusted Net Income: $34.5 million.

- Q4 Adjusted Diluted EPS: $1.17, a 48.1% increase.

- Fiscal 2025 Adjusted Net Income: $248.7 million.

- Fiscal 2025 Adjusted Diluted EPS: $8.44, a 24.5% increase from fiscal 2024.

- Backlog: $7.8 billion, with $4.6 billion expected to be completed in the next 12 months.

- Operating Cash Flow: $328.2 million in Q4; $349.1 million for the full year.

- Free Cash Flow: $137.8 million for fiscal 2025, an 82% increase.

- Share Repurchases: 410,000 shares repurchased in fiscal 2025, totaling $65.6 million.

- Fiscal 2026 Revenue Outlook: Expected increase of 10% to 13% over fiscal 2025.

- Q1 Fiscal 2026 Revenue Outlook: $1.16 billion to $1.2 billion.

- Q1 Fiscal 2026 Adjusted EBITDA Outlook: $130.6 million to $140.6 million.

- Q1 Fiscal 2026 Diluted EPS Outlook: $1.50 to $1.73 per share.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Dycom Industries Inc (DY, Financial) reported strong fourth-quarter revenues of $1.085 billion, reflecting a 13.9% increase over the previous year.

- The company achieved an adjusted EBITDA of $116.4 million, representing 10.7% of revenue, despite facing unforeseen weather challenges.

- Dycom Industries Inc (DY) announced a new $150 million stock repurchase program, demonstrating a commitment to returning capital to shareholders.

- The company has diversified its customer base, reducing reliance on its top five customers from 66% of revenue in fiscal 2022 to 55% in fiscal 2025.

- Dycom Industries Inc (DY) has a strong backlog of $7.8 billion, with $4.6 billion expected to be completed over the next 12 months, indicating robust future revenue potential.

Negative Points

- The company's fiscal 2026 outlook does not include any revenue from storm restoration services, which contributed $114.2 million in fiscal 2025.

- Dycom Industries Inc (DY) is not including any potential revenue from the BEAD program in its fiscal 2026 outlook, indicating uncertainty in this area.

- The company faces competitive pressures in the long-haul market, which could impact pricing and margins.

- Dycom Industries Inc (DY) experienced a sequential reduction in headcount, which may indicate challenges in workforce management or project demand.

- The company's SG&A expenses have grown faster than revenues in recent years, potentially impacting operating leverage and profitability.