- Target's stock has experienced a decline following disappointing earnings results.

- Wall Street analysts foresee potential upside with varied price targets for Target Corp (TGT, Financial).

- GuruFocus estimates suggest a significant potential increase in Target's stock valuation over the next year.

Target Corporation (NYSE: TGT) recently faced a setback as its shares dropped due to underwhelming quarterly results. The retailer reported a non-GAAP earnings per share (EPS) of $1.30, which missed analyst expectations by $0.35. Furthermore, the company generated $23.8 billion in revenue, falling short of projections by $550 million. This performance highlights a continuing trend of market share loss to major competitors such as Walmart and Costco.

Wall Street Analysts Forecast

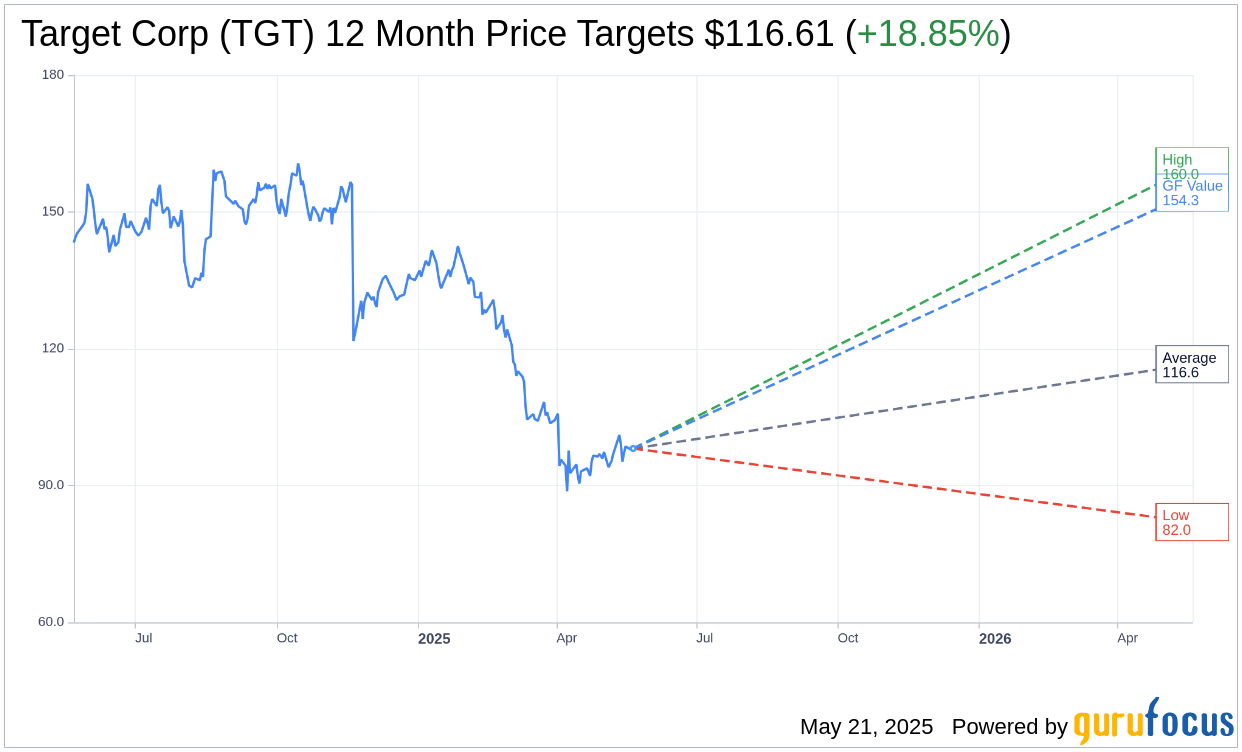

Analyzing the insights from 31 Wall Street analysts, the one-year price forecast for Target Corp (TGT, Financial) reveals an average target price of $116.61. High estimates reach $160.00, while low projections are at $82.00, suggesting a potential upside of 18.85% from the current share price of $98.12. For more in-depth analyst insights, visit the Target Corp (TGT) Forecast page.

Reflecting on recommendations from 39 brokerage firms, Target Corp (TGT, Financial) currently holds an average brokerage recommendation of 2.6, correlating to a "Hold" status. This rating is derived from a scale where 1 indicates a Strong Buy and 5 signifies a Sell.

GuruFocus Valuation Insights

According to GuruFocus, the estimated GF Value for Target Corp (TGT, Financial) in one year stands at $154.26, suggesting an impressive upside potential of 57.22% from the current price of $98.12. The GF Value represents GuruFocus' fair value estimate, calculated considering historical trading multiples, past business growth, and future business performance expectations. For a comprehensive understanding of Target's valuation and metrics, explore the Target Corp (TGT) Summary page.