Scotiabank has adjusted its outlook on Myriad Genetics (MYGN, Financial), lowering its rating to Sector Perform from Outperform. Concurrently, the price target has been revised from $20 to $6. The bank acknowledges potential for Myriad in its Oncology and Women's Health segments but regards 2025 as a potential turning point for the company.

Scotiabank is looking for clear and consistent progress as well as a possible strategic overhaul under the company's new leadership before adopting a more optimistic perspective on Myriad's stock. The bank's analyst emphasizes the importance of these developments in shaping future evaluations of the company's performance.

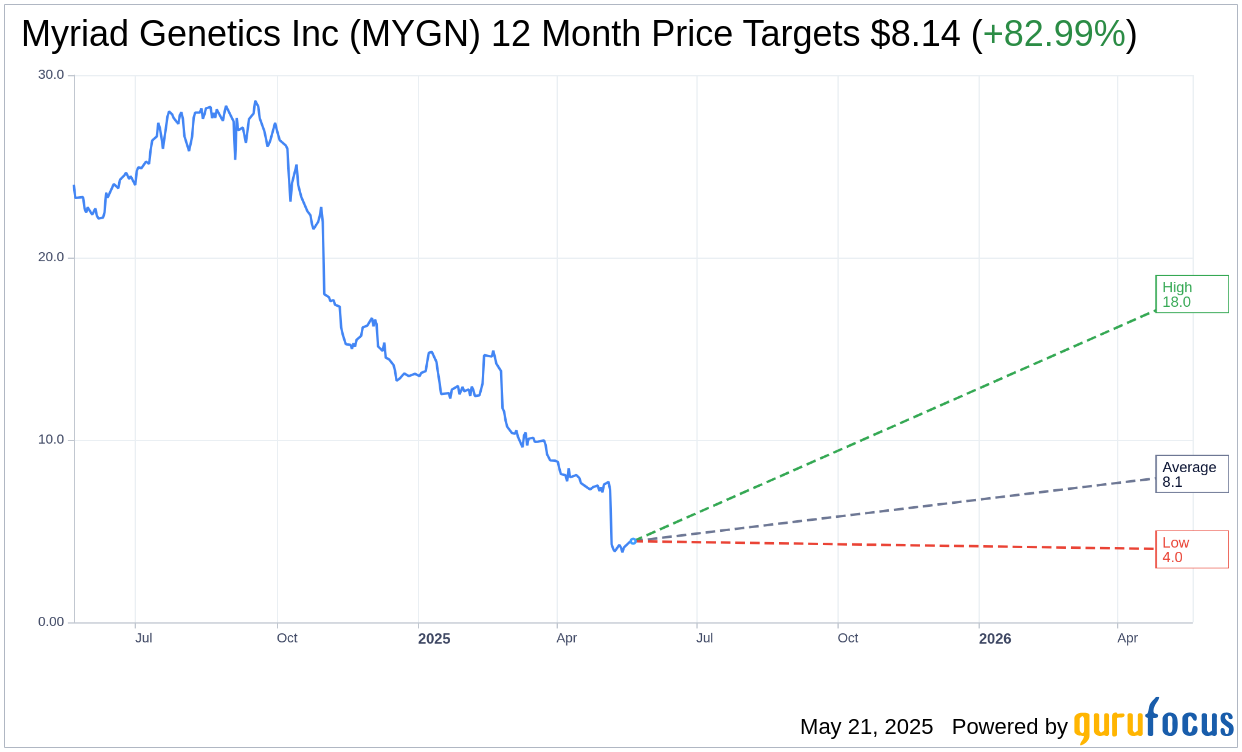

Wall Street Analysts Forecast

Based on the one-year price targets offered by 14 analysts, the average target price for Myriad Genetics Inc (MYGN, Financial) is $8.14 with a high estimate of $18.00 and a low estimate of $4.00. The average target implies an upside of 82.99% from the current price of $4.45. More detailed estimate data can be found on the Myriad Genetics Inc (MYGN) Forecast page.

Based on the consensus recommendation from 17 brokerage firms, Myriad Genetics Inc's (MYGN, Financial) average brokerage recommendation is currently 3.1, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Myriad Genetics Inc (MYGN, Financial) in one year is $20.97, suggesting a upside of 371.24% from the current price of $4.45. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Myriad Genetics Inc (MYGN) Summary page.

MYGN Key Business Developments

Release Date: May 06, 2025

- Revenue: $196 million, a decline of 3% year-over-year.

- Revenue Growth (Excluding Specific Impacts): 5% year-over-year growth excluding UnitedHealthcare impact, EndoPredict divestiture, and a one-time benefit from 2024.

- Gross Margin: Expanded by 50 basis points to 59%.

- Test Volume: Up 1%, but average revenue per test down 4%.

- Prenatal Testing Revenue: Increased 11% year-over-year.

- GeneSight Revenue: Declined 20% year-over-year due to UnitedHealthcare policy change.

- Women's Health Revenue: $87 million, an increase of 4% over the prior year period.

- Adjusted Operating Cash Flow: Usage of approximately $10 million.

- Cash and Cash Equivalents: $92 million at the end of Q1.

- Updated 2025 Revenue Guidance: $807 million to $823 million.

- Adjusted EBITDA Guidance: $19 million to $27 million for full year 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Myriad Genetics Inc (MYGN, Financial) reported strong performance in its prenatal testing segment, with revenue growth of 11% year-over-year.

- The company saw a 10% year-over-year volume growth in its ForeSight and Prequel tests.

- Myriad Genetics Inc (MYGN) expanded its gross margins by 50 basis points, achieving a 59% gross margin due to lab efficiencies.

- The company is on track to launch its first AI-enabled Prolaris test by the end of the year, which is expected to support clinical decisions at the time of biopsy.

- Myriad Genetics Inc (MYGN) is making progress on its new product pipeline, including the upcoming launch of the combined carrier screening and NIPS assay, and the PRECISE MRD test.

Negative Points

- The company reported a 3% year-over-year decline in total revenue for the first quarter, with GeneSight and myRisk tests underperforming.

- Revenue from GeneSight was down 20% year-over-year, primarily due to UnitedHealthcare's coverage policy change.

- Myriad Genetics Inc (MYGN) reduced its 2025 annual revenue guidance by $35 million and adjusted operating expenses by $25 million.

- The company faced challenges with EMR integrations, which have been slower than expected, impacting the hereditary cancer testing volumes.

- There is a significant headwind from the UnitedHealthcare policy change, resulting in a $10 million revenue impact in the first quarter.