BofA analyst Peter Galbo has decreased the price target for Campbell's (CPB, Financial) from $41 to $37, maintaining an Underperform rating on the stock. This decision comes as a response to disappointing scanner data in the Snacks division, prompting the firm to lower its Q3 and fiscal year 2025 adjusted earnings per share (EPS) forecasts. The outlook for fiscal year 2026 EPS has also been reduced, as the firm anticipates a gradual recovery path that will require further reinvestment to stabilize the segment's revenue. These adjustments reflect the challenges facing the company's snack business and the expected duration of its recovery efforts.

Wall Street Analysts Forecast

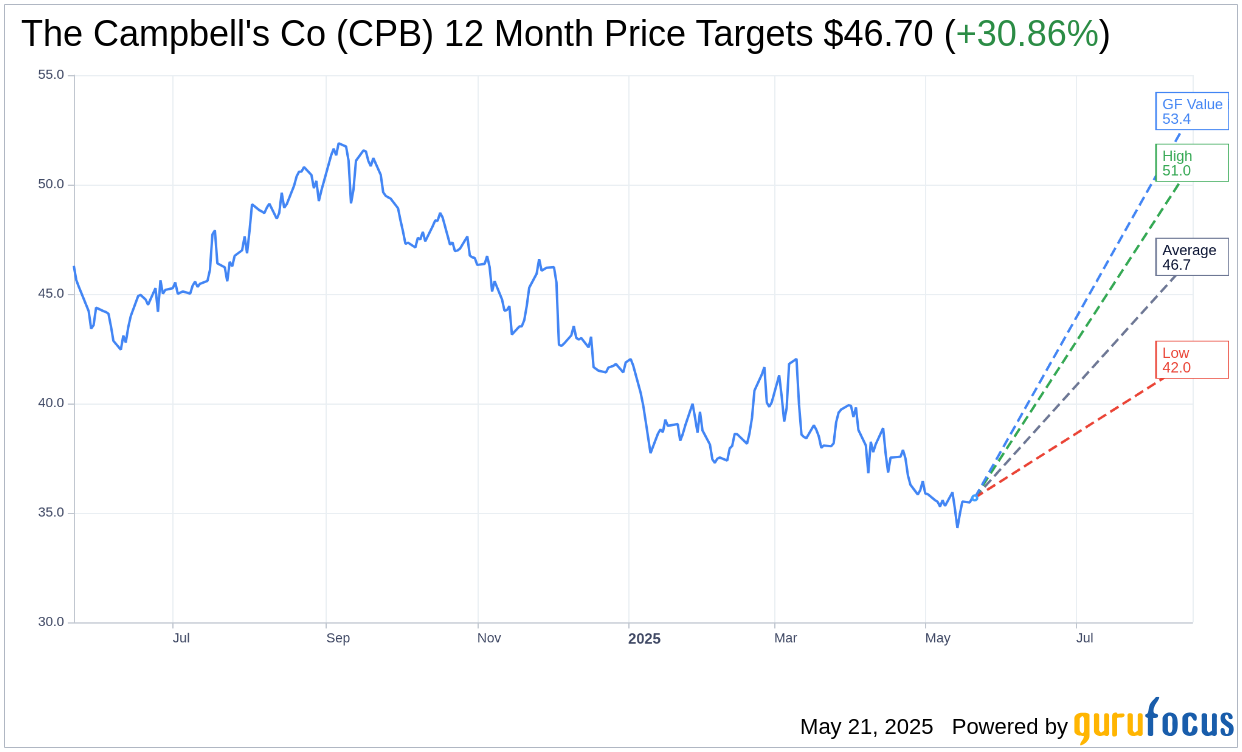

Based on the one-year price targets offered by 18 analysts, the average target price for The Campbell's Co (CPB, Financial) is $46.70 with a high estimate of $51.00 and a low estimate of $42.00. The average target implies an upside of 30.86% from the current price of $35.69. More detailed estimate data can be found on the The Campbell's Co (CPB) Forecast page.

Based on the consensus recommendation from 21 brokerage firms, The Campbell's Co's (CPB, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for The Campbell's Co (CPB, Financial) in one year is $53.36, suggesting a upside of 49.51% from the current price of $35.69. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the The Campbell's Co (CPB) Summary page.

CPB Key Business Developments

Release Date: March 05, 2025

- Net Sales Growth: 9% increase, driven by Sovos acquisition.

- Organic Net Sales: Decreased 2% due to weaker snacking categories.

- Adjusted EBIT: Increased 2% year-over-year.

- Adjusted EPS: $0.74, an 8% decline due to higher interest expenses.

- Snacks Division Organic Net Sales: Declined 3% with a 1% decline in leadership brand consumption.

- Meals and Beverages Organic Net Sales: Declined 1% with a 1% volume and mix growth.

- Adjusted Gross Profit Margin: Declined 100 basis points.

- Operating Cash Flow: $737 million year-to-date, an 8% increase.

- Capital Expenditures: $211 million year-to-date.

- Net Debt to Adjusted EBITDA Ratio: 3.7 times.

- Full Year Guidance - Organic Net Sales: Expected to be down 2% to flat.

- Full Year Guidance - Adjusted EPS: Expected range of $2.95 to $3.05.

- Cost Savings Program: $65 million delivered year-to-date, with full-year expectations increased to $120 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- The Campbell's Co (CPB, Financial) reported a 9% growth in net sales, driven by the contribution from the Sovos acquisition.

- The company's meals and beverages division showed consistent performance with a 1% increase in dollar consumption.

- Rao's sauce delivered high single-digit net sales growth in the second quarter and low teens growth for the first half.

- The Campbell's Co (CPB) achieved approximately $65 million in cost savings under its $250 million cost savings program.

- The company maintained a strong cash flow generation with $737 million in operating cash flow year to date.

Negative Points

- The anticipated recovery of some snacks categories did not materialize, leading to a softer top line.

- Snacks margin fell short of expectations due to unfavorable mix and operational headwinds in the fresh bakery business.

- Organic net sales decreased by 2%, driven by weaker-than-anticipated snacking categories.

- Adjusted EPS declined 8% to $0.74 due to higher interest expense from increased debt levels.

- The company revised its full-year guidance downward due to slower-than-anticipated recovery in snacking categories.