TD Securities has resumed its coverage of Enbridge (ENB, Financial), assigning a 'Buy' rating along with a C$67 price target. This comes on the heels of Enbridge’s strategic move to acquire a 12.5% interest in the Westcoast natural gas pipeline system. This investment is made in partnership with the Stonlasec8 Indigenous Alliance Limited Partnership. According to analysts, this decision aligns with Enbridge’s ongoing efforts to enhance indigenous ownership opportunities.

The firm highlights that the transaction likely aligns with or is close to Enbridge's current trading multiple. This indicates a promising financial strategy on the part of Enbridge, reflecting its dedication to both business growth and community engagement.

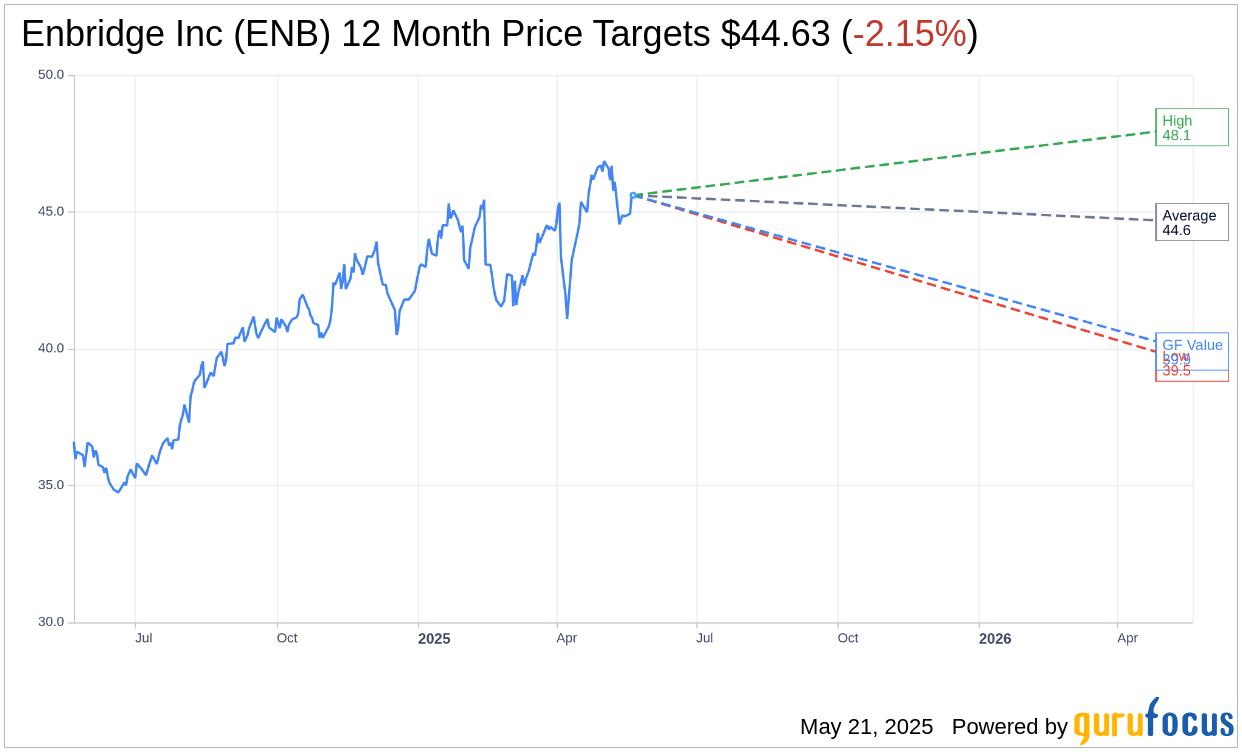

Wall Street Analysts Forecast

Based on the one-year price targets offered by 8 analysts, the average target price for Enbridge Inc (ENB, Financial) is $44.63 with a high estimate of $48.10 and a low estimate of $39.49. The average target implies an downside of 2.15% from the current price of $45.61. More detailed estimate data can be found on the Enbridge Inc (ENB) Forecast page.

Based on the consensus recommendation from 14 brokerage firms, Enbridge Inc's (ENB, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Enbridge Inc (ENB, Financial) in one year is $40.69, suggesting a downside of 10.79% from the current price of $45.61. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Enbridge Inc (ENB) Summary page.

ENB Key Business Developments

Release Date: May 09, 2025

- Adjusted EBITDA: Up 18% compared to Q1 2024.

- DCF per Share: Increased by 6% year-over-year.

- Earnings per Share: Rose by 12% from Q1 2024.

- Mainline Volumes: Record first quarter volumes of almost 3.2 million barrels per day.

- Gas Transmission: Up 13% year-over-year despite asset sales in 2024.

- Gas Distribution EBITDA: Increased by $170 million compared to Q1 2024.

- Capital Projects: Secured $3 billion of accretive low-risk projects year-to-date.

- Debt-to-EBITDA Ratio: Target range of 4.5x to 5x.

- Dividend Growth: Increased for 30 consecutive years.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Enbridge Inc (ENB, Financial) reported record first-quarter EBITDA, DCF per share, and earnings per share, driven by strong volumes and contributions from recently acquired US utilities.

- The company reaffirmed its 2025 financial guidance, indicating confidence in its ability to meet targets despite global trade tensions and tariffs.

- Enbridge Inc (ENB) continues to expand its renewable energy portfolio, with the Orange Grove solar facility entering service on time and on budget.

- The company is actively pursuing growth opportunities, securing $3 billion in low-risk projects year-to-date, including investments in the mainline and the Matterhorn Express Pipeline.

- Enbridge Inc (ENB) maintains a strong balance sheet with a debt-to-EBITDA ratio target of 4.5 to 5 times, supporting its investment-grade credit rating and financial flexibility.

Negative Points

- The company faces ongoing regulatory challenges and uncertainties, particularly in relation to permitting reforms in the US and Canada.

- Enbridge Inc (ENB) is exposed to commodity price volatility, which could impact future financial performance despite current resilience.

- There are concerns about the potential impact of higher US interest rates on the company's financial outlook.

- The integration of recently acquired US utilities is still ongoing, with disentanglement from Dominion yet to be fully completed.

- The dynamic policy landscape for renewables presents challenges, potentially affecting the timing and approval of future projects.